Daily trading volume by crypto exchange tells a thrilling tale of the movers and shakers in the digital currency realm. Today, I’ll pull back the curtain on the market powerhouses shaping our trades and investments. You might wonder why these figures matter. They are the pulse, the very heartbeat of the marketplace, driving prices and painting a picture of where the money flows. With my finger on the market’s pulse, we’ll sink our teeth into the significance, draw connections that outline how these numbers sway the crypto landscape, and spotlight the giants whose volumes set the bar. Buckle up as we embark on a journey to dissect and demystify the forces of market liquidity and what it means for your crypto journey.

Understanding the Significance of Daily Trading Volumes in Cryptocurrency Markets

Interpreting Exchange Liquidity Metrics and Market Dynamics

When we see big numbers flying on crypto exchanges, it shows something more than just hype. It’s about how thick or thin the trades can be. It means looking at how easy it is to buy or sell crypto without making big price waves. High volume on exchanges like Binance or Coinbase points to a solid market space. It’s like a party everyone wants to be at. More trades give us better odds of a fair price. They also show that an exchange means business.

To get it right, we peek into how deep the market is. We check out daily numbers and spot where big trades happen. This is the deep end of the pool, where big fish swim. Low volume trades, on the other hand, are like puddles. They can dry up fast and leave prices jumping wildly. As I dive into data, I match the trading tides to the moon – market events that pull the waves. I’m that surf dude telling you where the big swells are.

The Relationship Between Trading Volumes and Crypto Prices

How do the flood of trades stir prices? It’s all cause and effect. More trades mean more chances for prices to change. It’s like a busy market where fruit prices go up and down fast. With more folks buying and selling, there’s more buzz, and prices can shift in a snap. I slice and dice the data to see how storms form and then tell you how to sail or when to dock your boat.

If trades go wild out of the blue, it could mean news is breaking. Maybe a weighty tweet or a law shake-up. Ripple effects hit the prices. I mark these volume spikes – they’re like crypto heartbeats. On my radar, high volume could signal a solid buy or a warning flag. But watch out for quiet times when small moves can jolt prices. Those sneaky trends are key for your crypto-trading tool belt.

Trading smart means knowing the ebb and flow of daily trades. It’s about watching the big players and learning from them. It’s not just about the volume of trades but who’s making waves. Do more folks buy than sell, or is it the other way around? It’s crucial in spotting price moves before they happen. It’s what makes the difference between a smooth sail or a shipwreck in your crypto journey.

In every chart, each spike, each dip tells a story. By reading the market’s pulse through volume, we catch the whispers of price moves. It’s not just a numbers game – it’s about reading the seas of change. And that’s what makes or breaks a savvy crypto trader’s day. In this tide of numbers, my mission is clear: to steer you through the currents of crypto trading volumes. With the right compass, you’ll navigate these waters like a seasoned skipper.

A Spotlight on the Market’s Leaders: Binance and Coinbase

Binance Trading Volume: A Benchmark for Crypto Exchanges

Big fish in the sea—Binance leads the pack. It’s like a whale in a world of fish when we talk Binance’s trading volume. As a crypto expert, I always keep an eye on where the action is. Binance shines bright here, setting the pace for others. Why? It’s all about the numbers. On a busy day, billions change hands on Binance’s exchange floor. That’s right, billions with a ‘B’.

Folks from all over click and trade on Binance. This shows in its volume numbers. They mean trust in the platform, with lots of money moving. It gives us a hint about market health. More volume often signals more trades and a lively market. Binance isn’t just a market player; it’s a market maker.

Why does this matter? For any trader, Binance’s volume is like a beacon. It signals where the action is and hints at the safest place to play. By keeping an eye on Binance, we tune into the market’s beat. High volume means Binance has the juice, with traders all in, making moves. It tells us Binance is where many want to buy and sell.

Analyzing Coinbase Daily Volume Against Market Averages

Now onto Coinbase. A big name, yes, but its daily volume tells its own tale. On one side, we have Binance—the giant—and on the other, there’s Coinbase. A heavyweight in its own right, Coinbase’s numbers are huge, too, but not always as huge. Let’s dig a bit. Some days, Coinbase’s volumes scoot near Binance’s. Other times, they trail.

This push and pull paints a picture of two things. First, the crowd likes Coinbase. It’s got fewer trades but solid trust. Second, it means the market is wide and varied. Binance may lead the pack, but Coinbase holds strong, like a steady tree in Binance’s shadow. For traders, this is key to know. It shows more than one place to trade well.

Trade volumes bounce around, and every day tells a new story. Like weather forecasts, traders want today’s numbers. They look for patterns in the volume at Binance or Coinbase. Why patterns? They guide us to smart moves. Our money needs to land where it can grow.

Each exchange dances to the day’s tune. Some days are all about Binance. Others sing a Coinbase song. Why we care is simple—money matters. Knowing where the volumes flow can point us to profits. Binance and Coinbase are not just names. They are beacons in a vast crypto ocean.

We wrap our heads around these big numbers to make sense of the crypto waves. Just like captains use stars to navigate, we use Binance and Coinbase’s volumes to steer our trades. Understanding why one has more trades than the other can show us where the crypto winds blow. We’re like sailors seeking the best course.

Every shift in these volumes tells a story. A tale of trust, bold moves, and market vibes. For folks like me who breathe crypto, this is our daily bread. It’s a never-ending story. Every day, Binance and Coinbase lay out fresh clues. We just need to read them right. The key? Know where the volume flows, and you’ll catch the market’s rhythm.

Evaluating Market Shares: The Role of Major and Minor Exchanges

Crypto Exchange Volume Ranking – Assessing Market Dominance

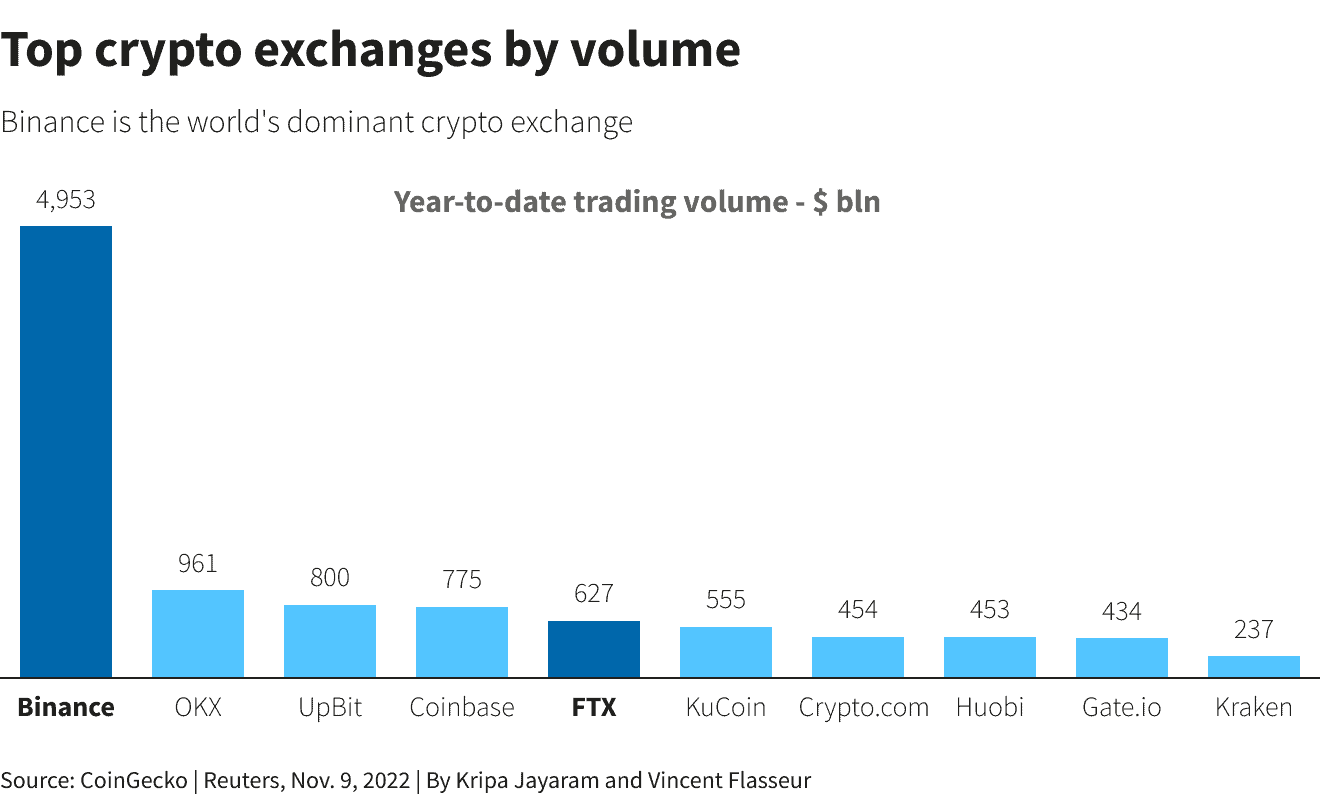

Every day, crypto markets buzz with trades. Big and small exchanges see coins exchanged like kids trading sports cards. We care about market share for a simple reason: it shows who’s boss. To find out who leads, we check the crypto exchange volume ranking. This ranking is like a scoreboard showing which platforms traders use most. Big names like Binance and Coinbase often top this list. Their high numbers show they’re trusted by many users for daily crypto trades.

Volumetric Comparisons Between High Volume and Low Volume Platforms

Now, let’s dive into the deep end. We compare high volume and low volume exchanges. High volume platforms are giants, like whales in the ocean. They have lots of trades and offer great market depth. This means you can buy or sell a lot without messing up the price too much. Little guys, the low volume platforms, are more like minnows. They’re important too but can’t handle as much action.

When you look at Binance trading volume or Coinbase daily volume, the numbers are big. They process millions in trades every day. This shows strong exchange liquidity metrics. It says they can handle your trades smoothly, with less price slip. Traders dig that. They want to hop in and out of trades without causing ripples. Think of it like trying not to splash water getting out of a bathtub.

Kraken and Bitfinex are other well-known names. They may not match Binance or Coinbase, but they’re still key players. Their volume stats give us clues on how users move with the market.

Trading pair volume in crypto exchanges tells another story. It’s about how different coin pairs do in the market. Some pairs trade more, some less. It’s like kids picking favorite ice cream flavors at a party. Chocolate may be a hit, but not everyone likes mint.

Real-time crypto exchange data tracks these ups and downs by the second. It’s like watching a race where the leaders change every moment. It’s exciting and paints a picture of who’s getting more attention.

DEXs, like Uniswap, turn heads too. Their decentralized nature changes the game. Yet, their daily volume doesn’t touch the giants—for now.

Understanding average trading volume in cryptocurrency is key. It helps us get the big picture. Are more people trading today than yesterday? Is the market getting hotter or colder? These answers matter for smart choices.

As a market guru, I live to decode these numbers. Armed with my trusty API for crypto trading data, I follow volume like a hawk. Watching the rise and fall of trades keeps my advice sharp and your moves smarter.

Why do some exchanges rock while others stay quiet? Many reasons! Trust, safety, and how easy they make trading are big ones.

Daily liquidity on crypto platforms can shift fast. One big news story can send volumes sky-high or down a hole. It’s like someone shouting ‘shark’ at the beach—everyone reacts.

So, building your crypto strategy? Pay attention to trading volume. It’s not just noise; it’s the market’s heart thumping. And that rhythm tells an epic tale of where money moves and why. Keep your ear to the ground, and use volume as your north star. It’s a surefire way to know where the market tide is flowing.

Actionable Insights from Volumetric Data for Crypto Investors

Utilizing Real-Time Crypto Exchange Data for Investment Strategies

Finding gems in the world of crypto calls for smart moves. It’s like digging for gold with data as your guide. We want to use real-time data from exchanges. Why? It can tell us what’s hot and what’s not. Think of it as a crypto crystal ball. Major players such as Binance and Coinbase can sway markets.

Real-time data on these platforms are gold mines for investors. It helps us spot trends before they’re news. Let me break it down. We look at average trading volume in cryptocurrency, and see how it moves. This tells us where the big money flows. And trust me, in crypto, the money’s voice is loud.

By checking trading pair volume in crypto exchanges, we learn more. It’s about matching dance partners in this digital ballroom. A Bitcoin-Ethereum pair may show more action than a Bitcoin-Ripple. That’s a clue where to invest. But, remember to peek at both ends of the spectrum. Low volume crypto trading platforms often reveal where the smart money slips in quietly. They can offer great opportunities before everyone else jumps in.

How Volume Spikes and Fluctuations Can Influence Trading Decisions

Now, let’s chat about volume spikes and what they whisper to us. Like a sudden crowd in a quiet street, they catch your eye. A volume spike in a currency tells us something is up. It’s a sign to look closely. Maybe news broke, or a big investor jumped in.

Here’s the thing: smart investors watch for these. They know it can flip prices fast. If you see a spike, dive into the why. Find the story behind the surge. This is how pros ride the waves instead of getting swept away. It’s like being a detective in a digital world.

Crypto is known for its ups and downs. Trading volume indicators help us avoid getting tossed around. They’re our seat belts in a speedy crypto ride. We watch things like 24-hour trading volume reports. They set the pace of the market every day.

True story – when trading volume goes up, prices often follow. But when they part ways, be wary, that’s shaky ground. Reasons behind volume changes in crypto could be many. New tech, some tweet by a big name, or even rumors can sway the market. Being wise means hanging onto this info.

Don’t just look at what’s happening. Look at why. It’s not only numbers; it’s the story they’re telling. When you understand the tale, you can make wiser bets. And that’s what we’re here for, right? To outsmart the game and make winning moves.

Remember, volume talks. It shouts where the action is in crypto. Keep an eye on Binance trading volume and Coinbase daily volume. Balance them with the quieter tunes from smaller exchanges. In this high-energy digital hustle, it’s the volume that turns whispers into roars. With real-time data, we’re no longer gambling. We’re playing chess in a world moving at the speed of light.

In this post, we’ve dived into the world of crypto trading volumes. We looked at how daily trading numbers help us get the true picture of market moves. We saw that high volume often means a strong market. We explored leaders like Binance and Coinbase and saw how their numbers set the pace. We learned that not all exchanges are equal and that size matters in the crypto world. We’ve also given you tips on using these numbers to make smart moves with your money.

So, what’s the big deal? Volume is like a heartbeat for crypto markets. It shows us life and energy. By watching it, we can make better choices and maybe even get ahead. Keep an eye on those numbers, and happy trading!

Q&A :

What does ‘daily trading volume by crypto exchange’ refer to?

Daily trading volume by crypto exchange is a measure of the total amount of cryptocurrency traded on a particular exchange platform within a 24-hour period. It includes buying, selling, and exchanging crypto assets among traders. High trading volumes can indicate a high level of interest and liquidity in certain cryptocurrencies on that exchange.

How can investors use information on daily trading volumes?

Investors often look at daily trading volumes to gauge the market activity of a cryptocurrency exchange. High volumes can suggest a healthy market with many participants and can indicate the ease with which a trader can enter or exit positions. Conversely, low volumes might signal less activity and potentially higher volatility or difficulty in executing trades at desired prices.

Which crypto exchanges have the highest daily trading volumes?

The crypto exchanges with the highest daily trading volumes typically include well-known platforms such as Binance, Coinbase, Huobi, and Kraken. These volumes can fluctuate based on market conditions, new asset listings, regulatory news, and changes in trader sentiment. Regularly checking exchange volume rankings can provide up-to-date figures.

Why do daily trading volumes by crypto exchange matter?

Daily trading volumes matter because they represent the level of activity and liquidity on an exchange. High volumes can lead to tighter spreads between buy and sell orders, which generally results in better prices for traders. They can also reflect the reliability and trustworthiness of an exchange, as more traders tend to flock to credible platforms.

Can daily trading volumes affect the price of cryptocurrencies?

Yes, daily trading volumes can have an effect on the price of cryptocurrencies. When there is a high volume of trades, it often coincides with increased price movement, as the demand for buying or selling a particular asset intensifies. Conversely, a low volume might indicate a lack of interest in a cryptocurrency, potentially leading to price stagnation or decreased levels of speculative trading.