Crypto Investment 101: Sidestep Rookie Mistakes With Ease

Embarking on your crypto journey can feel like sailing uncharted waters, where a single slip could mean hitting an iceberg. As a budding investor, learning how to avoid mistakes when investing in crypto for beginners is as vital as the investment itself. You want to grow your digital treasure chest, not watch your coins sink to the ocean floor. This guide shines a light on the hidden shoals and maps out a clear path to navigate these digital waves. With insight born from experience, I’ll arm you with the know-how to start strong, research with purpose, invest securely, and trade with the wisdom of an old sea captain. Let’s chart a course to confident investing, leaving costly errors in our wake.

Getting Started With Crypto Investments

Understanding Cryptocurrency for Newbies

When you hear “cryptocurrency,” think digital money. It is money you can’t touch, like a ghost in your computer. People use computers to make this money, and it’s safe because it’s locked by puzzles that are too hard for bad guys.

Many new folks jump into buying digital coins without knowing the game. That’s risky. Do you buy a car without learning how to drive? No. Think smart. Grab facts on what cryptocurrency is first. Learn what makes it tick.

Blockchain Technology Explained

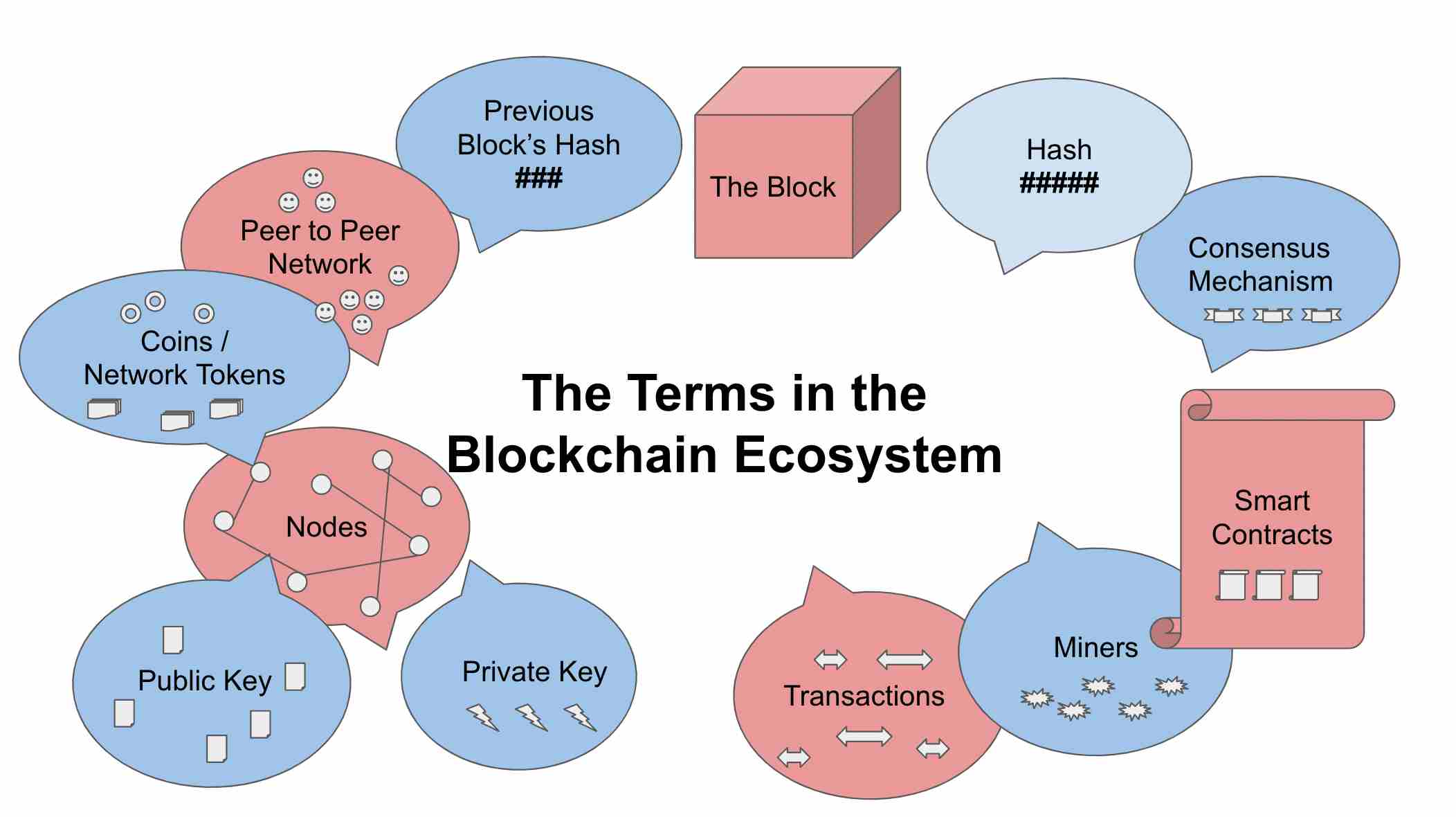

Blockchain? It’s like a magic notebook that never lies. When you send or get coins, that notebook records it. Once it’s in there, no one can erase it. Every computer in the network has this notebook. They work together to keep all things fair.

Blockchain is like a train carrying data-blocks. Each block hooks to the next. If you tried to mess with one, you’d have to mess with them all. That’s hard work. So, it keeps your coins safe.

You’ll hear “blockchain” and “cryptocurrency” often. Know that they’re buddies. Blockchain is the smart system that makes cryptocurrency work well.

Now, onto killer tips for keeping your crypto cash safe!

Researching and Analyzing Before You Invest

Cryptocurrency Research Basics

Let’s talk about doing your homework. In crypto, this means checking facts and learning lots. Beginners often jump in too fast. That’s a big no-no. Take time to understand cryptocurrency. We want zero “oops” moments later, right?

Good research starts with the basics. Like, what in the world is blockchain? Imagine a chain where each link holds info that anyone can check, but no one can mess with. That’s blockchain for you. It’s what keeps your digital money safe and sound.

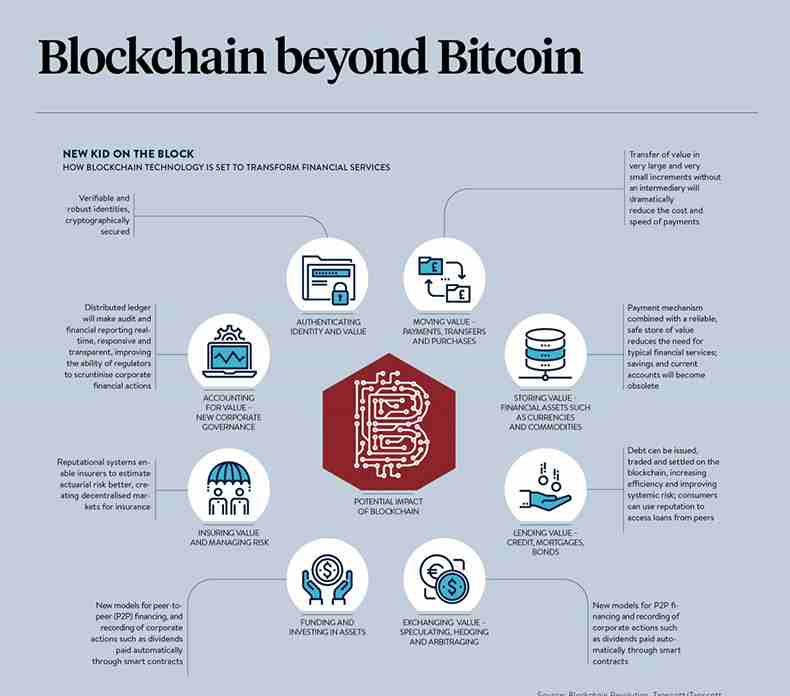

Now, what about these things called cryptocurrencies? Think of them like digital dollars or online coins. Bitcoin and Ethereum are some you might know. There are others too. Learn about them before you put your money in. Trust me, it matters.

Don’t forget to peek into crypto wallets. You’ll need one that’s safe, where no sneaky thieves can get your coins. It’s like a digital pocket for your cryptos. You want it locked up tight, always.

Fundamental vs Technical Analysis in Crypto

When we talk about analysis, it’s not scary math. No, it’s more like being a detective. There are two main types – fundamental and technical.

Fundamental analysis is like digging for treasure. You’re looking for gems – coins or projects with real value. You check things like who’s behind the project, what problem it solves, and if it’s something people will really use. Don’t miss checking whitepapers. They’re like instruction manuals that tell you what the coin or project’s all about.

Technical analysis is different. It’s more about patterns and charts. Think of it as trying to guess where a ball will roll based on how it bounced before. It’s about looking at prices from the past and betting on what they’ll do next.

Now comes risk management – planning how not to lose all your cash. You could start by not putting all your eggs in one basket. Yep, that means spreading your bets across different coins – it’s smarter that way.

And think long and short. Some folks like to hold their coins for ages. Others sell fast, riding the waves of prices going up and down. Both have pros and cons, but you’ve got to think about what fits you best.

Timing is tricky. No one knows the perfect moment to buy or sell. That’s like predicting the weather with a magic crystal – good luck with that! But with patience, research, and steady goals, you’re halfway there.

One last piece: scams and lies are out there. So, learn to spot those dodgy “get-rich-quick” schemes. If it sounds too good to be true, run the other way. Crypto’s exciting, but let’s not make it a wild west, okay?

Do these things: dig deep, learn lots, make smart plans, and keep your eyes open. Then, you’re ready to rock the crypto world – one careful step at a time.

Secure and Smart Investment Practices

Choosing Secure Crypto Wallets for Beginners

When you’re new to crypto, wallets are key. They hold your digital cash. Think of them like a bank account but just for crypto. You want a wallet that’s like a safe. It needs to be hard for bad guys to get into. That means it must have good security features. You might choose one that keeps your info offline. This kind is called cold storage. It’s like a vault that’s not easy to break into.

There are two main types of wallets: hot and cold. Hot wallets connect to the internet. They let you access your crypto fast but can be less secure. Cold wallets, like hardware wallets, are not connected. This makes them safer from hackers. When picking a wallet, make sure it supports the crypto you want to invest in. There are many choices, so pick one that is well-known and trusted. Always remember your password and keep your private key a secret. If you lose them, your crypto is gone for good.

Diversification and Risk Management Strategies

Spreading your money is wise. Don’t put all your eggs in one basket. In crypto, this means not just buying one kind of coin. You should mix it up. By investing in different coins, you spread risk. This can help when prices go up and down a lot. Yet, this doesn’t mean you can’t lose money. Investing is always risky. So, only spend what you can afford to lose.

The first step is to look at your money. Decide how much you can invest without hurting your needs. Then, think about how much risk you can handle. Are you okay with big changes in price, or do you want to be more careful? This will guide your choices. It’s smart to invest in both new and old coins. This can give balance to your investments. Lastly, review your investments often. This helps you see if you need to make changes. It’s like checking on a garden to see how your plants are growing.

When investing, setting goals is important. Do you want quick profits or to save for the future? Knowing this helps you decide if you should hold your crypto for a long or short time. If you play it smart, have patience, and learn as you go, you can avoid big mistakes. Always keep learning, and don’t rush. Crypto can be fun, but you’ve got to be safe and smart about it.

Navigating the Crypto Markets with Confidence

Staying Informed Through Community Insights and Whitepapers

When you dive into crypto, think of it like a wild jungle. It’s easy to get lost. You need to know where you’re stepping. First up, don’t go it alone. Join crypto forums and groups. People here share news and tips. They’ve been where you are. They know the tricks of the trade. They talk about new coins, market shifts, and how to read crypto signs. Listen and learn, but don’t follow blindly.

Now, about whitepapers—they’re like crypto’s heart. They tell you what a coin’s goal is, how it works. It’s like a map to hidden treasure. But watch out, not all that glitters is gold. Some whitepapers are all shine, no substance. Read them, sure. But ask, “Does this make sense? Is it true?” Use your head. A real solid whitepaper packs details: technology, plans, team. It makes promises it can keep.

Recognizing and Avoiding Common Pitfalls and Scams

So, you’re all set to trade. Wait up. Know the common slip-ups. Let’s talk scams first. They’re like monsters under your bed. You hear “ICO” and think, “jackpot.” Not so fast! Some ICOs are traps. They grab your cash, and boom, they’re gone. Look real close before you leap. Check out who’s behind it. See if they’ve done good stuff before. If it’s all talk, no track record, step back.

And wallets—think of them like your own safe. Do you leave your safe open? No way! Go for wallets that lock tight. Two-factor auth, tricky passwords – these are your friends. Think of them like a big, strong gate. They keep your coins safe behind it.

Last bit, don’t put all your eggs in one basket. Crypto jumps up and down. A lot. Spread your cash out. Put some here, some there. Think long game. Quick money sounds cool, but it’s like a rollercoaster. It can fall as fast as it goes up. Set goals that won’t crash and burn.

Remember, this isn’t a race. Take your time, do your checks, and keep those eyes open. With a sharp mind, you’ll cut through the noise. You’ll grow your cash and stay in the green. Stick with these steps to keep ahead. You’ve got this!

In this post, we cracked open the world of crypto for you, diving into the basics for those just starting out. We explored how blockchain works, making it clear even for newbies. Then, we looked at the must-do research and why knowing the difference between fundamental and technical analysis can make or break your crypto journey.

We also shared crucial tips on picking a safe wallet and why putting your eggs in different baskets is key in crypto. Finally, we tackled how to stay sharp and avoid traps in the ever-changing crypto markets.

I’ll leave you with this: take what you’ve learned and step into the crypto space with your eyes wide open. Smart moves and a cool head will serve you well. Keep learning, stay safe, and you could enjoy the ride in this digital gold rush. Remember, knowledge is as valuable as the investment itself!

Q&A :

What are common mistakes beginners should avoid when investing in cryptocurrency?

Investing in cryptocurrency can be a complex and volatile process. Beginners often fall into traps such as lack of research, investing more than they can afford to lose, chasing losses, and neglecting security measures. It’s imperative to start with a solid understanding of the cryptocurrency market, diversify investments, and use a risk management strategy. Additionally, ensuring that your digital assets are secure through strong passwords and two-factor authentication is non-negotiable.

How can beginners get started with investing in cryptocurrency safely?

The first step for beginners is to educate themselves about the cryptocurrency market. This includes understanding blockchain technology and the specific currencies in which they’re interested. Starting with a small investment to learn about the market dynamics without facing significant risk is advised. Using reputable exchanges, setting up secure wallets, and keeping abreast of market trends are essential practices for safely investing in crypto.

What should beginners pay attention to when choosing a cryptocurrency to invest in?

Beginners should look for cryptocurrencies with a strong track record, active developer communities, and clear use cases. They should also pay attention to the market capitalization and liquidity to ensure stability and ease of trade. It’s important to research the technology behind the cryptocurrency and read the whitepaper. Checking regulatory news and trends related to the crypto of interest can help in making an informed decision.

Are there specific strategies for beginner investors to manage risks in crypto investment?

Yes, beginners can manage risks by employing several strategies. These include diversifying their investment portfolio across different cryptocurrencies to spread risk, avoiding investing based on hype and speculation, and setting clear profit targets and stop-losses to manage volatility. Additionally, staying updated with cryptocurrency news, avoiding emotional trading, and not investing money that they cannot afford to lose are all prudent risk management tactics.

How can beginners learn from the mistakes of other cryptocurrency investors?

Beginners can learn from experienced investors by joining cryptocurrency communities, forums, and attending crypto-related events. They should also be reading case studies, analyses, and news articles about failed and successful investments. Podcasts, webinars, and online courses can provide educational material created by expert investors. Learning from others’ experiences can help beginners identify pitfalls and build a prudent approach to investing in cryptocurrency.