Ever wonder how you can sell your crypto as fast as you can click? It’s all thanks to a Market Maker in Crypto—the unsung hero making sure you can trade quick and easy. They’re the ones keeping your trades moving without a hitch. Dive in with me as we unwrap this mystery and see how these market magicians work their mojo to keep your crypto cash flowing. Here, you’ll learn the lowdown on what they do and why every trade counts on them to keep the digital dough rolling. Let’s get the scoop on these behind-the-scenes wizards and crack the code of crypto liquidity!

Understanding the Role of Liquidity Providers in Cryptocurrency

The Basics of Cryptocurrency Liquidity Solutions

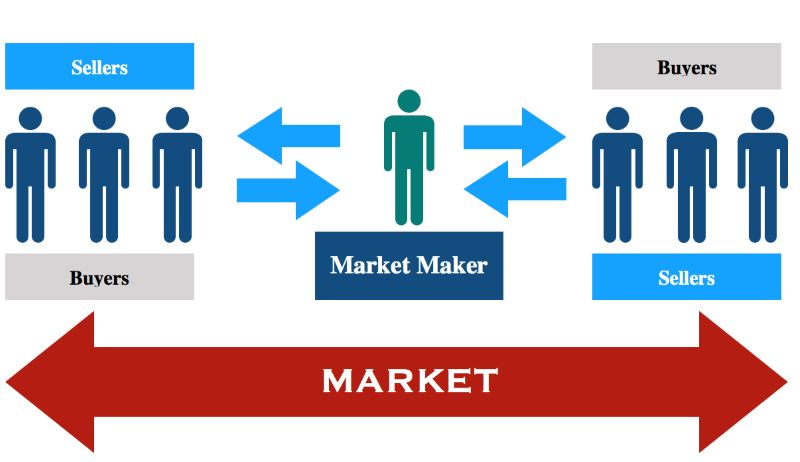

Liquidity in crypto means how fast you can turn crypto into cash. Think of it like a fruit market. If you can sell apples quick, the market has good liquidity. Now, for cryptocurrencies, market makers bring this juice. They are like shopkeepers who make sure there is always fruit to buy or sell.

These shopkeepers in the digital world are called “liquidity providers in cryptocurrency.” They make trading easy. Without them, you might not find someone to buy your crypto, or you could sell it much lower. It’s a bit like trying to sell a rare comic book. No shopkeeper means it’s hard to find a buyer.

Liquidity providers use “cryptocurrency liquidity solutions.” They place buy and sell orders for others to match. More orders mean a better chance to trade without waiting. It’s as if you have many fruit sellers and buyers. You can quickly sell your apples or buy oranges.

Another cool thing is “liquidity pools and crypto trading.” Pools are big pots of money. People throw in cash or crypto and get fees when others use it to trade. It’s like if you add apples to a community fruit basket and get a few oranges whenever someone grabs your apples.

Market makers help with “providing liquidity for exchanges.” They make sure you can always trade. They do this by using “crypto market maker algorithms.” These are smart programs that decide when to buy or sell. Like a computer game that plays itself to keep the score even.

Automated Market Makers vs. Traditional Market Makers

You’ve got two main types of shopkeepers. First up, the “automated market makers” (AMMs). Think of AMMs like vending machines. They’re always there, ready with snacks, no human required. In crypto, they let you trade without another person by using those liquidity pools.

Traditional market makers are more like old-school shopkeepers. They set the prices. And they’re real people or companies. They watch the market and make live decisions. It’s like a savvy fruit seller who knows when to drop apple prices because everyone wants oranges.

AMMs don’t set prices like humans. They have rules for pricing based on the pool. If there’s lots of crypto to buy, prices go down. If there’s less, prices go up. It’s like a vending machine that changes snack prices as they run out.

These market makers shape “order book depth in digital currencies.” A strong order book has lots of buy and sell orders close in price. It means less wait time and better prices for everyone.

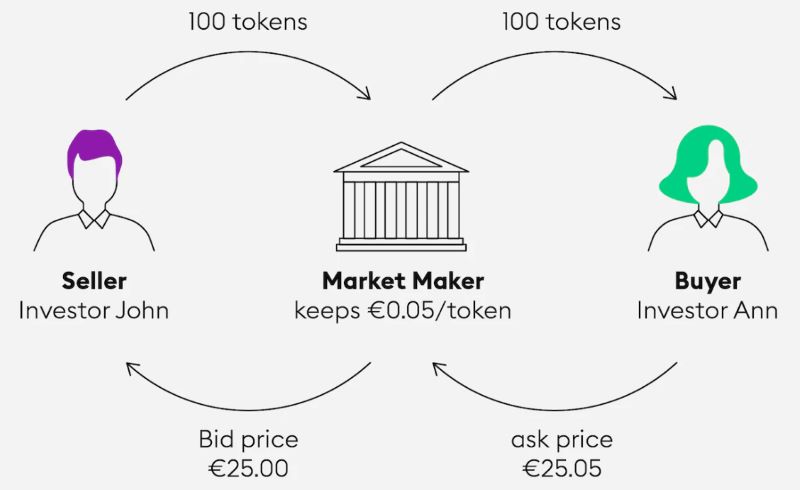

Market makers also fix “bid-ask spreads in cryptocurrency.” That’s the gap between what buyers want to pay and sellers want to charge. They narrow this gap, so it’s a win-win for buyers and sellers. Like if a fruit seller narrows the price gap between buying and selling apples, you get a better deal.

And they reduce “slippage in crypto trading.” Slippage means getting a different price than expected. With good liquidity, you get what you see, like a fixed price menu at a diner.

In short, these market makers keep the crypto world spinning. They make sure you can always buy or sell, no surprises, no fuss. They’re like the unsung heroes who keep the crypto gears greased and the trades moving smooth.

Devising Effective Market Making Strategies in Crypto

Enhancing Order Book Depth in Digital Currencies

Diving right in, let’s talk about ‘order book depth’ in simple terms. Imagine a storefront, but instead of goods, it sells digital coins. A thick order book is like having full shelves – it means lots of buyers and sellers. This thickness lets people trade large amounts without big price changes. I help keep these shelves stocked by balancing buys and sells. This balance is the core of my job as a market maker.

I use smart strategies to make sure there is always enough on the shelf. Both buys and sells. I prevent sudden price leaps and plunges. That’s key in a world where prices move fast. With deep shelves, folks can trade big without worrying. This calms the market.

Utilization of Liquidity Pools in Crypto Trading

Liquidity pools are big reserves of various coins that traders can jump into and out of. Think of a huge swimming pool, but filled with different crypto coins. Automated market makers guard these pools. They set rules for how you can swap coins.

These pools let folks trade 24/7. People everywhere can swap digital bucks with ease. They don’t have to wait for someone to match their trade. The pool is always there.

I create rules that make these pools fair and smooth. This encourages people to dive in and trade. I watch carefully to fine-tune things as needed. I ensure that slippage – that’s the gap between what you expect to pay and what you actually fork out for a coin – stays tiny. No one likes bad surprises.

Working with these pools, I make sure they have enough of each coin. This way, when you want to swap big, there’s no drama. More folks come to the pool. More coins get swapped. This makes things more lively and efficient.

Now, why does all this liquidity talk matter? More liquidity means a happier and healthier market. It means you can move coins without making waves. It’s my job to help provide that peace of mind.

When I do my market maker magic, I’m like a guardian for the coins. Making sure everyone gets a fair chance to buy or sell what they need. Creating order where there could be chaos. And believe me, in the wild world of crypto, that’s a pretty cool thing to do.

The Mechanics of Crypto Market Maker Algorithms

Achieving Market Stability Through High-Frequency Trading

Ever wonder how crypto markets stay stable? I’ll tell you. It’s high-frequency trading. This is where market makers come in with super fast moves. They buy and sell a lot in just seconds. This is what I do. And it’s vital. Without it, prices would jump like crazy. Nobody wants that. So market makers use smart programs, or algorithms, to keep things smooth.

High-frequency trading does more than just calm prices. It brings life to the market. It helps everyone, not just big players. It means more trades, and that’s good for all. It’s like being in a crowded street market. Lots of buyers and sellers make for great energy.

Now, let’s get into the nitty-gritty. These algorithms look at loads of trades all at once. They are super good at this. They check out the prices people want to buy and sell at. Then they make the market by jumping in. They set prices that work for buyers and sellers. This keeps the market humming.

Optimal Inventory Management for Effective Liquidity Provision

Keeping the right balance of crypto coins is crucial. This is called inventory management. You got to be careful so you can keep trading strong. If a market maker holds too much, it’s risky. Too little, and they can’t trade well. It’s a tightrope walk.

Market makers aim to have just enough on hand. Not too much, not too little. It’s a science. And it’s how they make sure traders always find a partner. Without this, you could be left hanging, wanting to trade with no takers.

Crypto coins are like products in a store. Think of the market maker as the shopkeeper. They must stock the right amount. If they pull this off, you’ll always find what you need when trading.

The goal? Make the market liquid. This means making it easy for everyone to trade. It’s like having a smooth freeway versus a bumpy road. A liquid market is the smooth freeway. It lets you speed on without bumps.

So, how is this done? Algorithms. These are the brainy systems I create. They check out everything in the market. They see how many coins are needed and keep the balance. It’s like a smart scale, always finding the perfect balance.

In short, my job is quite a juggle. I use these algorithms to keep the market just right — not too hot, not too cold. It’s a bit of magic, you could say. Crypto market maker algorithms are the secret sauce in this spicy financial world. And like any good recipe, it takes lots of practice, skill, and a dash of daring to whip up something special.

Navigating Regulatory and Ethical Practices in Crypto Market Making

Adapting to Market Maker Regulation in Crypto

Rules for crypto market makers can be tough. We stay good by changing fast. We study laws. We keep our trading clean and fair. It’s like a game where the rules often change. We play smart. And we win by keeping things right.

A market maker in crypto needs to check rules. Often. It’s vital. Breaking them can mean trouble. Huge fines, or worse. We keep our noses clean. We make sure our work helps the market, not hurts it.

Harnessing On-Chain Liquidity Analysis for Compliant Trade Execution

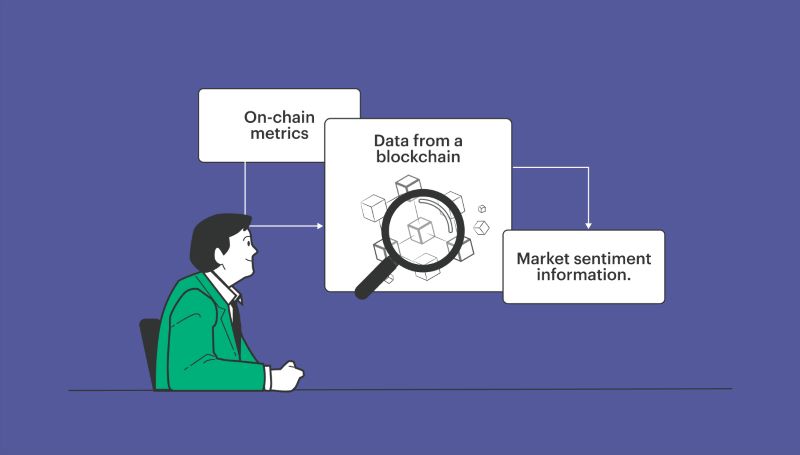

On-chain data tells us loads. Like, where money moves and how much. Why is it great? It helps us trade without breaking rules. We crunch numbers from blockchains. We see what’s up. Then we trade. And we do it all clean and straight.

We get info from the blockchain. This is called on-chain liquidity analysis. The data shows how full the market is. With this, we can make trades that follow the rules. It helps us see where things are going.

Keeping Trades Clean with Real-Time Data

Real-time data is our best friend. It helps us trade quick and clean. It’s like having super sight. We see the market pulse. We jump in at the right time. Super helpful!

This means watching the market live. It’s like a hawk watching its prey. We grab good deals. We help set fair prices. And we keep trades smooth. That’s our goal.

In crypto trading, we aim for small price gaps. This means tight bid-ask spreads. It’s good for everyone. It makes trading fair. It means you can trade more. And we all win.

In the crypto world, we work with token issuers too. They make new kinds of money. We help them find buyers. We bring the buyers. This makes their coin useful. More trades, better prices.

The Art of Balancing Risk and Reward

Risk is like a shadow in crypto. It’s always there. How do we deal with it? We manage our coins smart. We don’t put all our eggs in one basket. We spread our bets. This keeps us safe. It lets us keep trading, even on bad days.

We use special computer programs, bots, to help us. They trade fast. Faster than any person could. This makes trading smooth. It helps the market stay calm.

Our world, market making in crypto, is fun, fast, and always changing. We are like the wizards behind the curtain. We keep the crypto world spinning. And we do it by playing by the rules. It’s not just magic. It’s hard work, and it’s super important.

In this blog, we dived into how liquidity providers keep crypto trading smooth. We looked at how crypto liquidity works and compared automated market makers with the usual ones. We explored ways to make better market making plans, like making order books deep and using liquidity pools.

We learned how smart algorithms can help make markets stable and manage how much crypto they have well. Then we tackled the rules and right ways to do things in crypto market making. It’s about staying fair and within the law.

Here’s the bottom line: Good market making means trades are fast and fair. It helps everyone who buys and sells crypto. It’s tricky but key to a market that works well. That’s our wrap-up on crypto liquidity and market making. Always trade smart!

Q&A :

What Is a Market Maker in the Crypto Sphere?

Market Makers in cryptocurrency are entities or individuals that increase the liquidity of a digital asset by providing buy and sell orders on both sides of the order book. They help facilitate trading by allowing traders to fill their orders more easily, minimizing the spread (the difference between the buy and sell price), which makes it more attractive for others to trade.

How Do Market Makers Profit in the Cryptocurrency Market?

Crypto Market Makers profit primarily through the bid-ask spread. By offering to buy at lower prices and to sell at higher prices, they earn the difference as their profit. Additionally, exchanges may also pay market makers for providing liquidity, compensating them with trading fee reductions or rebates.

Are Market Makers in Crypto Necessary for an Exchange to Function Efficiently?

Yes, Market Makers are crucial for the efficient functioning of an exchange. They provide the necessary liquidity and depth to the market, ensuring that trades can be executed swiftly without significant price slippage. Without market makers, the markets can become illiquid, leading to high volatility and making it difficult for traders to enter or exit positions at their desired prices.

Can Anyone Become a Market Maker in Cryptocurrency?

Technically, anyone with sufficient capital, knowledge, and the right technological tools can become a Market Maker in the cryptocurrency space. It requires a strategic approach to setting buy and sell orders and handling the rapid fluctuations peculiar to the crypto market. Many also use automated systems or sophisticated algorithms to manage their positions more effectively.

What Risks Are Involved in Market Making in the Crypto Industry?

Market making in the crypto industry involves several risks, including inventory risk (holding large amounts of a crypto asset that can lose value), volatility risk (sudden and extreme price movements can lead to potential losses), and technological risks (system failures or outages can impair trading operations). Additionally, regulatory changes and market manipulation in less regulated markets can also affect market makers.