Diving into crypto means learning the difference between hot wallets and cold wallets for beginners. Hot wallets connect to the internet, offering easy access to trade and transact anytime. Think of these as your everyday wallets, buzzing with activity. On the flip side, cold wallets are the vaults of the crypto world—offline, secure, and away from prying digital eyes, perfect for long-term holding. Making the right choice is more than preference; it’s about the safety of your digital treasure. Let’s crack open this guide and ensure your crypto journey is both smart and secure.

Understanding the Basics of Crypto Wallets

Crypto Wallet Security Basics

Keeping your coins safe is crucial. Think of crypto wallet security like guarding a treasure chest. Just like you wouldn’t leave a chest full of gold out in the open, you shouldn’t keep your digital coins unprotected. Simple steps can make a big difference. Strong passwords, staying updated, and knowing the risks keep your treasure secure. Remember, in the digital world, there are pirates eager to swipe your valuables.

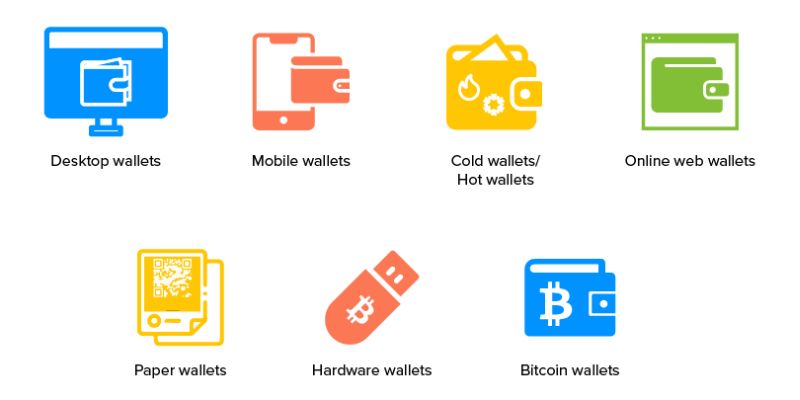

Types of Crypto Wallets

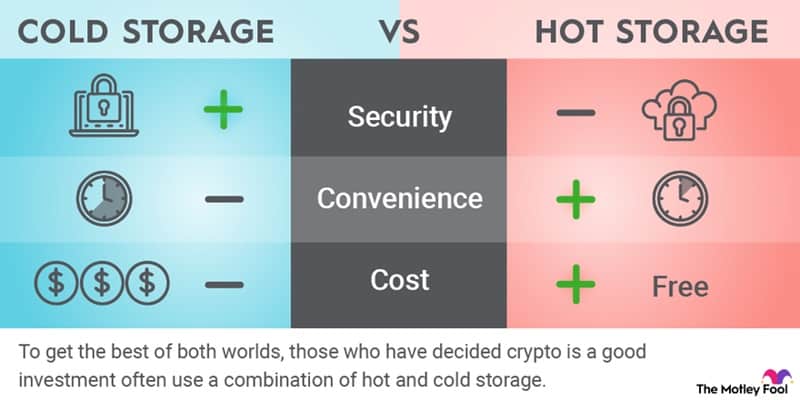

So, what choices do you have for storing your coins? Mainly, there are two: hot wallets and cold wallets. Hot wallets connect to the internet. They let you access your coins quickly. Perfect for those fast trades or daily spends! But, there’s always a ‘but’, right? They can attract unwanted attention from hackers because of this constant connection.

Cold wallets, on the other hand, are the vaults of the crypto world. They’re typically offline, so they’re not as easy to reach for quick spending. However, they provide an added layer of security. They’re like burying your treasure on a deserted island. Not as handy, maybe, but it gives you peace of mind.

Every wallet type has its place. Quick access for active traders? Hot wallet. Long-term safety for your savings? Cold wallet. Knowing which to use, and when, is key to keeping your cryptocurrency treasure safe and sound.

And remember, no matter the type, always back-up. If you lose your key (password), your treasure might be lost in the digital sea forever.

Understanding these basics arms you with knowledge. Now you’re ready to dive deeper into hot and cold wallets. Stay safe and keep your treasure guarded!

What is a Hot Wallet?

Hot Wallet Advantages

Hot wallets are like the wallets you carry every day. They’re always with you, making it easy to buy and sell your digital coins. You can access them from anywhere with internet—a big plus! They work well if you move crypto often. Think of it as your on-the-go purse for digital money.

Hot wallets hook up to the web, which makes them super handy. With them, you’re just clicks away from doing what you need with your crypto. For daily traders or spenders, this is perfect. It’s like having a shop open non-stop, right in your pocket.

Some popular online wallets even let you swap different types of crypto without moving them around. This makes it easier to handle sudden shifts in the market. Instead of several steps, you trade in one place—fast and smooth.

For new folks in crypto, hot wallets can be friendly for beginners to start with. They guide you on how to store digital coins without much fuss. Plus, learning about crypto wallet security basics is simpler this way.

Risks of Hot Wallets

But here’s the thing: being always online has its downsides. It’s like leaving your car unlocked—with the keys in. Bad news if a thief walks by, right? Hot wallets can face the same kind of trouble—attacks from hackers. These bad actors always hunt for chances to swipe your coins.

Hot wallets store private keys on devices that touch the net. These keys are what keep your coins safe. If they get stolen… well, you can guess what might happen. It’s like dropping your house keys in front of sneaky eyes.

Plus, since hot wallets are often part of exchanges, the risks go up. What if the exchange gets hit by cyber crooks? Your coins might be in danger too. So, while they’re great for convenience, remember: hot wallets are not the safest home for your long-term savings.

Keep your investments safe by moving only what you need into your hot wallet. It’s like not walking around with all your cash—just enough for what you plan to spend. And stay sharp! Always keep your wallet’s software updated. This is like locking your doors and checking the locks twice.

For securing digital currencies, these steps are key. They help guard you against mistakes that could cost you. Remember, in the world of crypto, staying safe should come first. Protect your coins like you would with anything you value.

In crypto, smart moves matter. So, use hot wallets for their perks but respect their risks. Know when to use them and when to go for safer, less exposed options. This blend of smarts and safety can help you enjoy the crypto ride. Without letting worries weigh you down too much.

Exploring Cold Wallets for Cryptocurrency

Benefits of Cold Storage

When you think of storing money, banks may come to mind. Yet, with digital coins, cold wallets are like secret vaults. They’re not online, so hackers can’t reach them easily. A major plus of cold storage is safety. Unlike hot wallets, these do not rely on internet connections. This cuts the risk of cyber-attacks. Your digital coins are offline, away from thieves and malware.

Cold wallets come in various forms, like hardware or paper ones. They keep private keys offline, which are needed to access your crypto. Think of them as uncrackable codes that unlock your digital treasure chest. With cold storage, you have full control. No third party can freeze or lose your assets, as can happen with online wallets. For those who have a big amount of cryptocurrency or plan to hold it long, cold storage is often best.

Cold Wallet Security

Security with cold wallets is like a fortress. It’s all about layers. Encryption is essential. It scrambles your data, so even if someone gets your hardware wallet, the info on it stays safe. Private key management is another line of defense. Only you should know and control these keys. If a stranger finds them, it’s like handing over the keys to your bank vault.

One might worry, “What if I lose my cold wallet?” This is where wallet recovery methods come into play. Many hardware wallets let you set up a recovery phrase. If you lose your wallet, use this phrase to regain access to your crypto. Paper wallets, however, do not have such recovery options. If you lose a paper wallet, it’s like losing cash – gone for good.

In cold storage, you need to handle upgrades and backups yourself. It’s like checking your smoke alarms regularly to ensure they work. For daily use and trades, a cold wallet isn’t as handy. Yet, for keeping your investment safe, especially in the long run, it beats hot wallets.

To wrap up, both hot and cold wallets have roles in the world of crypto. Cold storage excels in security, making it ideal for large amounts or long-term holding. Remember, the way you store your digital coins can make or break your crypto experience. Choose wisely, and prioritize safety to protect your virtual wealth.

Choosing the Right Wallet for Your Cryptocurrency Needs

Mobile Wallet vs Hardware Wallet

When you start with crypto, you hear a lot about wallets. But what kind? Let’s dig into mobile and hardware wallets, two popular kinds you’ll meet.

What is a hot wallet?

A hot wallet connects to the Internet. It’s like a pocket you carry on your phone or computer. It’s super handy for trading fast, and you can reach your coins with a tap. But, there’s a but – being online means hackers could sneak in.

Hot wallet advantages

Hot wallets shine with easy access. You can pay friends, buy goods, or trade all in real-time. They are great for small amounts that you use often, just like the cash in your real-world wallet.

Risks of hot wallets

Since hot wallets are online, they are at risk. Think of it like carrying cash. If someone snatches your phone, they could snatch your crypto, too. So, hot wallets are best for small, daily-use amounts.

Paper Wallet Basics and Software Wallets Explained

Now let’s chat about paper and software wallets.

What is a cold wallet?

A cold wallet stays offline. No Internet, no hackers. It’s like a safe for your crypto. You can make one from paper – just a piece of paper with your crypto keys printed on it. It’s simple and super secure, but not as quick to use.

Cold wallet security

Cold wallets, think paper or hardware, are the Fort Knox for your crypto. Hackers can’t touch them easily because they’re not online. Plus, you don’t depend on some online service that may vanish overnight.

With paper, keep it safe from fire and water. With hardware, pick one with tough security and always keep it close.

Mobile Wallet vs Hardware Wallet

We’ve seen hot and now let’s compare it to cold, starting with mobile wallets. Mobile wallets, those on your phone, are hot wallets. They are great when you’re out and about. You can shop or trade even in line for coffee.

But, what about bigger sums, like your serious crypto savings? Enter hardware wallets. These are cold wallets. They look like USB sticks and are just as portable but way more secure. You plug them in, do your thing, then unplug. Safe and sound.

Paper Wallet Basics and Software Wallets Explained

Lastly, we’ve got software wallets for your computer or laptop. These can be hot or cold. Hot when connected, cold when not. And paper wallets? The ultimate cold wallet. Just print and store.

So, which to choose? It depends. For quick spends, a mobile wallet on your phone is super. For big bucks, get a hardware wallet. Offline is the way to keep your investment safe.

And remember, whether it’s a scribbled note or a gadget, your wallet – and keys – are precious. Keep them close and keep them safe. That’s your crypto commandment number one.

We’ve covered a lot about crypto wallets today. First, we got the lowdown on how to keep them safe. We broke down the different kinds you can use. Hot wallets are easy to use, but there are risks. Cold wallets offer solid security and peace of mind. Choosing between mobile, hardware, or paper and software wallets depends on your needs.

For me, the key takeaway is balance. It’s about mixing ease of use with strong security. Think about how you use your coins and pick the wallet that fits that picture. Stay safe and smart in the crypto world!

Q&A :

What is the basic difference between a hot wallet and a cold wallet?

A hot wallet is connected to the internet and allows for quick and convenient access to cryptocurrencies, making transactions easy to complete. Contrastingly, a cold wallet is not connected to the internet and is used for the secure, offline storage of crypto assets, offering enhanced security at the expense of convenience.

Which is safer for storing cryptocurrency, a hot wallet or a cold wallet?

For security purposes, a cold wallet is generally safer than a hot wallet as it is less vulnerable to online hacking attempts due to its offline nature. While hot wallets are practical for everyday use, cold wallets are best for long-term storage of larger amounts of cryptocurrency.

For beginners, should I start with a hot wallet or a cold wallet?

Beginners may prefer to start with a hot wallet due to its user-friendly interface and ease of conducting regular transactions. However, it’s advisable to use a cold wallet for storing any significant amount of cryptocurrency to ensure better protection against potential cyber threats.

What are examples of hot wallets and cold wallets?

Examples of hot wallets include web-based wallets like Blockchain.info, mobile wallets like Mycelium, and desktop wallets like Exodus. On the other hand, cold wallets typically refer to hardware wallets such as Ledger or Trezor, and paper wallets where private keys are printed and stored offline.

Can I use both a hot wallet and a cold wallet?

Yes, it’s common for individuals to use both hot and cold wallets. A hot wallet can be used for daily trading and transactions with a limited amount of funds, while a cold wallet serves as a secure storage for the bulk of one’s cryptocurrency holdings to minimize risk.