Diving into the digital currency pool can feel like a leap into the unknown, but fear not! How to buy cryptocurrency for beginners doesn’t have to be a scramble. This guide breaks it all down into easy chunks to make your first buy a breeze. From the nuts and bolts of blockchain to securing your digital gold, we’ve got the map you need to start your crypto journey. With clear steps and pro tips, you’ll go from confused to confident as you step into the world of digital currency. Ready to transform from a beginner to a savvy investor? Let’s get started!

Understanding the Basics of Cryptocurrency and Blockchain

What is Cryptocurrency and How Does it Work?

Imagine you have a kind of money that’s not made of paper or metal. This is cryptocurrency. It’s like your arcade tokens but for buying stuff online. Each one is a string of codes. They are super unique – no two are the same!

Cryptocurrency works like an arcade too. In the arcade, machines check if your tokens are real. With cryptocurrency, computers do that job. They look at the code to make sure it’s a good coin. Each trade is a deal between two people. It’s like giving your friend some cash. No one else can say it’s theirs – just you and your friend know.

You can buy stuff with cryptocurrency, or trade it, like baseball cards. Some folks hold onto it, hoping it becomes more valuable, like a rare toy from a Happy Meal.

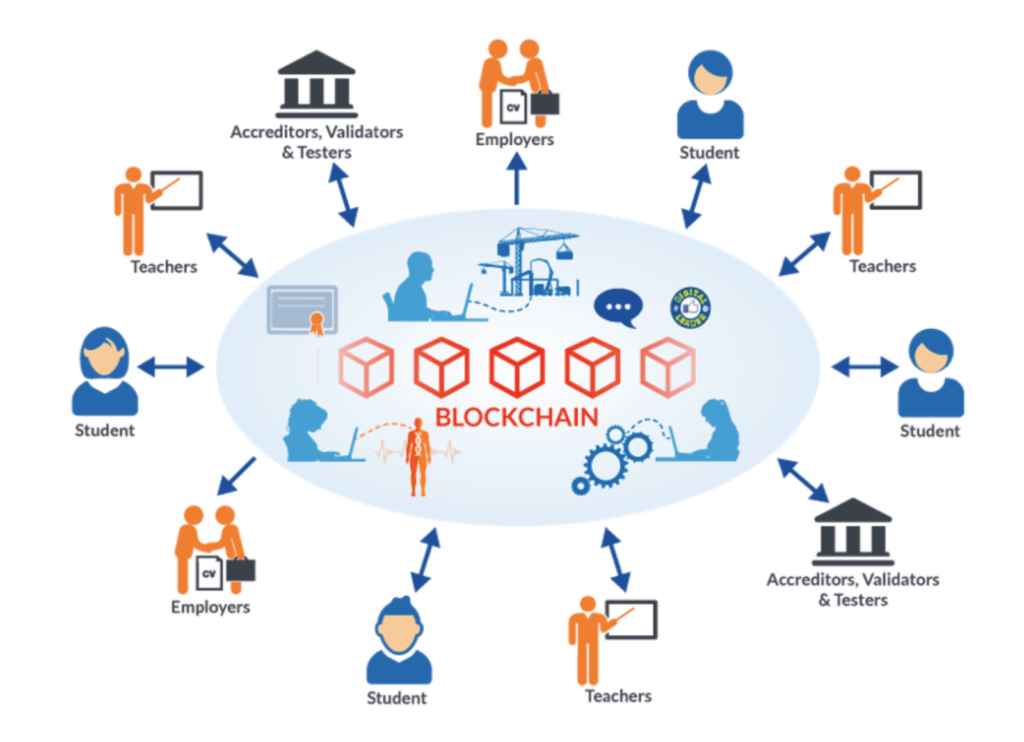

The Role of Blockchain in Cryptocurrency Transactions

Now, let’s talk about how the computer knows if a coin is real. That’s where blockchain comes in. Think of blockchain as a big book. Every time someone trades cryptocurrency, it writes down the details. It’s like your friend writing down that you gave them five bucks.

This book is super safe. Everyone can see it, but no one can scribble over what’s been written. This stops people from trying to spend their coins twice. It’s like the whole class watching you trade stickers and making sure you play fair.

It checks all trades to make sure they are okay. This way, everyone’s tokens stay safe. It’s smart because it doesn’t need a bank or a big boss to make sure everything’s good. It just needs the computers and the big book – the blockchain.

So, when you buy cryptocurrency, you’re getting special codes that everyone agrees are worth something. The blockchain makes sure no one tricks you or steals your codes.

Remember, while all this may seem like a game, it’s real money. Always think hard and learn as much as you can before you start. Buying and using cryptocurrency can be fun and exciting, but it’s important to play it safe and smart.

Setting Up for Your First Cryptocurrency Purchase

Choosing the Right Cryptocurrency Exchange

When you’re new to buying crypto, picking where to trade is key. Think of exchanges like digital marketplaces. Here, you can buy or trade types of digital money. Each exchange differs by the coins they offer and the fees they charge. Do your homework to find one that fits your needs.

What should you look for? Security, user-friendly layout, and coins offered are all musts. Fees matter a lot, too. What does it mean to verify your identity? It’s how exchanges keep you safe. You’ll need ID and possibly a photo to do this. It’s a step you can’t skip.

Once verified, you can add money to your account. You’ll often use money from your bank for this. Some exchanges even let you use a card. Remember, every exchange has different steps. You should compare before you choose.

The Process of Setting Up a Crypto Wallet

Now, a place to keep your coins. That’s a wallet. But it’s not like the one in your pocket. It’s digital and needs careful setting up.

First, choose your wallet type. Some are on exchanges, called “hosted wallets.” It’s like having an account with the bank. They’re easy to use but less in your control. Then there are “non-hosted wallets.” These give you more control. But you must keep your secret keys safe. Lose them, and you might lose your cash.

What are secret keys? They let you access your crypto. Think of them like the most important password you have. Security is super important here. It prevents thieves from taking your stuff. Always back up your wallet. Then, if tech fails, your cash is still safe.

Got your wallet set up? Great! Now you might think about how much to buy. Start small. Learn as you go. Mistakes can cost you, so go slow.

There’s more to buying digital currency explained in this first step. But this quick guide gives you the nuts and bolts. Keep it handy as you dive in. Welcome to the exciting world of crypto! Remember, it’s all about taking safe, smart steps as a beginner.

Making Your First Cryptocurrency Investment

Funding Your Account and Understanding Trading Pairs

Ready to buy your first crypto? Great! You’ll need some cash first. Before you dive into the exciting world of cryptocurrencies, you must set up and fund your account on a crypto exchange. This is your gateway to the crypto universe. So, how do you get started? You’ll need to deposit money, often your local currency like dollars or euros, into your exchange account.

What are trading pairs? Think of it as a dance between two different coins. When you see something like BTC/USD, that’s a trading pair. It tells you that you can trade Bitcoin for US dollars or buy Bitcoin with US dollars. Just like that, any two currencies form a pair, showing how they can trade for each other.

Buying Bitcoin or Altcoins: A Step-by-Step Approach

Buying Bitcoin or other cryptocurrencies is a lot like online shopping. Let’s go step-by-step.

- Choose an Exchange: Go for a reputable one. This is super important. This is where you trade money for crypto. Think of it as a digital marketplace.

- Set Up an Account: Here, you’ll give some personal info. Remember, you’ll need to verify your identity. This keeps it all safe and follows the law.

- Fund Your Account: This means putting money in. Use a bank transfer, credit card, or even PayPal.

- Select Your Crypto: Ready for Bitcoin or do altcoins grab your attention? Altcoins are just any coin that’s not Bitcoin. Ethereum, Ripple, and Litecoin are some names you’ll hear.

- Make Your Purchase: Decide how much you want to buy. Can be a whole coin or just a fraction.

- Safe Storage: Move your new digital coins into a wallet. Not your pocket wallet, but a digital one. It can be online, on your computer, or even on a piece of hardware.

Buying your first piece of cryptocurrency might sound complex. But it really just breaks down into these simple steps. You pick a platform, toss in some cash, choose your coin, and hit the buy button. After that, it’s all about keeping it safe in a wallet. Remember, doing your homework on the exchange and where to keep your crypto is key. Getting started is easier than it looks! Don’t fear diving in and becoming part of the crypto world. It’s a journey, and you’re on the first step.

Best Practices for Secure and Strategic Cryptocurrency Investment

Securing Your Digital Assets and Assessing Investment Risks

Investing in crypto is exciting! But, it’s key that you keep your digital money safe. Think of a crypto wallet as your personal bank vault. There are two kinds: ‘hot’ and ‘cold’. Hot wallets connect to the internet, making them easy to use, but more open to hacks. On the other hand, cold wallets store crypto offline, making them super secure but less handy for quick trades.

Always choose reputed wallets and exchanges. This guards you against scams and helps you feel safe about where your money is. Look for ones that require identity checks—called KYC, or Know Your Customer. These checks are a bit like an online photo ID to keep your investments safe.

And don’t forget about research. Just like you wouldn’t buy a car without learning about it first, you shouldn’t invest in crypto without homework. Get to know what each coin does and the team behind it. And always be aware of the fees when buying and selling.

Developing a Long-term Crypto Investment Strategy and Diversifying Your Portfolio

Diving into crypto needn’t be a wild ride. You can invest smartly with a clear plan. First up, think about your goals. Ask yourself, “Why am I investing? What do I want from it?” Some folks are in for quick wins, while others look for growth over years. Knowing this shapes your strategy.

Then, spread your bets. Don’t put all your money into one coin. If you buy different types of coins, like Bitcoin or Ethereum—plus some smaller ones—you’re not hitched to just one’s success or failure.

A big part of your strategy is knowing when to hold tight. Crypto prices can go up and down super quick. But if you believe in your choices for the long haul, stay put when things get shaky. Those who hold for years often see the best rewards.

And remember, the world of crypto is always changing. New rules and coins appear all the time. Keep up to date with crypto news to stay on top. That knowledge is priceless in making the best moves.

By securing your assets, vetting investment risks, planning long-term, and mixing up your choices, you’re set for a smart start in the crypto world. Remember, the goal is to grow your money while sleeping sound at night, knowing it’s safe. Happy investing!

We’ve explored the exciting world of cryptocurrency from the ground up. Starting with the basics, we know now that cryptocurrency is digital money and blockchain is its record keeper. Setting up your first purchase means choosing a good exchange and a secure wallet. When investing, funding your account is key, followed by using trading pairs to buy Bitcoin or other coins.

Remember, it’s crucial to protect your digital assets. Take time to understand the risks and craft a long-term strategy. Diversify your portfolio to stay safe. Smart moves and a level head make for wise investing in the crypto world. Stick with these tips and you’re set to start your crypto journey right. Keep learning and stay safe out there!

Q&A :

What are the first steps for beginners to buy cryptocurrency?

When starting on your cryptocurrency journey, it’s important to comprehend the basics. Initially, familiarize yourself with what cryptocurrencies are and how they work. The next crucial steps include selecting a cryptocurrency exchange, creating an account, setting up a secure wallet to store your assets, and starting your journey with a smaller, manageable investment to learn the ropes.

How can I safely set up a cryptocurrency wallet?

The safety of your investments in crypto hinges on how securely you manage your wallet. To set up a safe cryptocurrency wallet, choose between hardware (physical devices) and software (applications or online services) wallets, ensure strong password creation, enable two-factor authentication, and regularly backup your wallet. Considering cold storage (offline) options for larger amounts could provide additional security.

What are the best cryptocurrencies for beginners to invest in?

For beginners, it’s wise to consider well-established cryptocurrencies with a track record of market stability and active community support. Typically, beginners might start with Bitcoin or Ethereum due to their widespread adoption and relatively more accessible information resources. Still, before investing, thorough research is crucial to understand market trends and to learn about different coins and their potential.

How much money do I need to start buying cryptocurrency?

Starting your crypto investment journey doesn’t require a large sum of money. Many platforms allow you to start buying cryptos with as little as $10 to $25. It’s best to invest only what you can afford to lose, given the volatility in the cryptocurrency markets, and to diversify your portfolio over time.

Are there any reliable cryptocurrency exchange platforms you recommend for beginners?

Several user-friendly and reputable cryptocurrency exchange platforms are specifically tailored for beginners. Some of the commonly recommended ones include Coinbase, Binance, and Kraken. These platforms are known for their ease of use, robust security measures, and extensive educational resources. It’s vital to research and compare the fees, features, and supported currencies before making your decision.