How to Boost Your Crypto Exchange Liquidity: Proven Strategies Unveiled

You’ve got a crypto exchange. You need active buyers and sellers to keep it alive. Here’s the real sauce: how to improve crypto exchange liquidity. It’s about making your platform the go-to spot for trades. Imagine no delay, no slippage, just smooth transactions. We talk market know-how, nifty tech tricks, and ways to bring in more traders. Ready to make your exchange the powerhouse everyone trusts? Stick with me, and let’s dive deep into turning your liquidity from a trickle to a flood.

Understanding Market Liquidity and Its Impact on Crypto Exchanges

The Crucial Role of Market Making in Crypto

Imagine a bustling bazaar. It’s not just the goods that make it thrive, but also the steady stream of buyers and sellers. That’s like market making in crypto. It keeps markets alive. Market makers buy and sell assets, creating a liquid market. They make sure that when you want to trade, you can. No waiting, no stress.

Market making is a fancy way of saying: we help traders trade anytime. We set buy and sell prices for others to hit. This makes it easy for you to buy or sell your crypto fast. Think of us as the friendly shopkeepers in the crypto world.

We sit at the heart of the exchange. We hold crypto. We always stand ready. Ready to take the other side of your trade. Without us, things could get rough. Prices could swing wild or trading might stall. That’s no fun for anyone.

But with us, things run smooth. We ensure fair prices and snappy trades. We serve up offers to buy and sell all day. This helps reduce that annoying gap between buy and sell prices. It’s called the spread. A small spread is like a tight handshake. It means you pay less and trade more.

Measuring Liquidity: Order Book Depth and Market Depth Analysis

Now let’s talk numbers. Ever heard of order book depth? It’s big deal for us. It’s all about how many orders are up for grabs at any price. A deep book means there’s a lot of orders close to the current price. You can make big trades without the price jumping too far.

Market depth? It’s similar, but looks at the whole picture. It shows how orders at different prices stack up on the exchange. It gives us clues about how the market will handle big trades. If the depth chart is fat, you can dive in with big trades.

When we look at these charts, we see the health of the market. We can tell if we’re doing our job right. If it looks good, it means we have a lot of action on both sides. Buyers and sellers are happy. Trades happen fast and fair. But if it’s looking skinny, we know we need to step up our game.

We keep tabs on this all day, every day. That’s how we make sure you’ve got a good place to trade your crypto. We work hard keeping that order book beefy. It means you won’t see wild price swings when you come to buy or sell.

Enhancing exchange liquidity in cryptocurrency isn’t just about numbers. It’s about making traders feel at home. It’s about trust. We’re here to make sure your next trade goes off without a hitch. The happier you are, the healthier our market. And that’s good for everyone.

So, that’s the scoop on liquidity and market making. With us around, you’ll find trading is as smooth as skating on ice. Whether you’re looking to cash in or buy more, we’re your go-to for an easy trading day.

Implementing Robust Liquidity Strategies

Developing Incentive Programs for Liquidity Providers

Think about a busy market. Now, imagine one where traders can’t find stuff to buy or sell. That’s a bad market, right? We don’t want that in crypto! So, let’s kick things off with liquidity provider incentives. They’re key for a lively market. Here’s the deal: you give rewards to folks who add money to your exchange. This can be through fees they earn when people make trades with their cash. This draws them like bees to honey!

But how do we get this rolling? Start simple. Look at what rewards others give and do that… but better. Offer stuff like liquidity rebates or even a piece of the exchange’s fees. Sometimes, you’ll hear about crypto liquidity mining. It’s when you give out tokens for people’s cash stash in the market. It’s pretty cool and can really shake things up.

Capitalizing on Automated Market Makers (AMMs) and Liquidity Pools

Next, we swing over to automated market makers or AMMs. What are they? Tech-driven pals that let people trade crypto without a middle man. They use something called liquidity pools. These are big pots of money that anyone can trade with. When you trade, you swap with the pool, and prices adjust on how much folks want to buy and sell.

Why use AMMs? They’re always ready to trade, 24/7 – no waiting for a trading partner. Plus, they help with reducing slippage in crypto trading. Slippage is when prices change too fast, and you get a different price than expected. Not fun, right? AMMs help keep things steady.

And look at decentralized finance (DeFi) liquidity. Money here isn’t locked in one place. It can move around and create more chances for people to join the fun. More people trading means a better market for everyone.

As for liquidity pools in crypto exchanges, they let traders jump in without moving prices too much. This helps when there are big trades that could shake things up.

We’re always finding new paths to keep our markets filled with cash and easy to trade. Keeping fees fair, reaching out for new cash, and building cool tech. It keeps traders happy, and a happy trader is a trader that stays. Remember, a market without money to trade is like a car without gas – it ain’t going nowhere! So, we keep things running smooth for a good ride in the crypto world.

Enhancing Trader Engagement and Volume

Attracting a Diverse Pool of Crypto Traders

Here’s a truth you can bank on: more traders mean more trades. Simple, right? But how do we reel in these traders? We roll out the welcome mat with diverse coins and tokens. They come for variety, but stay when the trading is easy and safe. Liquidity is the key. It ensures trades move like clockwork.

To stick around, these traders need trust. Trust grows when they see a rich order book – one filled with buy and sell orders as far as the eye can see. Deep order books cut down on nasty slippage, which can scare off a trader faster than you can say “volatile market”.

We want everyone at our table. So we bring in the big spenders and the penny pinchers. Our platform becomes the spot where all sorts of traders find their groove. We make it a place that feels like home for high-frequency trading pros and newcomers alike.

Expanding Trading Pairs and Integrating Stablecoins

Trading pairs are like doors; more doors, more paths to stroll through. Every new pair is a chance to say “Hey, check this out” to traders hunting for the next big play. Let’s not forget stablecoins. These cool cats provide a haven when the crypto waves get too choppy.

Adding them into the mix is a no-brainer. They’re like the trustworthy friend that always has your back. Teams of traders come running when they see stablecoins paired up with other cryptos. It’s like adding more lanes to the crypto highway, making room for a flood of new traffic.

But we can’t stop there. We’ve got to make friends across the street and beyond. When we join hands with other exchanges – you’ve got it, that’s cross-platform liquidity sharing – we make a bigger pool for all to swim in. Better for them, better for us.

A trader’s thrill is the chase for the next big score. We power that thrill by introducing new coins and offering those sweet fiat onramps. Easy in, easy out, that’s how we make our exchange the one they return to, time after time.

The more, the merrier, right? New faces mean new trades. New trades beef up our book, and before you know it, we’re sailing smooth on the liquidity sea. Let’s throw open the doors, rev up the welcome wagon, and show traders the time of their lives. This is how we create a ripple that turns into a wave – a mighty wave of next-level liquidity that lifts us all.

Leveraging Technology for Optimized Liquidity

Smart Order Routing and High-Frequency Trading

When you dive into the world of crypto exchange, you quickly learn one thing: fast and smart matter. Let’s break it down with simple, yet powerful tools – smart order routing and high-frequency trading. With smart order routing, it’s like having your personal guide to finding the best trade paths. It scans different markets in the blink of an eye, seeking the lowest prices for your buy orders and the highest for sells. Now, this is a game-changer because it means better deals for everyone.

High-frequency trading takes things up a notch. Think of it as the flash of trading. It’s all about making lots of trades super fast. Not all can do this, but if you can, it’s a big win for liquidity. It fills up order books, bringing life to markets. It’s like putting a turbo boost on market activity.

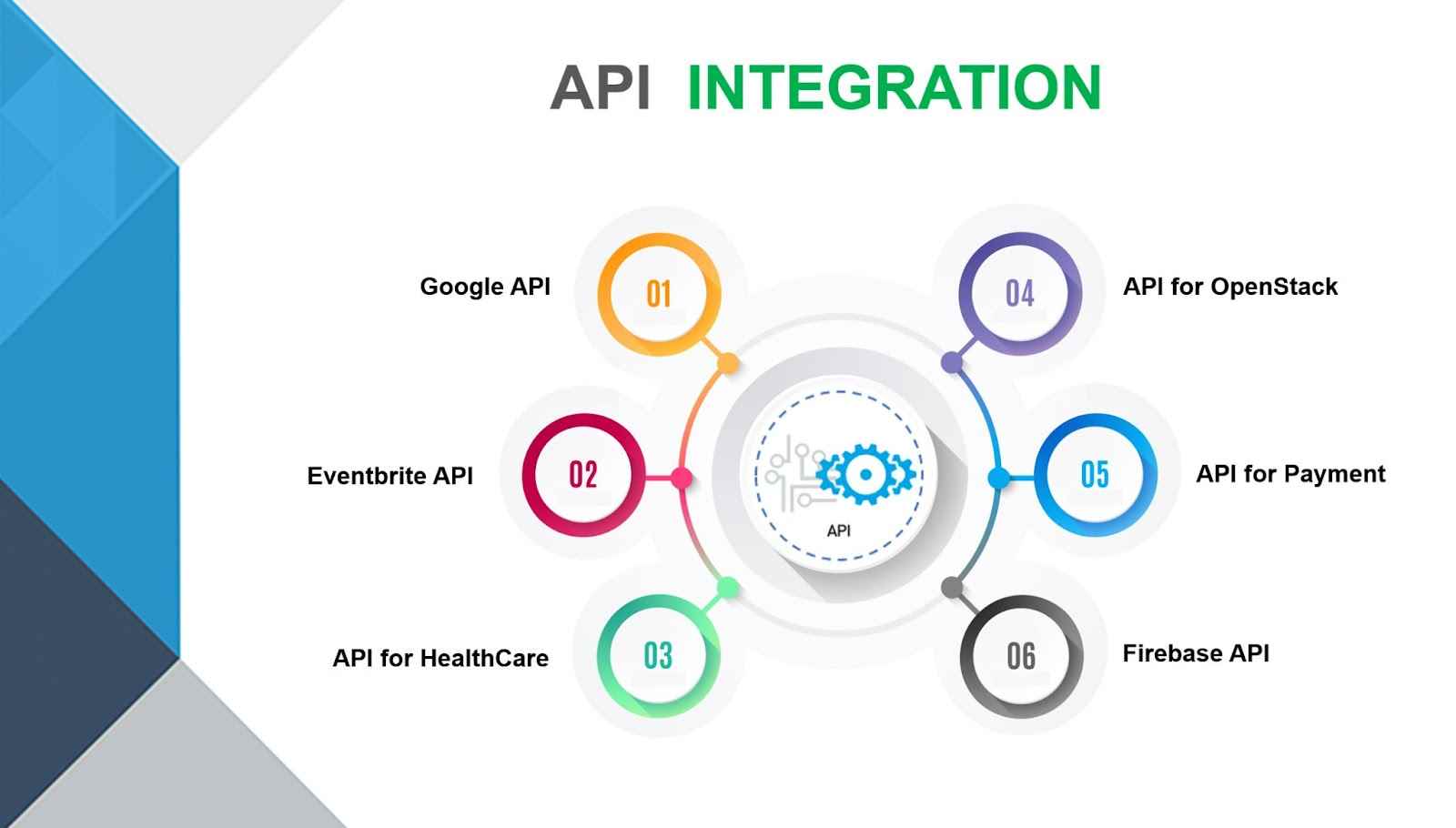

Utilizing API Integration for Seamless Market Connectivity

Let’s chat about another secret weapon – API integration. APIs are magical keys that link up your exchange to others. What does this magic do? It connects traders, markets, and even automated bots smoothly. Imagine you want a special toy that’s sold out everywhere. Then you find this one shop that magically has it because they’re connected to all the other shops. That’s what APIs do for trading.

When you set up APIs right, they can do heavy lifting in the background. This means traders find more matches for their orders. More matches mean more trades, and more trades mean better liquidity. APIs help with sharing information across platforms, making markets deeper and richer. They’re like invisible bridges, bringing everyone together in the crypto world.

Enhancing exchange liquidity with these tech strategies isn’t just smart – it’s essential. It moves your exchange from a quiet corner shop to a bustling market square. It’s how you roll out the red carpet for those seeking volume and variety in their trades. Use tech to make waves, and watch as your crypto exchange goes from a ripple in the water to a full-on tidal wave of trading activity.

In this post, we dug into the big deal of market liquidity in crypto trading. We started by exploring how making the market work plays a key role. I showed you how to track liquidity by looking at the order book and market depth. Next, we talked about ways to make liquidity better, like rewards for those who provide it and using smart tech like Automated Market Makers.

We also talked about how to get more traders interested and boost the trading action. This includes getting a mix of traders, adding more trading pairs, and using stablecoins. Lastly, we hit on using new tech to make sure trades flow smoothly. This covers smart order routing and making systems talk to each other using APIs.

I live and breathe this stuff, and I know keeping a healthy flow in trading is a must. The tech and strategies I mentioned are top-notch ways to keep the market moving. Making sure trades go through fast and fair helps everyone. Happy trading!

Q&A :

How can a crypto exchange enhance its liquidity?

Improving liquidity on a crypto exchange involves a set of strategic actions aimed at increasing the volume and ease of trading assets. This can be achieved through methods such as partnering with market makers to ensure continuous trading, introducing liquidity incentives to reward participants, or offering a broad range of assets to attract a diverse group of traders.

What are liquidity pools and how do they work in crypto exchanges?

Liquidity pools are essentially reserves of cryptocurrencies that are locked in a smart contract to facilitate trading on decentralized exchanges (DEXs). They enable users to trade assets directly from the pool, ensuring there’s always a counterparty to buy or sell to. Traders can also provide liquidity to these pools and earn a share of the transaction fees in return.

Can API integration help improve a crypto exchange’s liquidity?

Yes, API (Application Programming Interface) integration can significantly contribute to a cryptocurrency exchange’s liquidity. By connecting with external exchanges and liquidity providers, an API facilitates real-time sharing of order books and market data. This can attract arbitrage traders and create a more seamless trading experience, thus enhancing overall liquidity.

Why is liquidity important for a cryptocurrency exchange?

Liquidity is crucial for a cryptocurrency exchange as it ensures that traders can buy and sell assets quickly and at stable prices. High liquidity minimizes slippage, reduces the spread between bid and ask prices, and promotes a more efficient market, making the exchange more attractive to users.

What role do market makers play in improving liquidity on crypto exchanges?

Market makers are individuals or entities that commit to buying and selling cryptocurrencies on an exchange at all times. This constant activity helps to fill the order book, narrows the spread between the bid and ask prices, and ensures that there’s always enough trading volume. By doing so, market makers play a fundamental role in enhancing the liquidity and overall stability of crypto exchanges.