Diving into the world of digital currency is like stepping into a financial Wild West. It’s vital what to know before investing in crypto for beginners to avoid costly pitfalls. I’ve mastered these tricky trails, ready to guide you through. Think of this as your map for crypto success, crafted from my own journey. Let’s unlock the secrets: understand the tech, secure your assets, and read the market’s runes. With my savvy strategies and risk control smarts, you’ll set forth confidently. Ready to invest? Let this blueprint lead the way in navigating the crypto landscape wisely.

Understanding the Fundamentals Before Investing

Grasping Cryptocurrency Basics for Beginners

Before you dive into crypto, know what you’re getting into. Cryptocurrency is digital money. It’s like the cash or cards in your pocket but online. It’s thrilling to think about, right? It lets you buy goods, invest, or trade. But remember, it comes with big risks.

Think of it as playing a new sport. You wouldn’t step onto the field without knowing the rules. The same applies here. Learn the game before you play. Start by knowing key terms. Words like blockchain, digital wallet, and exchange are your ABCs here.

So, how do you start with cryptocurrency? First, research! Read a beginners guide to cryptocurrency. Understand terms, how it all works, and what makes it special. Look online – there are tons of resources. Remember, knowledge is power, especially when your money’s on the line.

Exploring Blockchain Technology and Decentralization

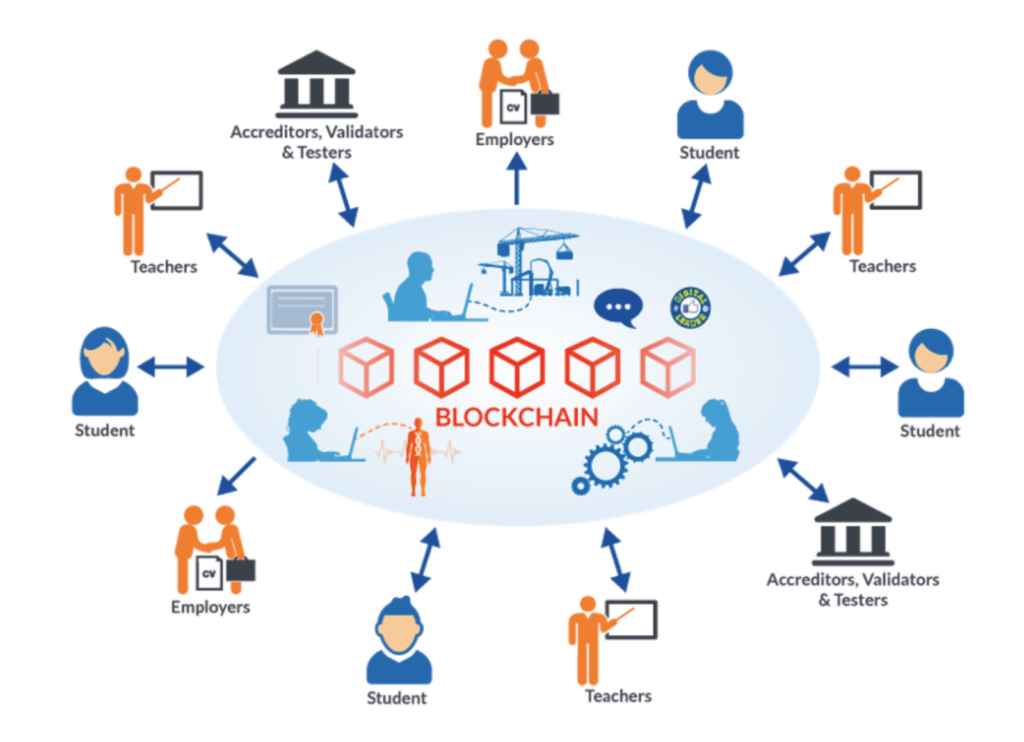

Now, let’s break down blockchain technology. Imagine a notebook that everyone can write in but no one can erase. That’s kind of what blockchain is. It’s a record of all transactions made with a certain crypto. It’s public and super hard to change.

Why does this matter? Because it’s what makes crypto safe and fair. It stops people from cheating, like spending the same coin twice. Think of it as the referee of the crypto game, keeping things honest.

Decentralization in crypto is its next cool feature. Unlike banks, no big boss controls it. It’s spread out across many computers. This means no one person or group has all the power. It’s like having a bunch of umpires in a game. It helps make sure no one is calling all the shots unfairly.

Wrapping your head around these concepts takes time. But it’s worth it! Once you start understanding crypto, you’ll feel more ready to invest. Take it step by step. Don’t rush, and don’t put in money if you’re not sure.

In the next sections, you’ll learn ways to set up your wallet, pick the right exchange, and keep your digital currency safe. I’ll also show you how to deal with market ups and downs. This will help you keep your cool when prices swing.

Investing can be fun. It’s about making choices, watching them play out, and learning. And remember, even with a great plan, success isn’t guaranteed. But with these basics, you’re one step closer to playing the game wisely.

Preparing for Crypto Investment

Setting Up and Securing Your Crypto Wallet

Let’s talk about keeping your crypto safe and sound. First off, you want a crypto wallet. This is where you keep your digital money away from harm. A wallet can be online or in a physical device. Think of it like a bank account, but just for your crypto.

Now, remember, security is top-notch priority. You’d want to make sure no one can sneak into your wallet. To do this, use strong passwords and keep your private keys secret. A private key is like a super-secret code that only you should know. It unlocks your wallet, so make sure no one else finds it. And also, always have backups for your wallet info. Computers can crash, and devices can break, so it’s smart to be ready for anything.

Diving into Crypto Exchange Platforms and Trading

Next stop, exchange platforms – your gateway to buying and selling crypto. To start, find a platform that feels right for you. There are lots out there, so take your pick. When you find one, set up your account. Usually, it’s just like making any online account. You’ll need some ID and your bank details too.

Trading crypto is exciting but comes with its own rules. Prices can jump up or down really fast. We call this volatility. It’s why you need to keep a cool head and think before you act. Buy low, sell high – the golden rule of trading. But it’s not only about luck; you’ll want to learn to read the market.

To make smart moves, you can’t just guess. You need to learn the ropes. Start small and don’t put all your money in one place. Spread it out. This keeps your risk lower. And never stop learning. The more you know about crypto, the better choices you’ll make.

Remember, friends, the crypto world is an adventure. It’s full of chances to learn and grow your money. Just be clever about it. Use strong passwords, keep your secret codes safe, and learn, learn, learn before you buy or sell. This way, you’ll be ready to dive into the digital currency adventure and come out on top!

Strategies for Navigating Market Volatility and Complexities

Cultivating a Diversified Crypto Portfolio

Let’s chat about keeping your money safe when buying crypto. It’s like not putting all your eggs in one basket. You spread your investment across different coins. This way, if one coin’s price falls, you’re not hit hard.

First, know the big names like Bitcoin and Ethereum. They’re like giant trees in a forest. Then, look at smaller coins, known as altcoins. Some might grow big too. Remember to only invest money you can afford to lose.

Study up before buying coins. Read, ask, and learn. That way, you make smart choices on what to buy and when. Also, keep an eye on the news. Big events can change coin prices fast.

Deciphering Market Capitalization and Reading Crypto Charts

Market capitalization, or market cap, shows how big a coin is. To find it, multiply the current price of a coin by how many are out there. Big market cap means a big player in the market.

Now, let’s get into reading crypto charts. They tell you how coin prices move over time. Look for patterns. They can hint at how prices might change. But remember, past success does not promise future gains.

Always start with small money. It helps you learn without big risk. And never stop learning. The crypto world changes fast.

Understanding these things helps you make better choices. And better choices give you a better shot at success.

So, dive in, stay smart, and happy trading!

Assessing Risks and Regulatory Compliance

Identifying Cryptocurrency Risks and Scams to Avoid

When starting with cryptocurrency, know the risks. Scams are real. They trick newbies. Be smart. Spot scams early. Look for red flags, like big promises that sound too good. Always check a project thoroughly before you invest. Ask, is this legit? A good way to check is by seeking reviews and active community feedback.

Be extra careful with offers online and social media. If someone pushes you to invest fast, step back. Real deals don’t rush you. Learn about common scams. For example, fake ICOs may grab your money and vanish. Always do your homework. Research a coin’s team, mission, and whitepaper.

Another risk is sudden loss. The crypto market can swing wild. At any time, prices might drop a lot. Only invest money you can afford to lose. That’s key. Remember, big gains also mean big risks. Don’t let dreams of fast money cloud your judgment.

Understanding Tax Implications and Regulatory Environment for Cryptocurrency

Now, think about taxes. Every time you trade, sell, or use crypto, it can count as a taxable event. This means work for you come tax time. You must keep track of all transactions. It’s your job, not the exchange’s. Learn the tax rules where you live. They can change often. Keep up.

Also, know that laws about cryptocurrency can vary a lot around the world. Some places welcome it, while others have strict rules or bans. So, do your research. This helps you stay on the right side of the law.

Remember, U.S. regulators like the IRS and SEC are watching crypto closely. They want to protect investors and keep markets fair. If you’re not sure about a rule, ask for help. It’s better to ask than to make a mistake.

In short, stay informed and cautious. If you get these things right, you’re setting yourself up for a better, safer start in the world of cryptocurrency.

In this post, we broke down crypto investment into clear steps. We started with the basics, exploring blockchain and what makes cryptocurrency tick. Then, we walked through setting up your wallet and getting to know crypto exchanges for trading.

We tackled the ups and downs of the market, showing you how to create a diverse portfolio and read charts. And it’s key to know the risks and play by the rules, including taxes and avoiding scams.

I hope this guides you on your crypto journey. Keep learning and stay sharp!

Q&A :

What Are the Essential Basics Beginners Should Learn About Crypto Before Investing?

Understanding the world of cryptocurrency can be daunting for beginners, so it’s crucial to start with the fundamentals. Get acquainted with what cryptocurrency is, how blockchain technology works, and the different types of digital currencies available, such as Bitcoin, Ethereum, and others. Learn how to set up a digital wallet, understand the concept of public and private keys, and familiarize yourself with how transactions work. Recognize the importance of security practices to protect your investments.

How Can Beginners Evaluate Which Cryptocurrency to Invest In?

For those new to the crypto space, it’s important to conduct thorough research before investing. Look into the market capitalization, project goals, whitepaper, community support, and development team credibility of each cryptocurrency you’re considering. Understanding the project’s use case and potential for growth is vital. Additionally, keep an eye on the cryptocurrency’s historical performance, but also be aware of the volatility and unpredictability of the market.

What Risks Should a Beginner Be Aware of When Investing in Cryptocurrency?

Cryptocurrency investments can be highly volatile and come with several risks. Be aware of market volatility, the potential for hacking and security breaches, and the regulatory environment that can affect the value of your investments. It’s important to only invest what you can afford to lose and to diversify your portfolio to mitigate risks. Beginners should also recognize the impact of speculation and market sentiment on crypto prices.

How Much Money Should a Beginner Invest in Cryptocurrency?

There’s no one-size-fits-all answer to this question as it depends on individual financial situations. Beginners should consider starting with a small amount that they are comfortable with losing, as the crypto market is highly unpredictable. It is wise to treat this as a high-risk investment and avoid allocating more than you can afford to lose. Over time, as you gain more knowledge and confidence, you may decide to adjust your investment accordingly.

Are There Any Trusted Educational Resources for Crypto Investment Beginners?

Yes, there are several reputable resources available to beginners looking to educate themselves on cryptocurrency investments. Websites like CoinDesk and CoinTelegraph provide up-to-date news and information, while platforms like Coinbase and Binance offer educational sections specifically for new investors. Additionally, many local and online courses can provide a structured learning environment for those wishing to delve deeper into the world of crypto. Remember to always verify the credibility of the source and cross-reference information to avoid misinformation.