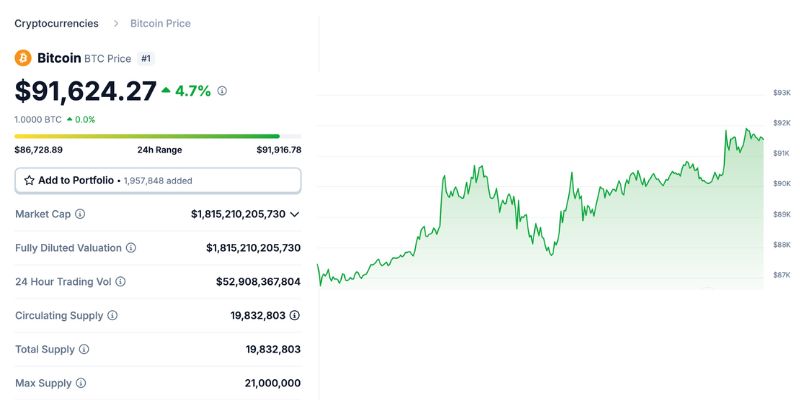

Bitcoin (BTC) has experienced a notable surge, reaching a price of $91,624.27 as of March 05, 2025, reflecting a 4.7% increase over the past 24 hours. Within this period, Bitcoin’s price fluctuated between a low of $86,728.89 and a high of $91,916.78, signaling strong upward momentum. With its current price hovering near the 24-hour peak, this uptick has captured the attention of investors and analysts alike. Below, we dive into the latest Bitcoin price update and explore the key factors driving this significant change.

Bitcoin Price Update (Mar 6)

Currently, Bitcoin boasts a market capitalization of $1,815,210,205,730, reinforcing its dominance in the cryptocurrency market. The 24-hour trading volume reached an impressive $52,908,367,804, highlighting robust activity among traders and investors. The circulating supply stands at 19,832,803 BTC, matching the total supply, while the maximum supply remains capped at 21,000,000 BTC, a fundamental trait that underpins Bitcoin’s scarcity-driven value.

Over the past 24 hours, Bitcoin’s price oscillated within the range of $86,728.89 to $91,916.78. The current price of $91,624.27, up 4.7% from yesterday, positions it close to the daily high, suggesting sustained buying interest and market confidence.

Why Is Bitcoin’s Price Changing?

Several factors could be contributing to Bitcoin’s 4.7% price surge. Let’s break down the potential drivers behind this movement:

Supply and Demand Dynamics

Bitcoin’s fixed supply cap of 21 million coins, with 19,832,803 already in circulation, creates a scarcity effect. When demand spikes—as evidenced by the $52.9 billion trading volume—and supply remains limited, prices naturally rise. This surge may indicate fresh capital entering the market, possibly from institutional investors or retail traders capitalizing on bullish sentiment.

Market Sentiment and Investor Optimism

Bitcoin often acts as a barometer for the broader crypto market. A 4.7% gain in a single day reflects growing optimism among investors, potentially fueled by positive developments or speculative momentum. The proximity of the current price ($91,624.27) to the 24-hour high ($91,916.78) suggests buyers are pushing to test higher resistance levels, a sign of confidence in Bitcoin’s near-term trajectory.

Macro-Economic Influences

Global economic conditions frequently impact Bitcoin’s price. For instance, uncertainty in traditional markets, shifts in monetary policy (like interest rate changes), or inflation concerns could drive investors toward Bitcoin as a hedge. While no specific event is tied to this 24-hour period, historical patterns—such as the approval of Bitcoin ETFs in 2024—demonstrate how macro catalysts can spark rallies.

Miner Behavior and Selling Pressure

Bitcoin’s supply is influenced by miners who earn rewards for securing the network. If miners hoard their coins rather than sell, circulating supply tightens, supporting price increases. Conversely, heavy selling by miners to cover costs could suppress prices. The current rally suggests minimal selling pressure from miners, with demand overpowering any potential sell-offs.

Short-Term Trading and Volatility

Bitcoin’s reputation for volatility is well-earned, and this 24-hour range ($86,728.89 to $91,916.78) underscores that trait. Short-term traders likely amplified the upward move by capitalizing on momentum, triggering buy orders as the price breached key technical levels (e.g., around $90,000). This speculative activity can exaggerate price swings in either direction.

Potential External Triggers

Though the data doesn’t specify events on March 05, 2025, Bitcoin’s price often reacts to news. Adoption by a major corporation, regulatory clarity, or blockchain upgrades could have sparked this rally. For example, past surges have followed announcements of Bitcoin integration by firms like Tesla or supportive legislation in key markets.

Bitcoin’s climb to $91,624.27, a 4.7% jump in 24 hours, reflects a confluence of supply-demand imbalances, bullish sentiment, and possible external catalysts. With a market cap of $1.815 trillion and strong trading volume, Bitcoin remains the crypto market’s cornerstone. However, its volatility warns of potential pullbacks, making it critical for investors to stay informed. As Bitcoin edges closer to its 24-hour high of $91,916.78, all eyes are on whether this momentum will carry it to new heights—or face a correction.