In the maze of crypto storage, the debate of Custodial vs Non-Custodial wallets stands tall. As you delve into the world of cryptocurrency, picking between a custodial and a non-custodial wallet is key to your assets’ safety and ease of use. Each choice comes with its own set of rules on who holds the all-important private keys and how your digital coins get guarded. It’s not just about security; it’s about who calls the shots— you or a company. Your decision will shape your experience, from the freedom to manage funds to relying on someone else’s system. Make the wise choice, and let’s start with the basics.

Understanding the Fundamentals of Wallet Custody

The Definition of Custodial and Non-Custodial Wallets

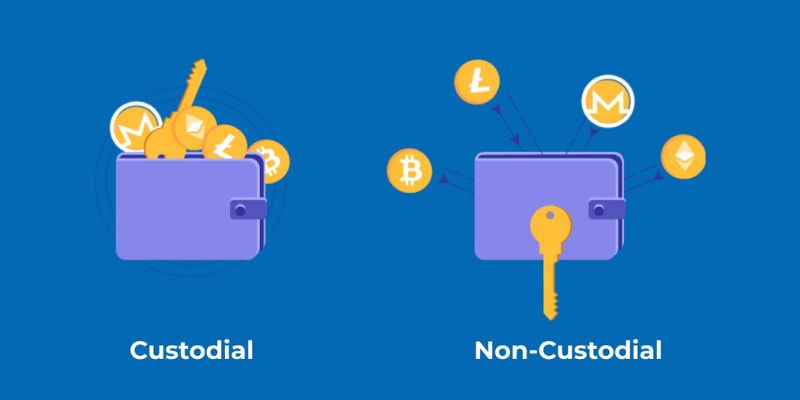

Think of a custodial wallet like a bank. Someone else keeps your money safe. But they have the keys, not you. You trust them to take care of your cash. Non-custodial wallets are different. You hold your money and the keys. It’s like keeping cash under your bed. You have all the control, no need to trust a bank.

The Role and Importance of Private Keys in Cryptocurrency Security

Private keys are a big deal in crypto. They’re like your wallet’s secret password. If you have them, you own your money. If you lose them, say goodbye to your coins. Custodial wallets manage your keys. Non-custodial wallets let you do it. Remembering your keys can be tough, though. That’s why some folks like custodial options better. But others want full charge of their keys and coins. It’s about what feels right for you.

Comparing Custodial and Non-Custodial Wallets: Features and User Experience

The Nature of Control: Autonomy vs. Trust in Third-Party Services

When you dive into the crypto world, you hold the map to your treasure. Think of custodial wallets like a bank. They keep your crypto keys safe. With them, you trust someone else to guard your coins. Non-custodial wallets put you in charge. Only you hold the keys. You’re the boss, but with great power comes great responsibility. If you lose your keys, there’s no “Forgot my password” button.

So, what’s better for you? If you want full control, non-custodial wallets are your friend. But remember, if things go south, there’s no one to blame but you. Custodial wallets might feel safer if you’re not too tech-savvy. They deal with the tech hiccups but always remember, you’re not the only one with access to your funds.

Accessibility and Convenience in Asset Management

Let’s talk about getting to your coins easily. With custodial wallets, logging in is a breeze. It’s like checking your email. Plus, you can trade fast on their platforms. They might even help if you forget your password. But don’t get too comfy. These pros come with a cost. You have to trust that they won’t mess up or get hacked.

Non-custodial wallets, they’re a different game. They give you a “seed phrase,” a magic set of words. Write them down, keep them safe, and you can always get back to your wallet. You call the shots, but it means you’ve got to be careful. Use a hardware wallet or keep your computer super secure for peace of mind.

When you compare both types, you see the trade-offs. Custodial services are like riding a bike with training wheels. Non-custodial is like a solo bike ride up a hill. It’s thrilling, but you’ve got to know how to handle the turns.

We’ve covered control and ease of access, so you’re steps closer to picking the right wallet. Remember, it’s not just about cool features. It’s about how you feel holding the reins, or trusting a pal to hitch your wagon. Choose what suits your adventure in the crypto world.

With all this insight, go ahead—weigh the pros and cons. Think about what feels right for you. Your crypto journey is uniquely yours. No matter your choice, stay smart, stay secure, and enjoy the ride on the blockchain highway.

Security Risks and Safeguards: Protecting Your Cryptocurrency Assets

An Overview of Security Measures in Different Wallet Types

Let’s talk safety in simple terms. You’ve got two main paths: custodial or non-custodial wallets. With a custodial wallet, a company holds your crypto keys. It’s like a bank, but for your digital bucks. These wallets can face security risks. Hackers might attack the company. If they get in, they could take your coins. That’s scary, right? So, these services work hard to stop these attacks. They use heavy-duty security to keep your loot safe.

Non-custodial wallets work differently. They give you the keys to your coin kingdom. You’re in charge. No third party, no middle-man. It’s all you. If someone wants to steal your crypto, they have to go through you. That’s a big plus!

Both kinds share common foes like phishing or malware, but the way they fight them varies. Custodial services may have teams of cyber ninjas at the ready. Non-custodial wallets bank on powerful tech to keep you safe. The point is, no matter your choice, safety comes first!

Types of crypto wallets play here too. Hardware wallets, think of them as high-tech safes. They hold your crypto offline — cold storage for the win. It’s harder to hack when it’s not on the net. Software wallets are more like your pocket. They’re handy but need more care, so you don’t get pickpocketed by a slick cyber-thief.

Best Practices for Storage and Recovery: Seed Phrases and Backup Strategies

Ever heard of seed phrases? Think of them as the master key to your crypto vault. Lose it, and you’re out of luck. No reset button here. So, write it down. Keep it safe. Not on your computer, but somewhere solid you won’t forget or lose. Some people even lock it up or split it up to store in different spots. Smart, huh?

Here’s the thing about backups — they’re your crypto life jacket. If bad stuff happens, like your hard drive crashes, or your phone takes a swim, backups save the day. A solid backup strategy can mean going from a total loss to a small bump in your crypto journey.

So what should you do? Back it up. Copy those seed phrases. Use a USB drive, or paper, or even a metal backup for those seed phrases. Check and double-check. Make sure you got everything right before you lock it down.

And think about where you put it. Some spots are safer than others. High and dry places are good. Away from prying eyes? Even better. Remember, with great power comes great… well, you know. Keeping your crypto safe is a big deal. You’re guarding your digital gold here.

As a pro, I say take control and be safe. Choose a wallet that feels right for you. Understand the risks, grab those safeguards, and lock it down tight. Happy and safe crypto handling!

Remember, securing your crypto is like gearing up for an adventure. You want the best tools and the wisest plans, so when the going gets tough, your crypto stash stays untouchable.

Navigating the Landscape: Legal, Financial, and Technical Considerations

Regulatory Aspects and Cryptocurrency Insurance for Wallets

When you think of crypto, you may not think of laws first. But, rules help keep your money safe. In the world of crypto wallets, the law sees two types: custodial and non-custodial. A custodial wallet is held by a third party. They keep your crypto keys for you. Just like banks keep your money. But here’s the thing: if the service holding your wallet gets hacked, you could lose your crypto. Laws in some places say these services must have insurance. This insurance can help get your money back if something goes wrong.

Now, what’s important is knowing who is liable if your crypto goes poof. With custodial wallets, the service you use might have to help cover losses. That’s part of their job in keeping your crypto safe. So, trust in these third-party services matters. They have rules to follow to protect you. And they keep your crypto keys safe and sound, so you don’t have to worry much.

But with great services comes great paperwork. These custodial services have to follow lots of rules. They work hard to not break laws and keep their and your business legit. If you choose this path for your crypto, you choose a path that others help watch and guard.

Evaluating Wallet Options: Balancing Security, Liquidity, and Self-Sovereignty

Let’s switch gears and chat about non-custodial wallets. These are all about you and control. With a non-custodial wallet, you’re the boss. No middle-man. You hold your private keys and no one else. It’s like keeping cash under your bed, but for the digital world. No one can move your crypto unless you say so. That’s power, my friend.

But wait, there’s more! With power comes responsibility. You must be good at keeping your money safe. If you lose your keys, or forget them, your crypto is as good as gone. There’s no “Forgot my password” button for this. That is why keeping your private keys safe is rule number one. Write them down, lock them up, maybe even hide them in a riddle!

And about liquidity, which is how fast you can move your money, non-custodial wallets are top-notch. They don’t wait for anyone. Click a button and the transfer starts. Use non-custodial wallets for quick moves and full control.

So, think about what fits you best. Do you like safety nets and rules? Go for a custodial wallet. Do you trust yourself and love control? Choose a non-custodial wallet. Your crypto journey depends a lot on this choice. Always aim for a balance between safety, speed, and being your own crypto king or queen.

In this post, we dove into wallet custody, breaking it down into digestible parts. We started by explaining custodial and non-custodial wallets and why private keys are vital for your crypto’s safety. Then, we weighed the pros and cons of each wallet type, discussing control and trust, as well as how easy it is to manage your assets.

We also tackled security risks and how to safeguard your cryptocurrencies with the right measures. Understanding seed phrases and having a solid backup plan are crucial steps to secure your investment.

Lastly, we looked at legal, financial, and technical angles you should consider – from regulatory effects to finding the balance between security, liquidity, and independence.

To sum up, managing crypto assets wisely means getting the hang of the types of wallets out there, securing your coins, and staying updated on laws and tech. Choose what fits your needs, stay safe, and keep learning! Your efforts will pay off in the robust protection and smooth handling of your digital wealth.

Q&A :

What is the difference between custodial and non-custodial services?

When discussing custodial vs non-custodial services, we’re generally looking at their application within the context of financial assets or digital wallets. Custodial services involve a third party holding and managing the assets on behalf of the owner, which typically requires the owner to trust the custodian to act in their best interest. This is common in banking or cryptocurrency exchanges where the institution holds your funds. Conversely, non-custodial services empower the asset owner with direct control over their funds and require them to manage their own security keys. This is often seen in the form of a private wallet in the cryptocurrency sector.

How do security measures compare in custodial and non-custodial setups?

Security is a key concern whether you’re dealing with custodial or non-custodial arrangements. With custodial services, the security measures are largely the responsibility of the custodian who must safeguard the assets against unauthorized access, fraud, and theft. This often involves institutional-grade security protocols. In non-custodial setups, the user is responsible for maintaining the security of their assets. This includes keeping private keys, passwords, and other authentication methods secure, as there is no third party to fall back on for security or recovery of lost access.

What are the advantages of non-custodial services over custodial services?

Non-custodial services offer several advantages:

- Control: Users maintain full control over their assets without relying on a third party.

- Privacy: There’s typically more privacy since transactions can be conducted without involvement from an intermediary.

- Access: Owners have immediate access to their assets without needing permission from the custodian.

- Lower risk of institutional failure: Since the assets are not held by a single entity, there’s no central point of failure that can affect the user’s funds.

Can you switch from a custodial to a non-custodial wallet or service?

Yes, it is possible to move from a custodial to a non-custodial wallet or service. This usually involves the process of withdrawing your assets from the custodial service and transferring them to a non-custodial wallet that you control. It is important, however, to be aware of the security implications and to understand how to safely manage and protect your own keys before doing this switch.

Why might someone choose a custodial service despite the benefits of non-custodial services?

Despite the benefits associated with non-custodial services, there are several reasons someone might prefer custodial services:

- Ease of use: Custodial services often provide user-friendly interfaces that make it easier for less tech-savvy users to manage their assets.

- Customer support: These services usually offer customer support to help with issues such as lost passwords or account recovery.

- Convenience: Custodial services can offer additional features like instant transactions or conversion between different types of assets.

- Trust in institutions: Some users may have more trust in established institutions and may feel more secure with a reputable company managing their assets.