Unveiling the Future: How Distributed Ledger Technology Revolutionizes Crypto Transactions

The secret’s out. Distributed ledger technology in crypto is changing the game. Gone are the days of simple digital cash. Today, we dive deep into the nuts and bolts of crypto’s backbone—blockchain. Want to know how cryptographic protocols guard your transactions like an armored knight? Or perhaps the magic behind consensus mechanisms that keep things running smooth and honest? We’ve got that covered.

Next, we’ll break down how smart contracts and decentralized finance are kicking doors wide open for crypto’s true power. And it doesn’t stop there—this technology isn’t just for the tech-savvy. From small start-ups to giants, businesses are catching on. They’re weaving distributed ledgers into the fabric of their operations. This isn’t just about making transactions faster or greener, although that’s part of it. It’s about building a future where crypto moves with the precision of a Swiss watch and the strength of a steel vault. Ready to leap forward? Let’s go.

Exploring the Bedrock of Crypto Evolution: Blockchain Technology Basics

Cryptographic Protocols: The Shield of Blockchain Transactions

When we talk about blockchain, we say it’s secure. But, why? The answer is cryptographic protocols. These are like secret codes that protect info. They make sure that no one can change the info once it’s put on the blockchain. Each piece of data is locked tight. With cryptography, we can trust that our transactions stay private and unchanged.

But there’s more. Cryptography doesn’t just keep things secret; it also checks who sends the data. It makes sure the sender is who they say they are. Imagine sending a secret letter but you want to make sure only your best friend can read it. Cryptography helps with that. It seals your letter and only your friend has the key to open it. That’s what happens with blockchain transactions.

Deciphering Consensus Mechanisms: Ensurement of Trust and Integrity

Blockchain works with many computers spread all over the place. Think of these computers as team players in a game. To win, they must all agree on the score. That’s what we call consensus mechanisms. These rules make sure everyone agrees on what the ledger says. If someone tries to cheat, the others will catch it.

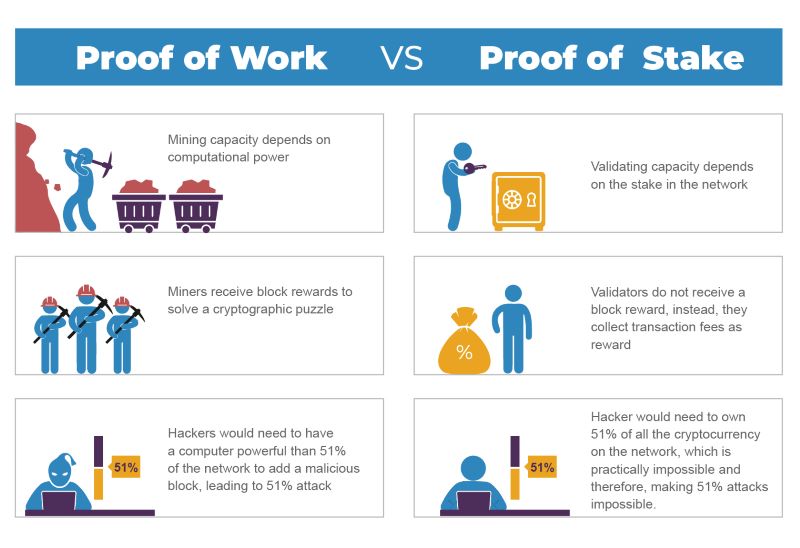

For example, one well-known rule is proof of work. It’s like solving a hard puzzle. The first computer to solve it gets to add new info to the blockchain. This way, the info is correct as everyone checks it. Yet, proof of work can take a lot of energy. It’s like leaving a car running all day just to win a game. People are now looking at proof of stake as a new rule. It’s like entering a raffle. If you have more of the crypto, you get a better chance to add info and win a prize. This takes less energy and still keeps the game fair.

By using these rules, blockchains work without a boss. They make sure the info is true and everyone plays fair. This trust lets us use blockchain for money, signing contracts, and even voting. It’s a big deal because it means we can do a lot without needing a middleman. And that changes everything we know about doing business.

Unlocking the True Potential of Crypto: Smart Contracts and Decentralized Finance

Smart Contracts and DLT: The Framework for Automated Agreements

Smart contracts and DLT work hand in hand. This combo makes deals that run by themselves. No middlemen. Trust is built-in. Let’s dig into how smart contracts on DLT do this.

When people agree on a deal, smart contracts lock it on the blockchain. The rules are set in code. When conditions are met, the deal auto-completes. This makes trust automatic. You don’t have to rely on someone’s word. The blockchain makes sure everyone sticks to the agreement.

These smart contracts can also talk to outside info. They check if conditions are met. Think weather info for a crop insurance payout. These contracts save time and cut down on fights. They can even handle money, shares, or property. All this works because of the trusty blockchain.

Smart contracts have more ups too. They cut out paperwork and speed things up. Many industries like finance, real estate, and law are hopping on board. But, there are challenges ahead. Building safe and bug-free smart contracts is tough. Yet, experts are on it, finding new ways to boost security. Look ahead and you’ll see smart systems handling more of our deals. And it’s all thanks to smart contracts and DLT.

The Rise of DeFi: Redefining Financial Transactions on the Blockchain

Now let’s check out DeFi. Short for decentralized finance, DeFi is changing money matters on the blockchain. It’s a new way to do banking, lending, and more, with no banks in sight.

DeFi runs on blockchain tech. It gives everyone a fair chance to use banking services. All you need is the internet and a digital wallet. You can lend, borrow, and trade without waiting or crazy fees. This is big for people who don’t have banks nearby.

DeFi works around the clock. There are no closed signs here. It’s global too. So, someone in the US can lend to someone in India, easy. And it’s not just for the big shots. Even you and I can play the game. But it’s more than just convenience.

DeFi’s foundation is solid, based on blockchain security. This means your money and deals are safe. Still, risks are there. The market can be wild, and laws are catching up. Smart people are looking at these challenges. They’re making systems to help keep our money safe.

DeFi is a peek at the future of finance. More freedom, more open, more trust. It’s built on blockchain promises. The journey’s just started, but it looks bright. We’re heading toward a world where finance is truly for everyone. And DeFi, with its roots in blockchain, is leading the way.

Navigating the World of Distributed Ledgers: From Theory to Business Application

Permissionless vs Permissioned Blockchains: Tailoring to Industry Needs

Picture two towns. One has no walls, no gates—anyone can walk in. This is like a permissionless blockchain. Here, no one needs an invite to join and take part in the ledger. It means any of us with internet and a bit of know-how can do peer-to-peer transactions. Think Bitcoin or Ethereum.

But there’s a trade-off. Each computer (node) must agree on new data, which can slow things down. And because everyone can peek in, it’s all public. This level of openness is great for trust but can be less suited for businesses that need more privacy and control.

Now the second town, it’s got walls, a gate, and a strict guest list. That’s a permissioned blockchain. Only a few can enter and mess with the ledger. They need special access. This setup lets businesses pick who they trust and limit who sees what. It’s less open but more private, which is good for companies guarding secrets or customer info.

In permissioned blockchains, not every node has to nod in agreement for things to happen. This makes things faster and more scalable for a growing business. Private industries, from healthcare to financial services, find this kind of controlled access useful.

Still, it’s not just about public or private. Imagine having a mix, a semi-public ledger. It opens up new ways to play with blockchain’s power while meeting custom needs.

But how do we pick? It’s like choosing a car. Need speed and style? Go for the sports car—the permissioned blockchain. Happy with something solid that gets you from A to B? The trusty sedan, our permissionless blockchain, will do just fine.

Revolutionizing Supply Chains: The Impact and Challenges of DLT Integration

Supply chains are tricky. They’re like a cross-country relay race. Passing the baton smoothly matters. In business, this baton is the trust in where things come from, how they’re made, and that they’ll arrive on time. Distributed ledgers shine here by tracking everything with no cheating.

But tossing a new tech like DLT into the mix isn’t child’s play. First, everyone in the chain must agree to use it and know-how. Then, there’s the cost of setting it up, keeping it secure, and teaching folks to use it.

Yet, when it works, it’s like magic. Real-time updates, fewer errors, and everyone knows where the baton is. Customers can check the journey of their purchase from start to finish.

In simple terms, integrating DLT into supply chains means a step up in trust and efficiency. It means a company can recall a bad batch of products fast, before it causes harm. It shows them where waste is happening or how to make things better.

To wrap up, DLT is like a Swiss Army knife for business. It has lots of uses, from making money moves in finance to checking identity without a doubt. It’s about finding the right tool for the job and using it wisely.

Advancing Towards a Sustainable and Efficient Crypto Future

The Move to Energy Efficiency: Proof of Work Versus Proof of Stake

We all hear that crypto eats up energy like kids eat candy. Proof of Work, or PoW, is the old way. It’s like a race where computers solve tough puzzles to win new coins. Yet, it uses power like there’s no tomorrow. We’re talking about as much as small countries use!

Now, say hello to Proof of Stake, or PoS. It’s the new kid on the block. Instead of puzzles, folks lock up some coins as a promise they’ll play nice. It’s like a security deposit. This means way less energy spent. Computers don’t need to run all out. It’s saving energy one coin at a time.

With PoS, the more coins you hold, the more say you get in the network. It’s like having a bigger vote because you own more of the company. Plus, it’s not just about saving power. It’s also quicker in a way – no more waiting for puzzle winners. Transactions get checked fast. Everyone’s happier, especially Mother Nature!

Enhancing Transaction Speed and Interoperability in Blockchain Networks

Ever been stuck in traffic wishing your car could fly? Well, that’s how slow some blockchain transactions can feel. With more folks using crypto, speed really counts. We need things to run smooth and quick. Nobody likes watching paint dry, right?

Good news! Blockchains are learning to talk to each other, too. This is called interoperability. It means no matter what blockchain you’re on, you can send and receive stuff without a hitch. It’s like having one key for all doors. Imagine sending a token from one blockchain to another just like that. It’s game-changing.

Why’s that matter? It opens doors for you to use different services across blockchains without sweating it. And remember how we used to barter way back when? That’s coming back in style with peer-to-peer trades – quick and direct without middlemen.

This isn’t just tech talk. These changes mean businesses are saving time and cash. They make better products and we get them faster. Plus, it’s safer, and our personal info stays ours. It’s a win-win for everyone.

So, when we chat about sustainable crypto, we’re not just talking going green. We’re speeding things up and wiping out bumpy roads in tech land. It lets us get the best service and keeps our planet happier, longer. Welcome to the future, where crypto’s not just smart; it’s lightning-fast and kind to Earth.

We’ve journeyed through the core of blockchain tech, from basic crypto protocols to smart contracts and DeFi. We’ve even looked at how different blockchains fit various business needs and the push for greener, faster networks.

To wrap it up, blockchain is more than just tech talk. It’s a game-changer for trades and deals, shaking up how we trust and verify each exchange. And as for the future, it’s clear: smoother, faster, and eco-friendlier blockchains are on the horizon. The crypto world is always evolving, and we’re just getting started. Keep an eye out—we’re in for quite the ride!

Q&A :

What is Distributed Ledger Technology in Cryptocurrency?

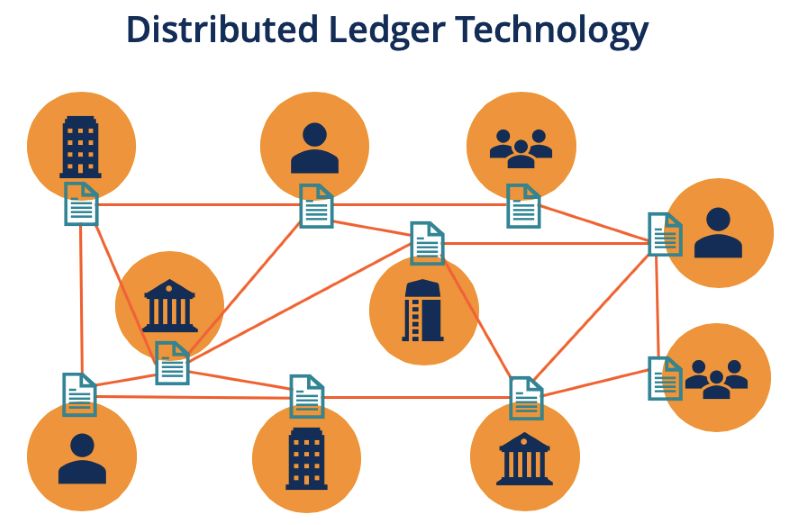

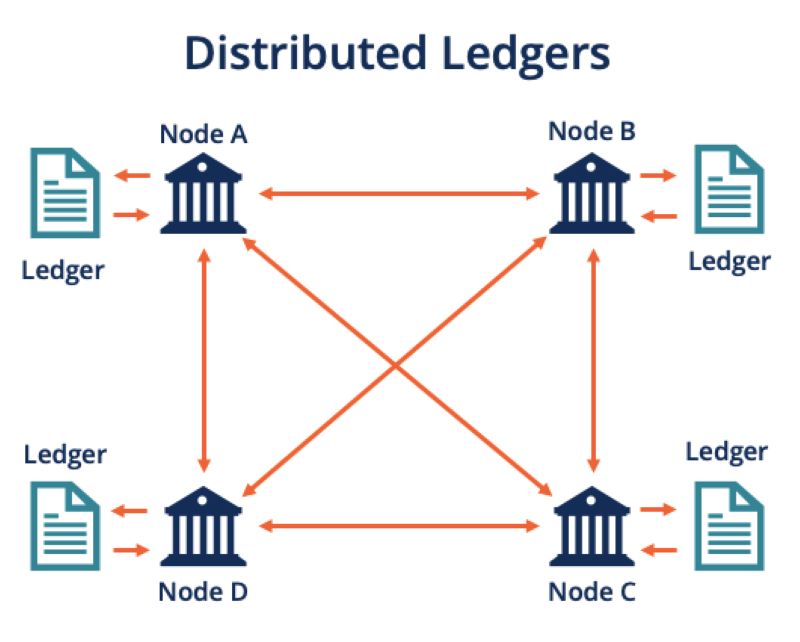

Distributed Ledger Technology (DLT) in cryptocurrency refers to a digital system for recording the transaction of assets in which the transactions and their details are recorded in multiple places at the same time. Unlike traditional databases, DLTs like blockchain have no central data store or administration functionality. This technology is what underpins most cryptocurrencies, ensuring security, transparency, and decentralization.

How does Distributed Ledger Technology work in Crypto?

DLT works by allowing multiple participants, known as nodes, to maintain their own identical copy of the ledger. Any changes or transactions made on the ledger are reflected across all copies almost simultaneously. In the context of cryptocurrency, this means that when a new transaction is made, it is broadcast to a network of peer nodes and once verified, it is added to the ledger.

What are the benefits of using Distributed Ledger Technology in Crypto?

The benefits of using Distributed Ledger Technology in crypto are numerous:

- Increased Security: DLT can reduce the risk of fraud, hacking, and unauthorized transactions because it removes the need for a centralized authority and the data is spread across a network.

- Enhanced Transparency: All participants on the network have access to the same transaction histories, ensuring clear visibility of all transactions.

- Reduced Costs: By eliminating the need for intermediaries, such as banks and clearinghouses, DLT can significantly lower transaction fees.

- Faster Transactions: DLT can streamline transaction processes, making cross-border transfers quicker than traditional banking systems.

Are there any limitations to Distributed Ledger Technology in Cryptocurrency?

While DLT has many advantages, it is not without limitations. Some of these include:

- Scalability Issues: The growing size of distributed ledgers can cause scalability issues, affecting transaction speed and efficiency.

- Energy Consumption: Certain consensus mechanisms, such as proof of work, require a significant amount of energy, causing environmental concerns.

- Regulatory Uncertainty: The decentralized nature of DLT can make regulatory oversight challenging, leading to potential legal issues.

How is Distributed Ledger Technology different from Blockchain?

Blockchain is a type of DLT, but not all distributed ledgers necessarily employ a blockchain. Blockchain is a chain of blocks containing information, whereas DLT encompasses a wider set of technologies that may or may not format their data into blocks. Additionally, some DLT systems use different methods for achieving consensus and validating transactions that differ from typical blockchain models.