Exploring Liquid Staking in Crypto: your key to a steady flow of earnings while holding onto your assets. Dive deep with me, and let’s unlock how this blend of tech savvy and smart investing opens doors to passive income that was once just a dream for crypto holders. We’ll weigh benefits, pick top platforms, manage risks, and eye future trends. Prepare to turn your crypto stash into an earning machine!

Understanding Liquid Staking and Its Advantages

Defining Liquid Staking and How It Works

You’ve heard of staking in crypto, right? Well, there’s a new player in town. It’s called liquid staking. In simple terms, it’s just like the usual staking – but with a twist. You still earn rewards for holding your coins, but now, you also keep your money free to use elsewhere.

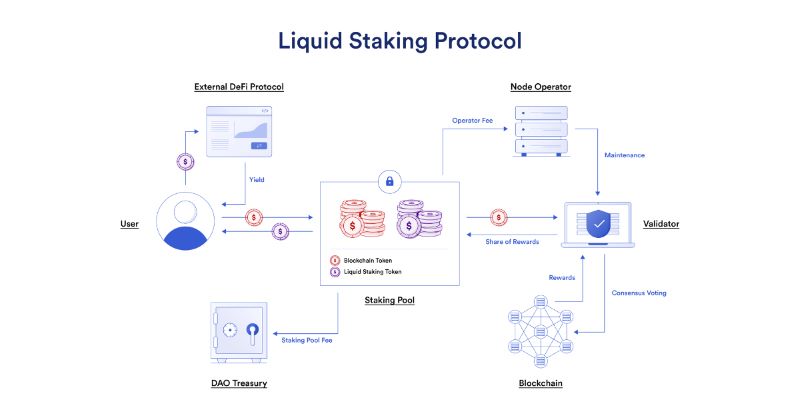

Think of it like this. In classic staking, you lock up your coins to help run the network. For this, you get paid in staking rewards. But, your coins are tied up. With liquid staking, though, you can stake your coins and get a token in return. This token represents your staked coins. You can trade it, sell it, or use it in DeFi. Your original coins are still earning rewards, and you’re free to use this token as you please.

Liquid staking lets you be part of staking pools. This is where a bunch of people put their coins together. Doing this can give you more rewards than going at it alone. Since pools have more coins, they can help validate more transactions. And more transactions mean more rewards.

The staking mechanism in liquid staking is just like in regular proof of stake networks. Your coins are still helping to keep things safe and moving along. You’re just adding a new layer. This new layer is what lets you keep your money liquid. Liquid means ready to use whenever you like.

One big name that uses liquid staking is Ethereum, or ETH 2.0. They give some solid staking benefits with their new setup. It’s all part of making their blockchain better and faster.

Comparing Traditional Staking and Liquid Staking Benefits

Now, let’s look deeper into why folks are loving liquid staking. For starters, in traditional staking, your coins are stuck. You can’t touch them without stopping your rewards. That’s a bummer if you need to use your coins for something else. With liquid staking, this isn’t a problem. You get to earn and keep your coins ready for action.

In classic proof of stake networks, if you want to unstake, you have to wait. This can be days or even weeks. But no one likes to wait around, right? Liquid staking platforms change all that. They offer what’s called staking liquidity. This means you can turn your stake into cash much faster.

Then, there’s the risk of slashing. That’s when you lose some of your staked coins because of issues in the network. With liquid staking, you can often reduce this risk. How? Because you’re part of a pool. If something goes wrong, you only take a small hit, not a big one.

We also need to talk about the earnings. In liquid staking, you can chase after other chances to make money with your liquid tokens. This is called compound earnings. You’re earning from staking, then putting those earnings to work again in DeFi.

Yes, there are risks with liquid staking too. But that’s a story for another day. For now, keep in mind that liquid staking can unlock new ways to make your crypto work for you. It’s a balance of keeping your coins safe and busy. Safe, because they’re still staking. Busy, because you can use the liquid tokens they give you.

Now, go check out some of the best staking coins and how you can start earning passive income through staking. It’s a fine way to let your digital dough grow while you do you.

Evaluating Popular Platforms for Liquid Staking

Key Features of Leading Liquid Staking Platforms

When looking at top liquid staking platforms, I dive deep. I ask, “What makes them stand out?” First up, staking rewards. They should be high enough to matter but not so high they’re risky. Next, I check the staking mechanism. It’s the engine in your staking car, and it’s got to run smooth. Staking pools offer more than just solo staking. They spread out risks and can boost rewards. But pools vary, and it pays to know who’s who.

Now, blockchain consensus protocols are no small deal in liquid staking. They underpin the entire show. For example, proof of stake networks are like the city councils of crypto. They make sure everyone plays fair. And speaking of play, ETH 2.0 staking benefits are a game-changer. They promise more rewards and a chance to support ETH’s next big step.

Weighing up yield farming vs staking? I’ll say staking is the marathon runner. It’s steady and can go the distance. Farming might sprint ahead but doesn’t always keep up. And if you’re looking at staking on Ethereum? You’re in the major league. But the competition is fierce, with many players on the field.

Criteria for Selecting the Best Liquid Staking Service

Choosing the right liquid staking service is crucial. My eyes are first on passive income through staking. Can we bank a nice steady cash flow? That’s the goal. Another big thing is staking liquidity. You’ll want quick access to your cash if you need to pull out. No one likes being stuck.

Next, I measure secure staking practices. Is it safe as a vault? Because in crypto, security is king. I also note each platform’s approach to validator node responsibilities. Solid validators mean a stable network, and that’s good for everyone.

I don’t stop there. I also compare staking returns to gauge the best bang for your buck. And don’t forget about those pesky lock-up periods in staking. Freedom to move your coins can mean a lot. Sometimes, you’ll face unbonding assets from staking. Flexible platforms make this easy, while others make you wait.

Let’s not ignore the elephant in the room – staking tax implications. It’s a murky water to navigate, and you’ll want a platform that’s clear and upfront. And beware of slashing in proof of stake. It’s the penalty for any missteps in the network. Not fun.

The rise of liquid staking platforms and staking-as-a-service providers has given us more options than ever before. This calls for smart selection. Look for staking derivatives which let you keep earning while using your staked coins elsewhere. Super handy for the savvy investor.

As for staking investment strategies, remember, it’s your money. You need a platform that matches your goals, risks, and wallet size. Speaking of which, staking wallet options speak volumes about user experience. Ease of use can make or break your staking journey.

In this fast-moving world of decentralized finance (DeFi), knowing the ins and outs of liquid staking can set you ahead of the pack. Take your time, make informed choices, and you might just unlock the door to regular, hassle-free passive income.

Managing Risks and Maximizing Returns in Liquid Staking

Common Risks Associated with Liquid Staking

When we talk about liquid staking, we’re in the world of earning while you sleep. It sounds great, right? But it’s not all sunshine. Let’s face what we’re up against. Think about when you lend out a favorite game. You hope it comes back in one piece. It’s like that with your crypto. You want to get it back, with a bit extra for the wait.

Smart people worry about risks. And in liquid staking, there are a few. The first is “smart contract bugs”. These are like gremlins in the code. If they’re there, they can mess things up. Another is “slashing”. If the staking service makes a whoopsie, everyone pays. Your staked coins might shrink.

And don’t forget, prices can jump around. This means even if you earn more coins, they might be worth less. Scary, right? But hold tight. There are ways to handle this.

Effective Strategies for Enhancing Staking Yields

Now, let’s chat on smart moves to make the most out of staking. Staking pool hopping is a solid trick. It’s like checking which ice cream shop has the best scoops. You move your crypto to where the rewards are sweetest. Just be sure about the fees and the rules for each jump.

Another hot tip is playing it cool with “cold staking”. This means your crypto is safe offline while earning its keep. It’s like your piggy bank growing without you having to feed it.

Want to level up? Use “staking derivatives”. These are like IOUs. You stake your coins, and get these tokens. They say “We got you”. You can then trade these or stake them again. It’s like your money making babies while it sits tight.

Think long-term too. In staking land, patience is a virtue and can boost your stash. Short stints can be tempting, but the big wins often come from waiting out the storms.

Lastly, let’s talk choosing coins. Everyone loves a winner. Go for “best staking coins” that have good teams, strong projects, and a solid track record. Remember, betting on dark horses can sometimes lead to dark days.

So, summing it up: face the gremlins, hop wisely, stay cool, make duplicates, play the long game, and pick champs. Do all this, and your crypto can work as hard as you do, maybe even harder.

The Future of Staking: Trends and Innovations

The Impact of Upcoming Blockchain Upgrades on Staking

Big changes are coming to how we stake crypto. For example, ETH 2.0 will bring big staking benefits. These updates make the system better and faster. They let us stake with confidence and get rewards. Upgrades like these keep our staking safe and let us earn more.

Proof of stake networks are always getting better. These upgrades can help us make passive income through staking. They let new folks join in and make money from crypto without much worry. It’s a way to earn without selling your coins.

Blockchain updates mean our staking gets better too. They help keep everything running smooth. This means more people can join staking pools and make money. We all want more staking rewards, right?

The best part is, we don’t have to do much. Just pick a good staking pool and watch the income flow. Keep an eye out for these upgrades, they could mean more money for your wallet!

Advances in Staking Protocols and User Experience

Staking cryptocurrencies is always changing. New tech makes everything easier than before. Companies want to make sure you have an easy time using their staking platforms. So, they work hard to make staking simple for all of us.

This focus on a better user experience means we can earn passive income easily. The best staking coins are often the easiest to use. DeFi staking products keep this in mind. They know better service means happier customers.

One cool thing happening is the rise of liquid staking platforms. They let us make money but still use our staked crypto for other things. This means we don’t miss out on other chances to earn.

The world of staking is evolving. We’re seeing safer ways to stake and more chances to earn. It’s getting better not just for people who know a lot about crypto, but for everyone.

The rest of the staking world can’t wait to see what comes next. From staking-as-a-service to staking wallets, everything is moving forward. We’re all looking out for the next big thing that’ll make earning easier.

Liquid staking seems to be that next big step. It keeps our money working for us in many ways. It makes sure we don’t have to choose between earning now or later. And who wouldn’t want that?

So, keep your eyes on these trends and innovations. They could help you make more from your crypto assets. And isn’t that why we’re all here in the world of decentralized finance (DeFi)?

In this guide, we plunged into what liquid staking is and how it stands out from traditional staking. We looked at the top places to stake your crypto and what makes them tick. We also delved into managing risks to keep your investment safe while trying to make more money.

To wrap up, liquid staking opens doors to earning while keeping your assets agile. It’s a game-changer in the crypto space. Just remember, picking the right platform matters, and always stay smart about the risks. With fresh tech and trends on the horizon, staking is only going to get more exciting. Stay ahead of the game and make those smart staking moves!

Q&A :

What is liquid staking in cryptocurrency?

Liquid staking is a process in the cryptocurrency world that allows users to stake their tokens and receive a liquid derivative in return, which can then be used within the DeFi ecosystem. Unlike traditional staking, where assets are locked up and become illiquid, liquid staking enables users to maintain liquidity and participate in other investment opportunities simultaneously.

How does liquid staking differ from traditional staking?

Liquid staking differs from traditional staking primarily in terms of liquidity. In traditional staking models, crypto assets are locked in a staking contract, disallowing any other use until the staking period ends. Liquid staking, on the other hand, provides stakers with a tradeable token representing their staked assets, allowing them to engage in other ecosystem activities without losing their staking rewards.

What are the benefits of liquid staking in DeFi?

The key benefits of liquid staking in DeFi (Decentralized Finance) are increased liquidity, flexibility, and capital efficiency. Liquid staking allows users to earn staking rewards while still being able to utilize their staked tokens for lending, borrowing, or trading. This leads to a more efficient capital utilization and the potential for additional yield generation.

Can you lose money by liquid staking in crypto?

Yes, like any investment process in crypto, liquid staking involves certain risks. The value of the liquid tokens received can fluctuate based on the market, and there are potential smart contract risks. If the staked asset’s price drops significantly, or if there are issues within the staking platform, users could lose money. Therefore, due diligence is crucial.

What are the popular platforms for liquid staking in cryptocurrency?

Several platforms have emerged as popular choices for liquid staking, each with its own set of features and supported networks. Some of the notable platforms include Lido, Rocket Pool, and StakeHound, which support various blockchain networks like Ethereum, Polkadot, and Tezos. These platforms provide the infrastructure and services needed to simplify liquid staking for users.