Diving into margin trading? You’ll need factors to consider when choosing a crypto margin trading exchange. Today, it’s not just about picking any platform; it’s about finding the right fit for your trading style. From fighting off risks to understanding layman’s tech talk, I’ll walk you through what really counts. Ready to leverage your trades smartly? Let’s break down the must-knows.

Understanding Margin Trading Requirements and Risks

Navigating Leverage Limits and Margin Call Policies

When you dive into crypto margin trading, you start with leverage limits. They tell you how much you can borrow. Most crypto exchanges set these between 3 to 5 times your balance. But why this range? It’s about balance. You get to up your game without risking too much.

If markets move against you, here comes the margin call. It’s a warning. It tells you to put in more money or risk your trades being closed. No one likes surprises, right? So, know these rules like the back of your hand. As leverage goes up, so does your risk. With high stakes, knowing when to fold is key.

Identifying and Mitigating Leverage Trading Risks

Leverage trading risks crop up fast. You’re using borrowed cash to trade. Sounds fun, but it can bite back. Imagine this: you go big, the market flips, and you’re on the hook for more than you put in. Scary, huh?

So, what do you do? First, get clear on margin trading requirements. You need to know what’s needed to start and keep trades going. Security measures come next. You want a trading platform that guards your funds like a fierce watchdog.

Liquidity is another big word. It means how easy you can move your money around without affecting prices. High liquidity = smoother trades. It’s a must.

And let’s chat about that user interface. You need it just right. Not too complex, not too simple. A good fit lets you trade with ease and speed. Add in solid funding and withdrawal options, and you’re set.

Let’s recap: Risk comes with the territory. But with the right know-how, you’re in the driver’s seat. Know your limits, prepare for margin calls, and pick a secure, liquid platform that feels just right. Stay sharp, trade smart.

Evaluating Trading Platform Integrity and Usability

Assessing Exchange Security and Fund Insurance

When you jump into crypto margin trading, think about the pool you’re diving into. The trading platform’s safety is key. Look at its security measures. Ask, is your money safe? Good platforms guard your cash like a fierce watchdog. They have fund insurance too. This means if something goes wrong, your money has a safety net.

Most people worry about hacks. Strong exchanges fight this risk every day. They use things like two-factor authentication and encryption. This is like having a good lock on your door.

What about the past? Check the exchange’s history. Have they ever been hacked? If yes, see how they fixed the problem. Past issues can show if they learned and improved.

Comparing User Interface and Mobile Trading App Usability

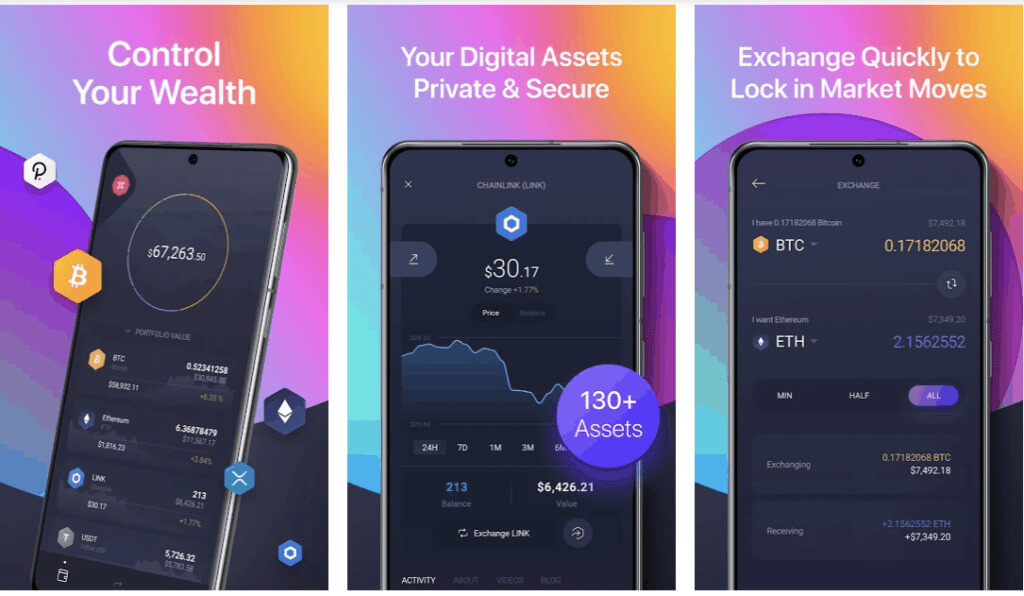

Moving on, let’s talk about the face of the exchange—the user interface. Is it easy to use? When you trade on margin, things move fast. You need an interface that is simple and quick. It should let you see important info at a glance. Charts should be easy to understand. Trading tools should be within reach.

Then there’s trading on the go. Mobile apps let you trade from anywhere. But not all apps are good. Some are slow or hard to use. A good mobile app is like a handy tool kit. It keeps all your trading tools in your pocket.

What’s clear and easy for one person might not be for another. So, try the platform first. Look for a demo account option. This is like a test drive for trading. It’s free and uses fake money. If they offer this, it shows they care about your experience.

Don’t forget, quick help is a plus. If things get bumpy, you want fast customer support. Take time to read what other users say. Their reviews can tell you lots about the support you can expect.

Last thoughts? Check if they have limits on where you can use their service. Think about how this fits with your needs. Are they okay with the cash you want to use? Do they support your local currency? Do they have rules that fit with your trading style?

Use this advice to find a crypto margin trading exchange that you can trust and works for you. Remember, you want a safe, easy place for your trading journey. This can make the difference between a smooth ride and a tough one. So choose wisely and start trading with confidence.

Financial Considerations in Margin Trading

Analyzing Exchange Fees and Margin Lending Rates

Let’s talk money. Every trade eats into your cash. So, knowing your costs is key. Exchange fees can nibble at your wallet. They vary with each platform. Some may charm you with low fees but beware. Always dig deeper. Sneaky costs can hide in margin lending rates. These are fees for borrowed money in trades. They add up fast.

Look for exchanges with clear fees. Watch out for high margin rates. They can turn a good deal sour. Now, don’t just glance and go. A smart move is to compare. Put exchanges side-by-side. Think about both fees and lending rates together. Get the full picture. It’s like hunting for deals. Patience pays off.

Exploring Funding, Withdrawal, and Tax Implications

Moving money can be a headache. But it doesn’t have to be. Check funding options. More is better. You want flexibility. Withdrawal should be just as easy. But remember, speed can mean fees. Find a balance that works for you. If it’s too complex, walk away.

Then there’s tax. No one likes surprises there. Each trade can count. You want to keep as much profit as possible. So, know the tax rules. Calculate how they shape your gains. Sometimes, a great trade on paper isn’t as sweet after taxes.

When you pick an exchange, think about your wallet. Fees and rates rule your return. Funding and tax can boost or bust your budget. Be sharp. Choose smart. Your future you will thank you for it.

Strategic Trading Tools and Compliance

Utilizing Advanced Trading Tools and API Functionality

Finding the right crypto exchange is key. Look for advanced tools and API access. These can make trading smoother and more profitable for you. APIs allow you to set up automated trades. These trades happen without your direct input. That means you can make money while you sleep!

API functionality varies between platforms. Some have simple order functions. Others offer complex market analysis tools. How will you use an API? Do you want to automate simple trades, or develop custom trading strategies? The answers help you choose the right exchange.

High-quality tools like real-time charts and indicators are also crucial. They guide your trading decisions. Look for platforms that provide a wide range of indicators. These could be moving averages, RSI, or Bollinger Bands. Trusted platforms will always have these essential tools.

Ensuring Regulatory Compliance and Understanding Exchange Liquidity

Next, let’s talk compliance and liquidity. Both are must-haves for any serious trader. A platform that follows rules keeps your money safer. Always check if an exchange meets global financial standards. This is important. It shows they handle your investments with care.

Exchange liquidity matters a lot. It’s about how easy you can buy or sell without affecting prices. High liquidity means you get the best prices and faster trades. Low liquidity can mean losses, as prices might change before your trade completes.

Also, check the exchange’s history with regulatory bodies. A clean record means fewer worries for you. Look at their margin trading requirements too. These include leverage limits and margin call policies. Knowing these can save you from unwanted losses.

Look for funding and withdrawal options that fit your needs. Some exchanges offer more fiat currency pairs. Others may have better options for crypto-to-crypto trading. Make sure they support your preferred way of funding or cashing out.

In summary, when choosing a platform for margin trading, think about trading tools, API access, compliance, and liquidity. Pick a platform that helps you trade smarter, not harder. Ensure it follows the rules and gives you flexibility in funding and cashing out. These factors will help you trade with confidence. Now, go find that perfect trading partner for your crypto journey!

In this guide, we’ve explored the keys to margin trading, from managing risk to choosing the right platform. We learned how to handle leverage limits and avoid margin calls. We also dived into platform security and how to spot a safe place to trade. Next, we looked at costs including fees and taxes linked to margin trading. Last, we checked out trading tools to keep ahead and the need to trade legally.

Bottom line, trading on margin is tricky. You’ve got to stay smart about risks and costs. Pick a platform that’s safe and easy to use, and use tools that help you trade better, while always following the rules. Play it safe, be wise, and trade well. Keep this advice in mind to help you make smart moves in the world of margin trading.

Q&A :

What are the key elements to consider when selecting a cryptocurrency margin trading platform?

When choosing a cryptocurrency margin trading platform, it’s crucial to assess several factors to ensure a secure and beneficial trading experience. The exchange’s reputation, regulatory compliance, and track record for security are fundamental. Additionally, consider the leverage levels offered, trading fees, interest rates on borrowed funds, platform user interface, and customer support quality. Ensuring the exchange supports the currencies you’re interested in trading and provides necessary risk management tools, like stop-loss orders, can also impact your trading success.

How does leverage impact my choice of a crypto margin trading exchange?

Leverage is the amount of capital that an exchange allows traders to borrow in order to increase the size of their trades. Different exchanges offer varying levels of leverage, which can range from 2x to 100x or more. Your choice should be influenced by your risk tolerance and trading strategy. Higher leverage can lead to higher profits but also increases the risk of significant losses. It’s essential to choose an exchange that offers appropriate leverage levels for your needs and includes measures to protect against the volatility commonly associated with the cryptocurrency market.

Can platform security features affect my crypto margin trading decisions?

Absolutely. The level of security provided by a crypto margin trading exchange is a paramount consideration due to the heightened risks of trading with leverage. Look for platforms that implement robust security measures such as two-factor authentication (2FA), cold storage for customer funds, encryption protocols, and insurance funds to cover potential losses from system breaches. An exchange’s history of security incidents or hacks can be a critical indicator of its long-term reliability.

What should I know about fees and interest rates on a margin trading exchange?

Before selecting an exchange for crypto margin trading, investigate the fee structure for trades, borrowing, and withdrawals, as fees can significantly affect net profits. Additionally, margin trading involves borrowing funds, and exchanges charge interest on these loans. The interest rates can vary widely and may be influenced by the length of the loan or market demand. Consider looking for transparent exchanges that offer competitive fees and interest rates, minimizing the cost of trading.

Customer support and ease of use—how important are these factors in choosing a margin trading exchange?

High-quality customer support and an intuitive trading platform interface are essential components when selecting a crypto margin trading exchange. The complexity of margin trading means that accessible, responsive support can be crucial, particularly for newer traders who may require guidance. A well-designed interface simplifies the trading process, reduces the potential for errors, and can help traders quickly respond to market movements. Reading user reviews and testing the platform through a demo account can help you gauge usability and support.