Historical trading volume of top crypto exchanges tells a tale of tech wizards and digital gold rushes. Its ups and downs trace the footprints of market giants. Today, I pull back the curtain on the secrecies behind their rise. Stick with me to dissect growth, liquidity measures, and spells of high trading across major players like Binance and Coinbase. We’ll dive into how kingpins Bitcoin and Ethereum steer these trading tides and how the seasons shift market moods. From raw data, you’ll gain smarts on timing your trades and glimpsing the market’s pulse. Ready for a deep dive into the numbers that power the crypto world? Let’s jump in.

Analyzing the Growth of Major Crypto Exchanges through Historical Volume Data

Examining Bitcoin and Ethereum’s Impact on Exchange Volumes

Bitcoin and Ethereum fuel the fire of crypto trade. They bring life to markets. Their moves can shake or build trade volumes across exchanges. Let’s dig into their histories on big-name platforms.

Bitcoin came first, making waves with its arrival. When it moves, the whole market watches. Every little up or down stirs buzz and floods exchanges with trades. Bitcoin’s story is key to crypto exchange volume analysis.

Ethereum followed, pushing the space forward. It launched an era of smart contracts and tokens. This drew even more action to exchanges. Ethereum trading activity tells us how the market grew over time. These two titans shape how coins change hands daily.

The Rise of Binance and Coinbase: A Volume Analysis

Binance leapt into the scene, hungering for growth. It skyrocketed by keeping trade quick and smooth. Binance historical volume reflects a hunger for more. It became a giant, leading the crypto exchange ranking by volume.

Coinbase started quieter, aiming for trust and ease. Its journey speaks to those valuing a steady ship. Coinbase trade volume history shows it climbing steadily. It earned its name among the top exchanges by winning user trust.

Both Binance and Coinbase charted paths others dream of. Studying them unveils secrets of trades over the years. How did their volumes rise? Notice their moves during big market shifts and their efforts to keep trades flowing. This shows the power of wisely managed market liquidity in crypto exchanges.

Binance jumped on altcoins fast, offering more pairings. That choice fed into its trading volume comparison with peers. Coinbase took a slower path, picking coins with care. This built trust and brought a steady stream of trades.

Kraken and Bitfinex trail a bit but stand firm with solid strategies. Kraken past trading data shows a hold on the market with robust security. Bitfinex volume trends show how swift moves in trading tech can boost volume.

The ebb and flow of these giants teach lessons for today’s market. From boom times to quiet days, exchange volume peaks and troughs tell tales. By studying their paths, we see how they used their might to shape trade winds.

As new coins surface, the impact on crypto trading volume by year shifts. Every exchange fights to keep its place in the 24-hour volume of crypto exchanges. What’s next for them? Eyes are on the horizon, watching for the next surge or slide.

To learn from the greats, watch how they ride the waves of Bitcoin and Ethereum. Their moves can guide how you see the exchange trade volume growth. Remember, these are not just numbers. They are stories of bold moves and smart bets in the vast ocean of crypto trade.

Market Liquidity and Trading Volume Comparison Across Platforms

Deciphering Market Liquidity in Leading Crypto Exchanges

Ever wonder what keeps your crypto trades smooth? It’s called market liquidity. High liquidity means you can buy or sell fast. Without it, trading can stall, and prices may swing wildly. Leading crypto exchanges are like big busy markets. They have lots of people buying and selling all the time, which gives us that smooth trading we love.

How do exchanges stay so liquid? Well, it’s a mix of having lots of users, and a big pile of different coins to trade. Top exchanges like Binance and Coinbase attract lots of traders. This means more chances to match your trade with someone else’s. Think of it as having a huge crowd at a concert—more fans make for a greater show.

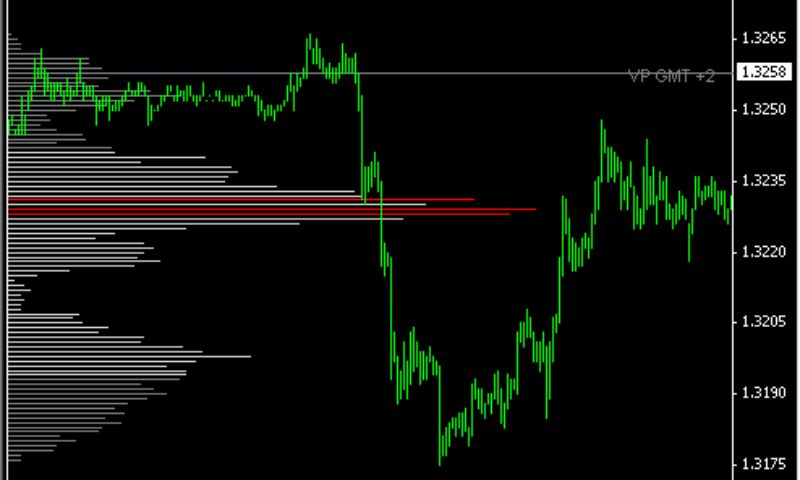

A Comparative Look at Trading Volume Fluctuations

Now, diving deeper into trading volumes, let’s see how they go up and down. Picture a seesaw, with trading volumes dancing on one end. They bounce with news, trends, and how people feel about the market. Take Bitcoin, for example. When it makes headlines, more people jump in to trade, pushing volumes higher.

Exchanges like Kraken and Bitfinex see this seesaw action too. Sometimes, even a small event can make waves. And it’s not just about Bitcoin. Ethereum and other altcoins have their own rhythms. These ups and downs get tracked over time, building up a history. This history tells us stories of past market moods.

But why do volumes change so much? A lot of things play a part. Big news can send traders rushing in. Think of it as a burst of music that gets everyone dancing. Other times, the market is quiet, like a calm stretch in a song. When we look at exchange volume peaks and troughs, we’re seeing the market’s heartbeat.

Trading volume analysis helps us get the big picture. It lets us see which exchanges keep the trade beat going, even when the tune changes. By comparing, we learn how sturdy an exchange’s liquidity really is. We can spot the places ready for a sudden crowd surge or the quiet spots that may need a boost.

But why does this all matter to you? Well, imagine wanting to sell your coins quick to grab some cash. Good liquidity means you can do that just as fast as clicking a button. And nobody wants to be left waiting when it’s time to dance to the rhythm of the markets.

Finally, this back and forth is the real ticker tape parade of crypto. It shows us where the energy is pulsing in this digital world. So when we talk about crypto exchange volume analysis or trading volume comparison, we’re really talking about finding your best spot on this giant dance floor. Whether you’re grooving with Bitcoin or swaying with Ethereum, knowing the market’s rhythm keeps you right in step with the beat.

Unpacking the Influence of Trading Periods on Exchange Volumes

Identifying Peak Trading Periods and Their Effects on Liquidity

Ever notice how crypto exchanges get busy at times? Let’s dig into this. You can spot times when trading goes wild. We call these peak trading periods. They matter a lot when you trade.

So, why are peak periods big for liquidity? Simply put, more trades mean more cash moves around. More cash makes it easier to buy and sell. That’s good for traders. You want to get in and out fast? You want these busy times.

Let’s take two big names, Binance and Coinbase. Their busiest times can shift the whole market. More action on exchanges can mean prices jump around. For traders, this is key. You catch these busy waves, you might ride them to profit.

How do we know when it’s busy? We look at the numbers. Crypto exchange volume analysis tells us. Binance historical volume, Coinbase trade volume history, all these figures paint a picture. They show us the rush hours in crypto trade.

Remember this: Trading’s not the same day to day. An event in the news can wake traders up. Suddenly, it’s rush hour on your favorite exchange. Big news equals big moves, or so it seems. You need to watch out for these spurts of activity. They can tell you a lot.

Seasonal Trading Patterns and Volume Metrics in Cryptocurrency Markets

Let’s switch gears. Think about seasons like winter or summer. Crypto has its seasons too. We see patterns that show up year after year. Think of it as the weather forecast for money.

Winter might bring a chill, but what about crypto winters? Do falling leaves mean falling prices? Sometimes these patterns repeat, and that’s where seasonal trading patterns come in.

Data is key here. Cryptocurrency market data shows us past winters, so to speak. Bitcoin transaction history goes way back. Ethereum trading activity dates back years too. This history can clue us in on what might come next.

Don’t get me wrong, it’s not a crystal ball. But trends are friends for those who want to plan ahead. Knowing if history might repeat itself is gold. Well, digital gold, if you will.

And it’s not just about Bitcoin and Ethereum. Altcoin exchange volume history can also show patterns. Different coins might have different busy times. And, volume metrics for cryptocurrency help us see it all clearly.

Think like a surfer. You want to know when the big waves come. These patterns, they’re like the tide charts for trading. They can help you pick the best times to ride the highs and dodge the lows.

Market watchers, like you and me, we see these cycles. We learn, adjust, and use them. Those waves of trading, they’re not random. They’re clues. Spot the patterns, and you join the ranks of savvy traders.

In the end, it’s about timing and knowledge. Whether you’re a pro or just starting, these insights matter. They power your moves and shape your strategy. Keep an eye on the historical ebb and flow. It’s like catching the rhythm of the market’s heart.

Strategic Insights from Exchange Volume Data and Market Trends

The Role of High-Frequency Trading in Shaping Market Dynamics

Let’s dive into the fast world of high-frequency trading (HFT). HFT firms use complex algorithms to trade crypto fast. They look at market conditions and act in a blink. This changes how markets move and prices form.

Think of HFT like super-smart robots in a game. They play the trading game much faster than humans. This means they can win a lot if they play it right. They react to news or prices before we even blink.

HFT has grown a lot in crypto exchanges. It makes markets move smoother. But it can also whipsaw prices a lot. This means prices can jump up or down real fast. Let’s say bitcoin’s price starts to change. HFT can make this change bigger or faster. Sometimes it’s good, sometimes not.

These HFT strategies impact not just bitcoin or ethereum. They change trading for a whole bunch of coins. We see this in how prices go up or down across different exchanges.

Correlating Total Volume Traded with Crypto Market Cap History

Now let’s look at total volume traded and market cap. Market cap means the total value of a crypto, like bitcoin. When we say volume, we mean how much of it gets traded. These two are like best buddies. They often move together.

If lots of people trade bitcoin, its volume goes up. This often means the market cap goes up, too. It’s like having a party. The more folks show up, the bigger the party. In trading, when more people buy and sell, the value can go up.

This tie between volume and market cap has a big role. It tells us if the market is healthy. A big market cap with low volume can be a warning. It may mean not many people actually want to trade.

If we take a history trip, we can see this in action. Looking at times when bitcoin’s price shot up, trading volume did, too. It wasn’t just people talking about bitcoin. They were trading it like crazy!

We can learn lots from looking at total volume and market cap history. It helps us get why prices change. This helps us make smarter trades.

When we compare exchanges like Binance or Coinbase, we see trends. These trends show how the game changes over time.

Seeing volume changes can show us a lot about how exchanges grow. It also tells us where the market might go next. Big jumps in trade volume can mean big news is coming. Smart traders keep their eyes open for these signs.

By understanding these parts of the trading world, we do better. We become smarter in making choices. This is key for winning in the fast-paced crypto world.

In this post, we dove into major crypto exchange growth by looking at their volume data. We saw how Bitcoin and Ethereum pushed a lot of this growth. We then checked out how big players like Binance and Coinbase climbed the ranks.

Next, we compared market liquidity and trading volumes. This showed us who leads and who follows in the crypto exchange world. We also looked at when people trade the most and how this affects market flow.

Finally, we talked about how fast trades shape markets and how trading volume connects with the total worth of crypto. This stuff matters to anyone in the crypto game.

In the end, it’s clear: knowing these patterns helps us make smarter moves. Markets will go up and down, but with the right info, we can ride the waves better. Remember, there’s risk in trading, but knowledge is power. Stay sharp and trade wise!

Q&A :

How can I find the historical trading volume of top cryptocurrency exchanges?

To find the historical trading volume of top cryptocurrency exchanges, you can visit various financial news websites, market analysis platforms, or directly check the exchange’s website, where they often provide historical data. Cryptocurrency market aggregators, such as CoinMarketCap and CoinGecko, also provide comprehensive historical trading volume data for a wide range of exchanges.

What are the benefits of analyzing historical trading volumes on crypto exchanges?

Analyzing the historical trading volumes on crypto exchanges can provide insights into market trends, liquidity, and the popularity of certain exchanges over time. This information can be used to gauge investor sentiment, understand the reliability of an exchange, and make informed decisions about where to trade.

Which top crypto exchanges have consistently high trading volumes?

While the cryptocurrency market can be volatile and rankings can change, some top crypto exchanges that consistently have high trading volumes include Binance, Coinbase Pro, Kraken, and Huobi Global. These exchanges are known for their liquidity, wide range of traded assets, and user trustworthiness.

How does trading volume impact the cryptocurrency market?

Trading volume is a key indicator of market activity and liquidity. High trading volumes can suggest a healthy market with active traders and investors, which can in turn attract more users. It can also affect price stability and the ease with which assets can be bought or sold without causing major price fluctuations.

Are there any tools to compare historical trading volumes across different crypto exchanges?

Yes, there are several tools available to compare historical trading volumes across different crypto exchanges. Market analytics platforms like CryptoCompare and Skew allow users to view and compare trading volume data alongside other key market metrics. These tools can provide valuable insights into how exchanges perform against each other over time.