In the realm of crypto, knowing the difference between hot wallet and cold wallet solutions is like recognizing which lock to use for your treasure chest. If you’re tossing and turning at night, pondering over the safety of your digital assets, you’re in the right place. This isn’t just about tastes; it’s a strategic move to shield your cryptocurrencies from the digital pirates lurking in the vast sea of hackers. Get ready to dive deep as we explore the essential knowledge that could make or break your crypto experience. With a razor-sharp focus on security, you’ll learn not only how to store your coins but also how to rest easy knowing your digital gold is safe.

Understanding Wallet Types: A Primer

The Basics of Hot Wallets

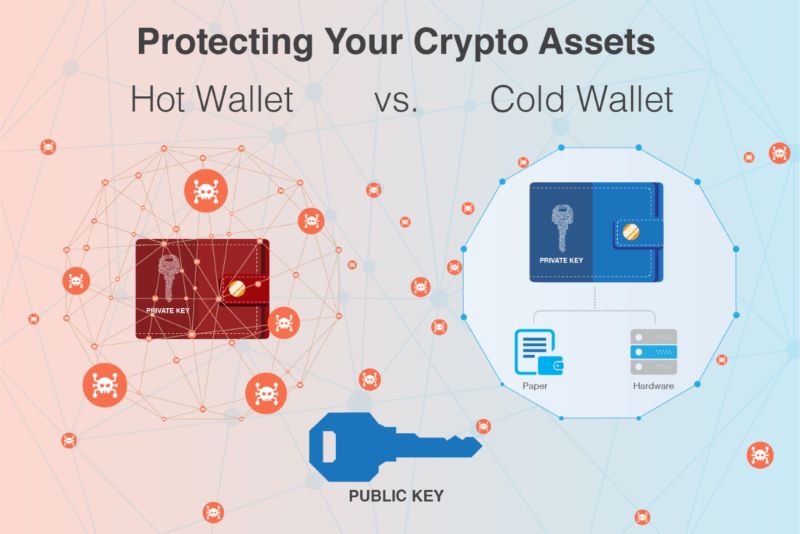

Hot wallets are like your everyday wallet. You use them to keep money for buying stuff. They’re handy, but you wouldn’t keep all your cash in them, right? It’s the same with hot wallets. They are connected to the internet, which makes them easy to use. But it also means they face more risks – like theft or hacking.

Hot wallets come in different shapes: you have web wallets, mobile wallets, and desktop wallets. Imagine them as doors to your digital coins. Web wallets are like doors with locks that only the wallet company has keys to. Mobile and desktop wallets are like doors you have the keys to, but they could still be picked because they’re connected to the internet.

The Essentials of Cold Wallets

Cold wallets are the safe in your house. They’re offline, so they’re much harder to break into. With cold wallets, you store Bitcoin and other coins away from hackers. Think of them as vaults. No internet, no robbery – simple as that.

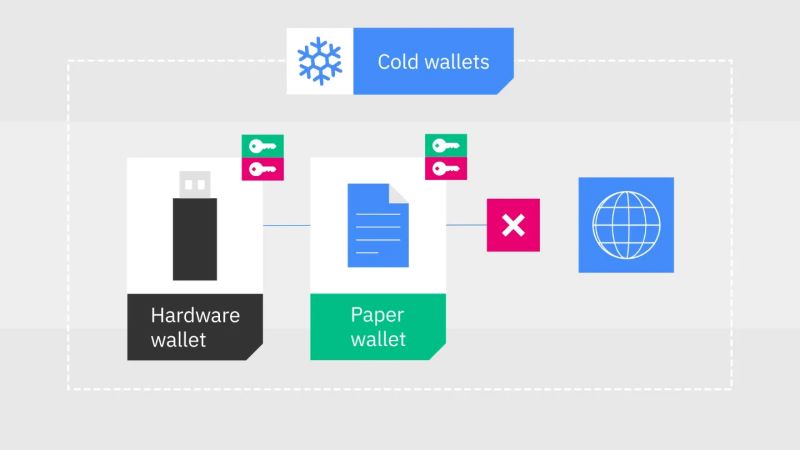

Hardware wallets, USB wallets, paper wallets – these are types of cold wallets. Hardware wallets are small gadgets where you can keep your crypto locked up. USB wallets are flash drives designed to hold crypto safely. Paper wallets are pieces of paper with your private keys written down.

Cold wallets are top-notch for long-term storage. Thieves can’t reach them, because they aren’t connected to the web. To use the coins, you have to plug in your hardware wallet or enter keys from your paper wallet. That means extra steps, but it’s worth it for the safety.

Remember, whether you’re using a hot wallet or a cold wallet, you should keep a backup. Write down your seed phrases – these are special codes that let you get into your wallet if something bad happens.

In a nutshell, hot wallets are great for daily spending, while cold wallets are perfect for keeping your crypto safe over time. Use them wisely, and your digital treasure will stay secure!

Navigating the Security Landscape: Hot vs Cold Storage

Evaluating Hot Storage Vulnerabilities

Do you worry about digital wallet security? If so, you’re right to be cautious. Storing Bitcoin safely and other cryptos in a hot wallet—a wallet connected to the internet—can be risky business. This is like leaving your house doors unlocked. Anyone with skill can reach your wallet online. So, what are these hot storage vulnerabilities? Hackers love them. And they are good at breaking into online systems.

Now, this doesn’t mean you must avoid hot wallets like mobile and web wallet services altogether. They’re super handy! You can access your cash fast for quick payments or trades. Plus, they’re often free. But, if you’re not careful, they can leave your assets exposed.

Online wallet risks include theft from hackers who trick you or exploit wallet weaknesses. They can open your wallet, like picking a lock, and take your funds. This is why you must keep software up to date to guard against such threats. Public and private keys are like your safe’s code; never share them.

Advantages of Cold Storage Best Practices

On the flip side, we have cold storage. Think of it as a digital treasure chest buried underground. Cold storage best practices mean keeping your crypto off the internet, where bad guys can’t reach it easily. This includes hardware wallets that store your coins offline, USB wallets, and even paper wallets. With these, you turn your digital wealth into something you can hold. As cool as treasures!

Cold storage is less about quick trades and more about peace of mind for your stash, keeping it far from online dangers. You won’t touch it without effort, which helps resist impulse moves. Plus, devices like hardware wallets are built tough against hacking. They are your own private vault.

Offline wallet benefits are many. Imagine no worries about wallet hacking incidents while you sleep. Or knowing your stash can survive even if online exchanges collapse. Yet, this fortress needs care too. Make sure you have a strong backup, like a wallet seed phrase. This is a magic set of words that can bring your wallet back to life if needed.

Storing your virtual currency in an offline wallet also means following one golden rule: Keep your backups safe and secret. Paper wallet guidelines say keep them dry and away from sunlight. As for hardware wallets, avoid dropping them and always keep them in a safe spot. If you do this, they are like your loyal guard dogs.

When you compare software vs hardware wallets, think about going to the store. If you’re just buying snacks (or trading a little crypto), a software or desktop wallet might do fine. But for your big screen TV (aka your large Bitcoin stash), you’d want it delivered securely—much like moving crypto into cold storage.

Choosing between a hot and cold wallet is a key part of your crypto holding strategy. Both have their place. Hot wallets are your pocket change, while cold storage is your safe at home. Be smart with public and private keys, and keep a clean wallet backup plan. Then, whatever comes, you’re ready to protect and grow your digital empire.

Optimizing Your Crypto Wallet Security

Strategies for Secure Crypto Transactions

To keep your crypto safe, you must use safe ways to buy and sell. Start with a secure web connection and devices free of malware. Then, use wallets that encrypt your data. This makes it tough for hackers to get your info.

Choose wallets that ask for multiple sign-offs from different devices or people before spending your coins. This is multi-signature wallet security. It adds extra safety. Store only a bit of crypto in mobile and web wallets, as they are more at risk.

For desktop wallets, update them often. Keep your antivirus software strong. Backup your wallets to several places, like USB drives or paper. If your computer breaks, you still have your crypto.

Each wallet has a seed phrase. This is a list of words to help you get to your coins if you forget your password. Write it down. Keep it secret and safe. Do not tell it to anyone or lose it, or you could lose your money.

Backup and Recovery: Keys to Protecting Your Digital Assets

To secure your money, make good backups. Save them in different places, like your home and a safety deposit box. Use paper wallets, which are print-outs of your keys. Or, store them on USB drives or hardware wallets, which are not connected to the internet.

Hardware wallets are often seen as safe because they are offline. Software wallets are riskier but handy. Compare them and choose based on your needs.

Know how to get back your crypto if you lose your wallet. Learn your wallet’s recovery process. Practice it. Make sure your family knows it too, just in case.

Keep track of your public and private keys. Public keys are like your bank account number. Share them to get crypto. Private keys are like your PIN. Guard them with your life. If someone gets your private key, they can steal your crypto.

Never skip updates to your wallet software. They often have security fixes. If your wallet offers wallet encryption methods, use them. It locks your wallet with a password, keeping unauthorized users out.

Paper wallet guidelines include keeping it dry and safe from sunlight and fire. USB wallet advantages are that they are small and can hide well. They can also be plugged into any computer when needed. Air-gapped wallets never touch unsafe networks, so they are super safe.

In the end, know the choices for cryptocurrency storage options. Know the risks of online wallets and the good parts of offline ones. This will help you in storing Bitcoin and others safely. Stick to secure crypto transactions and have a strong crypto wallet backup strategy. Always remember, securing your crypto assets isn’t just smart, it’s a must.

Adopting the Right Storage Solution

When to Use Hot Storage: Convenience vs. Risk

Think of hot wallets like your pocket wallet. It’s where you keep cash for daily needs. For crypto, hot wallets are online tools that let you access your digital money fast. But they face risks, just like your wallet might get stolen. Hackers target hot wallets because they’re connected to the internet—”online” means reachable.

So, when should you use a hot wallet? Use one for small amounts. It’s like not carrying much cash to avoid loss. Hot wallets are great for easy paying and trading. Always check for first-class digital wallet security. This means strong passwords and two-factor auth (short for ‘authentication’).

Now, let’s dive into its risks. The main worry is theft. Your online wallet risks include scams and hacking. Just think of it as leaving your house door unlocked. Would you do that? No! So always be aware and keep your hot wallet safe.

Embracing Cold Storage for Long-term Holding Strategies

Cold storage is the safe. It’s where you keep valuables secure. In the crypto world, cold storage refers to offline wallet benefits. No net connection means no hack fears. It’s perfect for storing Bitcoin safely or any crypto for the long haul. People often compare hardware wallet to Fort Knox—hard to break into.

Keeping your coins in cold storage is wise for big amounts, like your life savings. So how to do it? Paper wallets sound simple (it’s just a paper with your crypto keys), but keep it safe from fire and water. USB wallet advantages include ease of use and portability. But what if you lose it? Then there’s hardware wallets, which are like hard-to-crack digital safes.

Cold storage best practices involve keeping your crypto offline most of the time. Remember, you must handle your key with care. If you lose it, think of it as losing your safe’s key. All is lost. So, write down or print your wallet seed phrases clearly.

Most people want to know: what’s the best option? The answer depends on your needs. If you trade daily, go with hot wallets. But make sure you boost your crypto wallet backup strategies. If your plan is to keep crypto for years, cold storage is your friend. You can even mix both, keeping spending money in hot storage and your savings in cold.

Choosing between hot and cold is like deciding between a car or a bike. Each has its time and place. Your job is to use them wisely. And never forget, no matter how you store your crypto, security is the main game. Keep your keys safe, use strong protections, and you’ll sleep soundly while your digital gold is tucked away.

In this post, we looked inside the world of crypto wallets. We saw how hot wallets offer ease but come with risks, and why cold wallets are the safer bet for saving your coins over time. Remember, hot wallets are great for quick trades, while cold wallets keep your savings secure.

I shared how to keep your crypto safe, what practices will shield your coins and what to do if things go south. Pick hot storage for daily use, cold storage for the long haul. Use what you’ve learned here to make smart choices and keep your digital money safe.

Keep these tips in mind and you’ll stay ahead in the crypto game. Your wallet’s security is in your hands, so choose wisely!

Q&A :

What is the difference between a hot wallet and a cold wallet?

Hot wallets are digital wallets that are connected to the internet and allow for convenient transactions and quick access to assets. They are often used for trading and day-to-day transactions. In contrast, cold wallets are offline storage solutions, such as hardware wallets or paper wallets, that provide enhanced security by keeping your assets offline and out of reach from online threats. Both have their own security measures, but cold wallets are generally considered more secure due to their offline nature.

How can I decide whether to use a hot wallet or a cold wallet?

When deciding between a hot wallet and a cold wallet, consider your needs in terms of accessibility, security, and the volume of transactions you plan to execute. A hot wallet might be a good choice if you frequently trade or spend your cryptocurrencies, while a cold wallet is better suited for long-term holding and added security for larger amounts of assets. It’s also not uncommon for people to use both – a hot wallet for daily use and a cold wallet for substantial savings.

Are cold wallets more secure than hot wallets?

Yes, in general, cold wallets are more secure than hot wallets. This is because cold wallets are not connected to the internet, making them immune to online hacking attempts and breaches. However, they are still susceptible to physical damage or loss, so it is important to have secure backups. Hot wallets, while more convenient, are vulnerable to cybersecurity risks such as unauthorized access, phishing, and malware.

What are some examples of hot wallets and cold wallets?

Hot wallet examples include mobile apps like Coinbase Wallet, desktop software such as Exodus, or web wallets like MetaMask. These wallets are constantly online and provide fast access to your funds. On the other hand, cold wallet examples include hardware wallets like the Ledger Nano S or Trezor and paper wallets, which are printouts containing a wallet’s public and private keys. These cold storage options keep your cryptocurrency completely offline unless when needed for transactions.

Is it possible to transfer cryptocurrency from a hot wallet to a cold wallet?

Yes, transferring cryptocurrency from a hot wallet to a cold wallet is not only possible but also a common practice for enhancing the security of your funds. To make a transfer, you will need to generate a transaction from the hot wallet, specifying the public address of your cold wallet as the recipient. Once confirmed on the blockchain, your assets will be securely stored in your cold wallet, away from online threats.