Navigating the world of digital currencies can seem like exploring a digital maze. With my help, though, you’ll find it’s simpler than you think. So, you want to know how to use crypto tools for beginners? You’re in the right place. This guide is your key to understanding and using crypto tools confidently. Let’s dive in and unlock the potential of cryptocurrency for you, starting with the basics and moving to advanced tips that will sharpen your crypto know-how.

Understanding the Basics of Cryptocurrency

Cryptocurrency Basics for Newbies

Starting with cryptocurrency can feel like learning a new language. It has its terms, tools, and rules. I know it can seem daunting, but fear not! Grasping the basics is your first step. Think of it as the ABCs of digital money. First, what is cryptocurrency? It’s digital cash that you can use to buy goods and pay for services online.

Let’s dive in by setting up a digital wallet. This wallet holds your digital money. It’s needed for almost everything in crypto. How does it work? Simply choose a wallet from many online, download it, and create your account. Look after your wallet’s secret keys! They open your wallet and let you access your money. If lost, they can’t be replaced, and you might lose your funds.

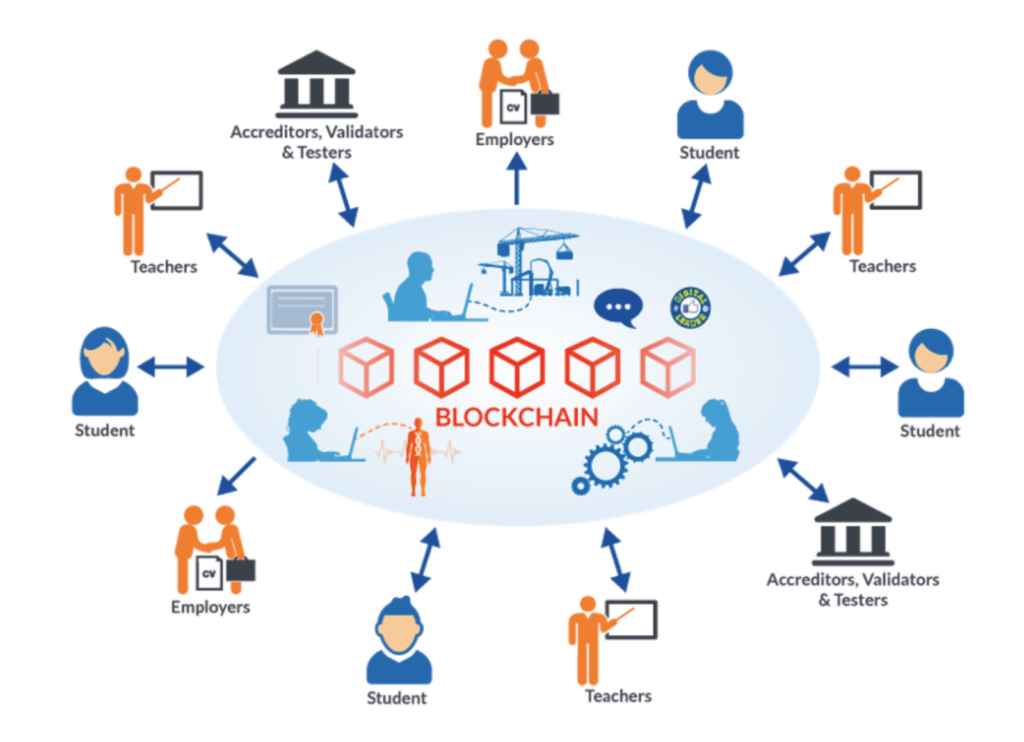

Next, we need to understand blockchain, which is like a digital ledger that records all crypto deals. Every time someone buys or sells crypto, it’s recorded here. Keep in mind, it’s public. Anyone can see the data, but they can’t see who’s behind it – that’s you and me.

Fundamental Blockchain Concepts

Now, let’s get to know the blockchain better. You can picture the blockchain as a chain of digital blocks. Each block contains a list of all recent transactions. Once a block is full, it’s added to the chain in a permanent way. This is key to why many trust blockchain. Once recorded, the data can’t change. This makes fraud tough, which is good news for all of us.

Each transaction is also checked by many computers. They solve tough puzzles to confirm each trade. When they agree, the trade goes through. The careful checking is called ‘consensus,’ and it’s huge in the trustworthiness of digital currencies.

Knowing these concepts builds the foundation of your crypto journey. Keep your wallet secure and understand how the blockchain works. Now, you’re ready to move ahead and learn more about using crypto tools. Like any good tool, they work best in the hands of someone who knows how to use them. As we explore further, always remember these essentials.

Please note that diving into the world of cryptocurrency isn’t risk-free. Risks include market swings and the chance of losing your investment. It’s vital to keep learning and stay cautious. Investing or trading should always be done based on your judgment and research. But don’t let this hold you back. Knowledge is power, especially here in the digital space.

Armed with these basics, you are now ready to start managing and growing your digital funds. Look forward to developing strategies, exploring exchanges, and enhancing security. Make your first steps firm, and the path ahead – exciting and fruitful!

Setting Up and Securing Your Cryptocurrency Wallet

Understanding Crypto Wallets

Let’s dive into wallets for storing your digital coins. Think of a crypto wallet like a key to a safe. This safe holds your precious coins. To set up a wallet, choose from two types – hot or cold. Hot wallets connect to the internet and are handy for quick trades. Cold wallets, on the other hand, are offline and super safe. They’re like vaults that hackers can’t touch.

When you pick a wallet, write down the secret words or seed phrase. Keep it hidden, like treasure. If you lose these words, you might wave goodbye to your coins for good. Now, sending and getting coins is easy. Use your wallet’s address, it works like an email for money. Check the address twice for errors, to avoid sending coins to the void.

Cryptocurrency Security Practices

Safety first, folks! Protecting your digital cash is critical. Start with a strong password. Mix letters, numbers, and symbols like a secret code. Two-factor authentication (2FA) is like a double lock on your wallet’s door. Use it. It’s a big yes to software updates. They patch up holes so hackers can’t peek in.

Beware of fishy emails or messages. These might be traps. If a deal feels too good, trust your gut. It’s probably not legit. Always double-check any links or apps you use. Some might disguise themselves as the real thing but aren’t.

Remember, your coins are in your hands. No bank can save them if things go south. So, treat them like gold. Keep your wallet as secure as a fort.

Security is not just what you do, but also what you avoid. Never reveal your seed phrase, password, or 2FA codes. Not in a voice call, nor a text. No customer service needs it. Only scammers do.

To sum it up: pick the right wallet, guard your secret keys, and be a smart cookie about security. Do these right, and you’ll be set up for a smooth sail in the crypto sea.

Getting Started with Crypto Trading and Investing

Introduction to Crypto Exchange Platforms

Crypto exchanges are like online shops for digital money. They let you swap dollars for cryptos like Bitcoin. Think of them as your gateway into the world of cryptocurrency. I’ve walked in your shoes, starting fresh, eager but not sure where to begin. Here’s the truth: picking a secure exchange is your first big step.

First up, choosing a cryptocurrency exchange. Decide on one that many people trust. This matters because you want your money to be safe. Don’t rush; check out reviews. Once you find a good one, you’ll need to make an account. The verification process on crypto platforms keeps you safe from fraud. You might need to upload an ID or a bill to prove who you are.

Once you are all set up, adding cash to your crypto account is next. Use a bank transfer or a card. Now, purchasing your first cryptocurrency may feel huge! But it’s as simple as buying anything online. Choose the crypto, input how much you want, and click ‘buy’. It’s ok to start with a small amount.

They’re your cryptos now, but remember to keep them safe. Using crypto exchanges safely means enabling things like two-factor authentication. This makes sure that only you can get into your account. It’s like a secret code sent to your phone.

Remember, the crypto world can be wild with price ups and downs. Navigating crypto market volatility is important. Don’t let a wild market scare you. Start by investing just a little. That way, you get the hang of it without big risks.

Fundamentals of Crypto Investing

Now, let’s talk investing basics. Treat crypto just like you would any important buy. Think first. Then act. Ask yourself, “Why this coin?”. Read up and choose wisely.

Beginner crypto trading strategies don’t have to be complex. The key is not to put all your eggs in one basket. This means, spread out your money across different cryptos.

Just so you know, tracking your buys and sells is smart. Come tax time, it helps you report what you need to. Plus, watching your trades can help you learn what works.

And don’t forget, mistakes are chances to learn. Avoiding common crypto mistakes is easier when you take it slow. A mistake could be buying just because a coin’s price is up. Here’s the thing, high prices can drop. The aim is to buy low, sell high. It sounds simple, but sticking to this can be toug

Protecting digital assets is more than a green lock on your browser. It’s about using your head. Only use your own devices to trade. Public computers are a big no-no.

Last words, friends. The crypto journey is exciting. With these steps, get a solid start and have fun on the way. Remember, every expert was once a beginner. You’ve got this!

Advancing Your Crypto Knowledge and Management

Utilizing Crypto Charts and Analysis

You’ve got your wallet set, and you’ve even bought your first crypto. But wait! Before you dream of your crypto rocketing to the moon, it’s time to get a grip on crypto charts. Think of these charts as maps that show where prices have been and might go.

Don’t freak out though, reading charts is a skill you’ll master with time. Let’s begin with a candlestick chart. Each “candle” shows prices within a set time – be it a minute, day, or even longer. The main body of the candle tells the opening and closing prices. If the close is above the open, the candle is often green or white; it’s red or black if it’s the opposite. Wicks sticking out? They show the high and low prices for that time frame.

Line charts are simpler, just a line marking the closing prices over time. Great for a quick glance at the market. Got it? Great! Now let’s move onto market trends. Trend lines on charts help spot directions in which prices are moving. If it’s pointing up, the market’s bullish – prices might rise. Downward trends, that’s bearish – prices might fall.

Remember, trends come with friends. Support and resistance levels are these friends. They’re like invisible barriers that often stop prices from going higher or lower. Understanding these can help you guess when to buy or sell.

Diversifying Your Crypto Portfolio

Just like you wouldn’t eat only candy for every meal (tempting, I know), put your crypto coins in different baskets. This helps you balance out risks, ’cause not all coins will dip or soar at the same time. Begin by choosing different types of digital assets. Maybe mix Bitcoin with some Ethereum, and throw in other altcoins or even some tokens.

Diversification extends beyond types. Sometimes, adding assets that move opposite to crypto markets — like certain stocks or commodities — can help steady your ship during rough crypto seas. And don’t forget, keeping a part of your portfolio in stablecoins can offer a safe haven when markets turn wild.

But how much to put where? Don’t go all-in on one asset. A common strategy is to have a bigger chunk in well-known, less volatile cryptos. The smaller part of your pie can go into riskier, possibly higher-return assets.

Portfolios aren’t set in stone. Adapt as you learn more. Watch the markets, check out news, and don’t ignore global events — they all affect your crypto. Most important, only invest what you can afford to lose. Crypto is exciting, but it’s also risky.

You see, advancing your crypto knowledge doesn’t have to be boring or super complex. Start with charts, add some smart diversification, and keep learning. It’s your money adventure, after all. Stay patient, stay curious, and who knows where your crypto journey will take you! Keep these basics in mind, and you’ll be on your way to becoming a savvy digital currency investor.

Alright, let’s wrap this up! We kicked off by walking through the basics of crypto—what it is and how the blockchain works. Next, we moved on to setting up and keeping your crypto wallet safe. Remember, security is key in the crypto world.

Then we dove into trading and investing, getting to know the platforms and key strategies. You learned about exchanges and crucial investment tips. Game-changing stuff!

Lastly, we stepped up our game by mastering crypto charts and the smart move—portfolio diversity. This can really amp up your crypto journey!

So here’s my final take: Dive in, stay sharp, keep your assets safe, and don’t put all your eggs in one basket. Stick with these tips, and you’re set for a solid start in the dynamic world of crypto!

Q&A :

What are the basic crypto tools every beginner should use?

Starting with cryptocurrency can seem daunting, but with the right tools, it’s much more accessible. Beginners should consider using a reliable cryptocurrency wallet for storing their assets securely. Exchanges like Coinbase or Binance are user-friendly platforms for buying and selling cryptocurrencies. Additionally, beginners might find portfolio trackers useful for monitoring their investments, and basic chart analysis software can help in understanding market trends.

How do I safely store my cryptocurrency as a beginner?

One of the most critical steps in dealing with crypto is ensuring the safe storage of your assets. As a beginner, you may start with a simple software wallet, which is easy to use and provides a reasonable level of security. However, for enhanced security, hardware wallets are recommended as they store your private keys offline, making them less susceptible to online hacking attempts. Always ensure your wallet’s software is up-to-date and your backup seed phrase is securely stored offline.

What is the best way for a beginner to learn to trade crypto?

For beginners looking to trade crypto, the best approach is to start with a solid educational foundation. There are many free online courses and resources available to understand the basics of blockchain and how trading works. Practice trading on a demo account before investing real money can help to familiarize you with trading platforms and market volatility. Moreover, following reputable crypto traders on social media, reading market analyses, and using simulation tools can accelerate the learning process.

Can beginners use crypto tools without any technical knowledge?

Yes, beginners can use crypto tools without in-depth technical knowledge. Many tools have been designed with user-friendliness in mind, offering intuitive interfaces and step-by-step guides. Wallets, exchanges, and tracking apps often provide comprehensive FAQ sections, video tutorials, and customer support to assist users in navigating their services. Starting with essential tools and building gradually will help non-tech-savvy users gain confidence and experience.

What are some common mistakes beginners make when using crypto tools?

Beginners in the crypto world often make mistakes such as using unsecured wallets, failing to enable two-factor authentication (2FA), or using the same passwords across different services. Many also fall into the trap of not conducting sufficient research before investing in tokens or participating in trades. Skipping the learning curve associated with understanding market trends and trading strategies can also result in unfavourable outcomes. It’s crucial for beginners to take the time to learn tool functionalities and market dynamics and to prioritize security practices to mitigate risks.