In the fast-paced world of digital currency, tapping into the best market hubs is key. You want to make smart moves, right? That’s where top crypto exchanges by liquidity step in. They make your trades swift and secure. Understanding this can mean the difference between profit and loss. The most liquid platforms offer smooth trading and stable prices, giving you the upper hand. Stick around as we dive into the exchanges leading the pack and how to use this info to your advantage. Join me on a journey to dissect their liquidity profiles, compare their order books, and unveil strategies that leverage their powerful markets to your advantage. Ready to turn the tide in your favor? Let’s get started.

Understanding the Importance of Liquidity in Crypto Markets

The Impact of Liquidity on Trading Efficiency and Asset Volatility

Liquidity. Big word, right? Think of it like this: It’s about how easy you can buy or sell something without causing a huge price change. In the wild world of crypto, it’s super important. When a crypto exchange lacks liquidity, trading gets rough. Prices can swing wildly if you buy or sell. Not fun.

Being quick matters in trading. More liquidity means you can make moves fast. Prices don’t jump around as much. It’s like having a super-wide highway instead of a tightrope. Want to sell? There’s a buyer ready. Want to buy? There’s a seller. It’s that sweet spot where everyone meets to trade without hassle. It’s good for you.

Understanding crypto exchange liquidity is key. When choosing where to trade, look for high liquidity crypto platforms. You’ll notice the difference. Quick trades, better prices, and less stress.

Liquidity Indicators and Their Role in Market Analysis

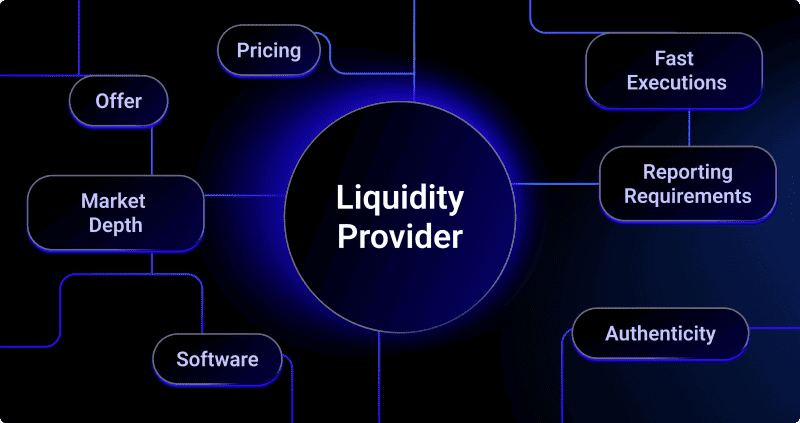

Now, let’s break down liquidity indicators. These are tools that help us peek at how good an exchange is at handling trades. They tell us about market depth, how much trading happens, and at what speed.

First stop: trading volume. It’s how much of a crypto gets traded in a day. Big volumes, big liquidity. Simple, right?

Next up, we’ve got order book depth. Ever peek at a list of buy and sell orders? That’s it. A thick book means lots of orders. It means you’re more likely to trade at the price you want.

Then there’s the spread. It’s the gap between buy and sell prices. Tiny gap? Shows the market’s in good shape.

Understanding these helps us see which exchanges are king. We want places with deep liquidity. It means they can handle the heat of high volume crypto trading.

So, assessing crypto exchange performance is more than just a quick look. Use these indicators to really get the lay of the land. It leads to smarter trades on top trading platforms cryptocurrency.

In the end, the goal is to trade with ease and confidence. Knowing how liquid a market is helps us take steps with sure feet. Because in a market that moves at lightning speed, every second and every penny counts. Remember this, and you’ll be set up for success in the vibrant universe of crypto trading.

Analyzing Top Crypto Exchanges by Liquidity Profiles

Comparative Assessment of High Liquidity Crypto Platforms

When we talk about high liquidity in crypto markets, we mean lots of trading. This matters a ton. Big players in this game are Binance, Coinbase Pro, Kraken, Bitfinex, and Huobi. These names keep popping up when looking at cryptocurrency exchange rankings. Why? They make trading smooth by having lots of buys and sells.

To really get why this is so important, think of a busy market. Think of a place where you can sell apples fast and at good prices, not waiting for that one person who might buy your apple later in the day. In crypto, if a platform has high liquidity, you can trade quick. You get the price you see without much change.

Spot Markets Liquidity: In-Depth Look at Order Books

Now let’s dive deep into spot market liquidity. An order book is like a list. It shows all the buy and sell orders for an asset. Want to know how deep the liquidity is? See how thick the order book is – that means more orders, closer prices.

Why look at this? A fat order book means less risk in price moving. It tells you the market can handle big orders without the price going wild. This helps everyone. For high-volume crypto trading, it makes sure big trades don’t shock the market.

But you might ask, how do I find this stuff? Simple! Each platform shows their order book. Check out the depth. See if big orders make the prices move. If they don’t, that’s deep liquidity. And it’s good for your trades.

So, why care about all this order book talk? Because knowing which places have thick books can save you money. It means no huge price changes when you buy or sell. In a flash, your trade goes through at a price you expect.

In crypto, having these smart details means a better chance of trading wins. They make a path for you in a wild market. Use this knowledge. Choose platforms that help, not hurt, your trading game. Being smart with crypto liquidity is what winners do!

Liquidity Rankings and Metrics: Binance, Coinbase Pro, and Others

Case Studies: Binance and Coinbase Pro Liquidity Assessments

Let’s dive into two big names: Binance and Coinbase Pro. Binance stands out in high liquidity crypto platforms. It often tops cryptocurrency exchange rankings. Its trading volume on crypto exchanges is massive. Why? It’s got a huge user base and lots of coin pairs.

Coinbase Pro holds its own too. It’s known for stable, deep liquidity in cryptocurrency. Its crypto market depth analysis shows strength. This is key for quick, secure trades. Users love the speed and reliability it offers. Plus, it’s a top pick for U.S. traders.

Liquidity Metrics for Exchanges: Interpreting Data Across Platforms

Understanding crypto exchange liquidity is about numbers – but also feel. Take liquidity metrics for exchanges. They tell you how much money can move without huge price shifts. Leading crypto exchanges by volume, like Kraken, Bitfinex, Huobi, use these numbers to flex their muscles.

What should you look for? High volume crypto trading marks a safe bet. Crypto liquidity comparisons can help. Top trading platforms cryptocurrency folks trust are usually your go-to. They mean less wait, better prices.

For serious traders, advantages of liquid crypto exchanges are clear. They pair up buyers and sellers faster than you can say ‘trade’. And, those liquidity pools in crypto markets? They’re like safety nets for your trades.

Consider Binance liquidity ranking. It’s high. Why? Because Binance has it all. Swarms of users. Lots of coin choices. Fast moves. It’s like the king of liquidity. Coinbase Pro liquidity assessment is solid too, but different. It can seem more steady and sure.

So when it comes to liquidity risk in cryptocurrency exchanges, don’t sweat. Stick to the big names. They have the tools to keep you afloat. Determining exchange liquidity is part art, part science. Look at spot markets liquidity in crypto. Check the crypto exchanges order book depth. Seek out liquid markets for digital assets.

Finding high liquidity crypto assets might seem like a treasure hunt. Use crypto liquidity indicators to make it simpler. They’re your map.

Remember, high frequency trading crypto liquidity is a big deal too. You want in and out fast, with no fuss. That’s where the importance of liquidity in trading shines.

For peace of mind? Look at market liquidity and crypto assets hand in hand. A liquid market is a happy market. And a happy market means happy trading. Keep an eye on liquidity provision in blockchain exchanges. Smart ones know how to build a strong, fluid market.

Measuring crypto exchange liquidity isn’t just for pros. It’s for anyone wanting to make smart, informed trades. Big-name exchanges have the depth, the tools, and the trust. Go there, and you’re swimming with the current.

Strategies for Utilizing Liquid Markets in Crypto Trading

Finding High Liquidity Crypto Assets: Tools and Techniques

When you trade crypto, you want to make smooth trades. That’s where liquid markets help. They let you buy or sell fast, at stable prices. Finding high liquidity assets is key. How do you do that? Use tools that track trading volume on crypto exchanges. Volume shows how much trading happens. More volume means more liquidity. Always look for the latest cryptocurrency exchange rankings. They show which platforms have the most activity.

Here’s something cool: check out Binance and Coinbase Pro. They’re often top dogs for liquidity. This means they have lots of money flowing. Many traders trust them. So, your trades can happen quick, with less price change. This is good for everyone.

Want to know something else smart? Use trading volume charts. They paint a picture of market action. Look for peaks and drops to pick the best times to trade. Don’t forget to compare crypto liquidity. Seeing different platforms side by side helps a lot. It shows where your trades will run smoothest.

Liquidity Pools: Boosting Market Depth and Reducing Slippage

Now, let’s chat about liquidity pools. These are like big pots of money. They help trading stay smooth on crypto platforms. They make sure there’s enough cash around for trading. Pools come from people who add their money to help out. They get a little reward when trades use their money. This is cool because it makes the market deep. And a deep market lets big trades happen without big price jumps. This is called “low slippage”.

Ever heard of DeFi? It’s short for Decentralized Finance. DeFi is big on liquidity pools. It’s part of what makes DeFi special. Pools in DeFi help all sorts of trading and lending things happen.

So, if you’re into trading a lot, you should look at the liquidity pools in crypto markets. They can tell you where you can trade quick and easy. Plus, if you’re into helping the market, you can add your own money to a pool. You get some rewards and help everyone else trade better.

In short, pick exchanges with deep liquidity for the best trading. And keep an eye on those pools, they’re where the magic happens. They give you more chances to trade without fuss. This means you can focus on the real goal: making smart moves and growing your money.

In this blog, we’ve looked at how vital liquidity is in crypto markets. We talked about how it helps trade go smooth and keeps prices from bouncing all over. We also checked out how you can spot liquidity by looking at certain signs in the market.

Then, we sized up different crypto exchanges and saw who’s on top when it comes to being liquid. We took a close peek at how spot markets lay out their order books.

We even did deep dives into Binance and Coinbase Pro, using solid examples to show how liquidity works. Plus, we figured out how to read the data on various platforms.

Lastly, I showed you some smart ways to make the most of liquid markets. We discovered tools to find good crypto picks and dived into liquidity pools to cut down on price shifts.

Remember, understanding liquidity can make or break your crypto trading. Use this guide to steer clear of rocky markets and stick to the smooth sailing ones. Stick with strong, liquid markets and you’ll set yourself up for better, smarter trades.

Q&A :

What are the top crypto exchanges with the highest liquidity?

Liquidity in the cryptocurrency market refers to the ease with which a particular asset can be bought or sold without causing significant price fluctuations. Exchanges with high liquidity typically offer better price discovery and enable larger transactions with minimal impact on the market price. As of the latest data, exchanges known for high liquidity include Binance, Coinbase Pro, Kraken, and Huobi Global.

How does liquidity impact trading on crypto exchanges?

Liquidity affects trading significantly as it determines how quickly and at what price point a cryptocurrency can be traded. High liquidity means that there are enough buyers and sellers in the market, which facilitates faster trades and more stable prices. This is crucial for traders who need to enter or exit positions without incurring high slippage costs, which occur when there is a difference between the expected price of a trade and the price at which it is executed.

Why is it important to consider liquidity when choosing a crypto exchange?

When selecting a crypto exchange, liquidity is a key factor because it ensures traders can buy and sell their crypto at transparent and fair market prices. High liquidity also offers tighter spreads (the difference between the buy and sell price), lower slippage, and generally lower transaction fees. For investors and traders, this could potentially lead to better trading experiences and improved profit margins.

Can liquidity vary for different pairs on crypto exchanges?

Yes, liquidity can greatly vary between different trading pairs on crypto exchanges. This variation is often influenced by the popularity and market capitalization of the cryptocurrencies involved. For instance, trading pairs involving Bitcoin (BTC) or Ethereum (ETH) usually have higher liquidity than those involving less known or newer altcoins. Traders should always check the liquidity of specific pairs before executing large trades.

How do crypto exchanges ensure they maintain high liquidity?

Crypto exchanges employ various strategies to maintain high liquidity. These include incentivizing market makers, offering low trading fees, or providing a wide range of trading pairs. Some exchanges also use liquidity pools, where a collection of funds is locked in a smart contract to facilitate instant trades. Additionally, exchanges may enter into partnerships with larger financial institutions to access deeper liquidity pools.