Ever scratched your head wondering, how do different countries regulate Bitcoin? You’re not alone. The world is divided not just by borders but by how they treat Bitcoin. I’m here to guide you through these complex lanes of legalities. Some nations welcome it with open arms; others look at it sideways. Let’s dive into the nitty-gritty and untangle the global patchwork of regulations shaping the future of cryptocurrency. From Asia’s mixed messages to Europe’s bold strides, get ready for a clear-cut breakdown of Bitcoin investment and trading guidelines, taxes, and anti-money laundering directives that will shine a light on where the world stands. Buckle up – it’s a wild regulatory ride!

Diverging Paths: The Legal Status and Regulation of Bitcoin Worldwide

Understanding the Global Patchwork of Cryptocurrency Legal Frameworks

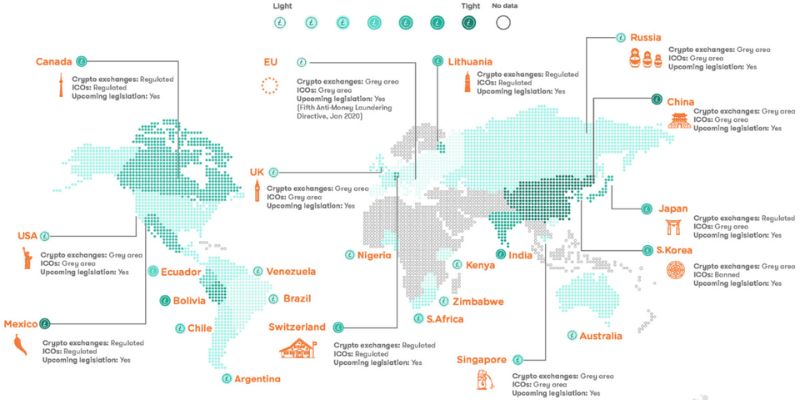

When it comes to Bitcoin regulation by country, there’s no one-size-fits-all rule. Each nation has its own view on Bitcoin and other cryptocurrencies. These range from open arms to complete bans. In the U.S., crypto regulation varies but generally leans toward federal oversight, with states like New York setting their own stricter rules. Meanwhile, the European Union is crafting comprehensive EU bitcoin legislation to unify how member countries deal with crypto.

Across the waters, in Asia, countries have their own takes. Japan was early to accept Bitcoin, crafting careful rules to protect users. South Korea also regulates it, but looks harder at its use. China, though, took a different path. They banned all things crypto to make way for their own digital money.

Key Differences in Bitcoin Investment and Trading Guidelines by Region

In Latin America, Bitcoin finds mixed views. Some nations, like Venezuela, see it as a lifeline amidst economic woes. Others still debate its place in their economy. Africa presents a patchwork, with some countries welcoming Bitcoin to boost their financial systems, while others show caution.

The tale doesn’t end with borders; it’s also about what happens inside them. Taxation of Bitcoin varies widely, from places where it’s tax-free to others taxing it like stock gains. And with the rise of exchanges, countries are imposing rules to keep money safe and clean. Anti-money laundering and Bitcoin often go hand in hand, with nations enforcing strict Know Your Customer (KYC) norms.

The verdict on Bitcoin is still out. From Asia’s mix of red and green lights to Europe’s plans for unity and the diverse views across Africa and the Americas, Bitcoin’s legal journey continues. Understanding this ever-shifting landscape keeps us all on our toes, as the world figures out just where Bitcoin fits in the global monetary puzzle.

Taxation and Anti-Money Laundering Directives: Compliance in the Crypto World

A Closer Look at Bitcoin Taxation Policies Across Nations

Countries handle Bitcoin taxes in many ways. In the USA, the IRS says Bitcoin is property. This means you pay taxes based on how much cash you make from it. Like if you sell Bitcoin for more than you paid, you owe taxes on the profit.

As a global expert, I’ve seen how tough it can be. Some folks get surprised by these taxes. Others work hard to follow the rules. We’ve got countries like Japan that view Bitcoin as legal tender. This means Bitcoin can be used to buy things and is taxed less. But not all places are like that. In India, Bitcoin isn’t legal tender, but it’s still taxed.

Tax systems are like puzzles. Each piece must fit just right. If you make money from Bitcoin, a part of that cash goes to the government. That’s how most places work.

Implementing AML Measures in the Bitcoin Ecosystem

Money laundering is a big worry with Bitcoin. Bad guys sometimes use it to hide their tracks. So, many places use AML laws to stop this. AML stands for anti-money laundering. These rules help catch folks trying to do illegal stuff.

For example, exchanges that trade Bitcoin must know who their customers are. This is called KYC, which stands for Know Your Customer. These rules mean you show ID to trade Bitcoin. It helps keep everything clean and safe.

The big goal is to stop crime but also let folks use Bitcoin freely. Some places, like South Korea, are strict with these laws. Others, not as much. It’s a balance thing. Too much control, and people can’t enjoy Bitcoin. Too little, and it’s open for bad stuff to happen.

Countries all over are trying to get it right. In Singapore, there’s a clear system that companies must follow. They use the latest tech to keep an eye on trades and report anything fishy. Canada is similar; they keep tabs on Bitcoin businesses.

This part of Bitcoin is super important. If we all play by the rules, we keep Bitcoin safe and fun for everyone. And safety is key, right? We all want to use Bitcoin without any trouble. That’s the dream, and AML helps us get there.

So yeah, whether it’s paying taxes or stopping crime, countries are tackling Bitcoin regulation head-on. Each one is carving its path in the crypto world, trying to find the right mix of freedom and safety.

Crypto at the Crossroads: Country-Specific Approaches to Bitcoin Legislation

Pioneering EU Bitcoin Legislation and Approach to Digital Assets

When it comes to Bitcoin regulation by country, the EU stands out. They move fast. The EU shapes laws that make sure digital assets are safe for everyone. They want to protect you from fraud and help your money grow securely. Laws in the EU try to balance control and growth of crypto markets. They look at how Bitcoin can fit into their financial system without trouble.

Laws on Bitcoin taxation policies are clear here. They say when you need to pay taxes on what you earn. EU countries share info to stop tax dodging. They use anti-money laundering rules to track Bitcoin’s flow to stop illegal use. It’s all about keeping the system clean.

Asian Countries’ Stance on Bitcoin: From Acceptance to Prohibition

Now, let’s fly over to Asia. Different story here. Each country has its own take.

Japan says yes to Bitcoin. It’s legal and has a good set of rules. They keep an eye on exchanges. This means you can buy and sell Bitcoin with less worry. They tax your profits though. So, you earn it, they tax it.

South Korea is similar. They like blockchain and use strict rules to make it work well. But no funny business – they’re watching for scams and hacks. Taxes come into play once you cash in on those investments.

Then there are Bitcoin ban countries. Some say no to Bitcoin. They fear it might cause problems – for their money, their rules, their control. Others worry about how much power Bitcoin mining uses. They want to protect the earth, so they say stop.

No matter where, it’s about keeping things safe. They focus on the legal status of Bitcoin and make rules to control it. They look at risk, tech, and what people need. It’s a balance. Some places give more freedom; others hold Bitcoin tight.

In the end, each place is choosing its path. Some are friendly to Bitcoin. Others are cautious. They must think about their people, their economy, and how Bitcoin changes things. Every decision can change how Bitcoin grows.

Watching this big world of Bitcoin is like seeing a story unfold. Countries pick their moves with care. They hope to win for their people. They aim to make money safe, stop crime and let people use Bitcoin in the best way. It’s a tough job, but someone’s got to do it. And it seems the EU and parts of Asia are leading the charge, each in their own unique way.

Now your head might spin with all these rules and changes. But fear not. This map of Bitcoin regulation is here to guide you through. Just remember, the world of Bitcoin changes fast. Keep your eyes open, and always play by the rules – wherever you may be.

Decentralization Meets Regulation: DeFi, Wallets, and ICOs Under the Microscope

The Challenge of Regulating Decentralized Finance (DeFi) Platforms

DeFi stands for “decentralized finance.” It’s a big change in how we do money stuff. It uses tech to cut out middlemen like banks. But here’s the rub—how do you make rules for a system that’s everywhere and nowhere at once?

When we talk about making DeFi safe, it’s like herding cats. Countries are trying hard to figure this out. They want to keep your money safe without stopping all the fun and freedom DeFi brings. The USA is taking baby steps. They ask DeFi groups to follow some money rules but it’s still the Wild West out there.

Addressing the Complexities of Cryptocurrency Wallet and ICO Regulations

Now let’s chat about wallets and ICOs. A crypto wallet isn’t like the one in your pocket. It holds digital coins. ICOs, or “Initial Coin Offerings,” are like the first sale of a new crypto coin. They’re ways to raise money.

Keeping these two in check is a head-scratcher. Countries can’t agree on one way to do it. Some, like Japan, say “OK” to Bitcoin but keep a close eye on wallets and ICOs. They have rules to make sure no one’s up to no good. South Korea’s similar, but they’re stricter. They want to know everyone who’s trading, and sometimes say “no” to ICOs.

The big question is: How can a country control something that’s all over the internet? Tough, right? And then there’s tax. Some folks have to pay tax on their Bitcoin cash in places like the USA. But others, don’t sweat it, like in Singapore.

Crypto is still new, and it’s shaking up how we think about cash. Some places see big promise. Others are scared of the risks. Like Latin America, they’re getting on board with crypto, using it for everything from buying bread to saving up money.

Africa’s catching on too. They’re saying “yes” to crypto more and more. But it’s slow. They’re taking steps to make sure no one gets hurt as Bitcoin and pals move in.

So, why does all this matter to you? Imagine sending cash to your family across the sea with just a few taps. No waiting, no big fees. Nice, right? That’s the dream Bitcoin’s chasing.

But the big wigs want to make sure it’s all safe and fair. That’s why these rules are cooking. They’re not to bug you, they’re there to help. But like putting together a giant puzzle, it takes time to see the whole picture.

What you should know is this world of digital dimes and dollars is always shifting. And with every shift, someone’s trying to keep up, making new rules. It’s a dance, and everyone’s learning the steps as they go along. Keep your eyes peeled, because what’s true today might be old news tomorrow!

We’ve taken a deep dive into the world of Bitcoin regulation across the globe. From the mix of rules in different places to the way countries handle taxes and fight money laundering with crypto. We’ve seen how places like the EU lead with laws while some Asian countries are saying no to Bitcoin.

In the end, Bitcoin shows us how tough it can be to set rules for something that doesn’t care about borders. Each country tries to find the right balance. As we look at DeFi, wallets, and ICOs, the rule book gets even more complex.

So, what’s next? Countries will keep wrestling with how best to handle Bitcoin. As they do, we’ll see new laws come to life. Stay sharp and keep learning. That’s how you’ll stay ahead in the fast-changing world of Bitcoin.

Q&A :

How is Bitcoin regulated around the world?

Bitcoin and other cryptocurrencies face a patchwork of regulations globally. Some countries embrace it with open policies, while others have strict regulations or have outright banned it. Countries like the United States and those within the European Union have focused on creating clear frameworks for taxes and anti-money laundering. On the other hand, countries like China have imposed severe restrictions on the use of Bitcoin and cryptocurrency trading.

What are some examples of Bitcoin regulation in specific countries?

In the US, Bitcoin is regulated mostly as a commodity by the Commodity Futures Trading Commission (CFTC), and all cryptocurrency exchanges need to register with the Financial Crimes Enforcement Network (FinCEN). Japan recognizes Bitcoin as a legal method of payment and regulates it accordingly, while in India, the regulatory environment is more volatile with a history of restrictions although not explicitly banned. Conversely, El Salvador has adopted Bitcoin as legal tender, which is a unique approach to cryptocurrency regulation.

How do international laws impact Bitcoin regulation?

International laws do not directly govern Bitcoin as it is a decentralized asset; however, international agreements and guidelines, such as those from the Financial Action Task Force (FATF), influence how countries develop their own cryptocurrency regulations. These guidelines are often aimed at preventing money laundering and terrorism financing.

Do regulations affect the price and use of Bitcoin?

Regulations can greatly affect the price and use of Bitcoin, as they determine how easy or difficult it is for consumers and businesses to adopt and use cryptocurrencies. Clear and favorable regulations can boost investor confidence and widen adoption, potentially raising the price. Conversely, strict regulations or bans could decrease demand and lower the price.

Can governments ban Bitcoin, and has any country done so?

Governments can and have moved to ban Bitcoin activities; countries like Algeria, Bolivia, and Nepal have such prohibitions on the use of Bitcoin. Such bans can limit the ability of citizens to engage in Bitcoin transactions and can force the closure of Bitcoin-based businesses within those countries. However, due to the decentralized nature of Bitcoin, it is challenging to enforce a complete ban on its usage.