How to Use Crypto Charting Tools: Unveil Market Secrets Like a Pro

Cracking the code of the crypto market isn’t just for the Wall Street wizards. If you’ve ever felt lost staring at the zig-zag lines and bursts of color on crypto charts, it’s time for a mighty change. How to use crypto charting tools is more than a fancy skill—it’s your ticket to becoming the savvy trader you aspire to be. Reading this post, you’ll grab the essentials for telling a mere price change from a profit-making pattern. Get ready to decipher candlesticks and catch market moods as if you were born to trade. Let’s chart your path to trading stardom, navigating through whales and dips like a seasoned pro.

Grasping the Basics of Crypto Chart Analysis

Deciphering Candlestick Formations and Patterns

Candlestick patterns in crypto tell us lots about price moves. Picture them as storytellers of the market. They show buyers and sellers fighting it out. A single candlestick can reveal much. It has a body that shows opening and closing prices. Wicks stick out from the body, pointing out the high and low.

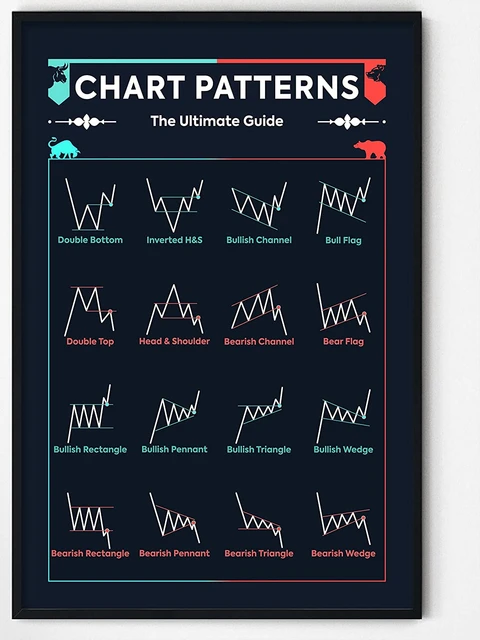

Watch for common patterns like ‘bulldozers’ or ‘dippers’. Well, not their real names. Traders call them ‘bullish engulfing’ or ‘bearish hammers’. They hint at future prices, like if bulls or bears gain power. Think of bullish engulfing as a sign that buyers might rule soon. Bearish hammers could mean sellers might take over.

Reading these signs is like learning a new language. It’s about spotting these candle clusters. They could signal a trend’s start or end. But remember, these patterns don’t always promise what’s next. They’re just clues. Keep an eye on them as part of a wider strategy.

Understanding Support and Resistance in Cryptocurrency Trading

Now, let’s talk about support and resistance levels in crypto. They’re key in crypto chart analysis tools. Support is like a safety net, where prices stop falling and might bounce up. Resistance is the ceiling prices have a tough time breaking through. Imagine a ball bouncing between your floor and ceiling. That’s like prices bouncing between support and resistance.

How do you spot them? Look for places on the chart where prices stop and reverse often. Drawing crypto trend lines can help you see them clearer. When prices near these lines, traders watch closely. They make bets on if the price will bounce back or burst through.

Breaking these levels is a big deal. It tells traders there’s a mood shift in the marketplace. If a price slices through support, watch out. It might keep dropping. If it surges past resistance, it could climb more.

Technical indicators for crypto, like moving averages or RSI indicator crypto, back up what support and resistance tell us. Using volume in crypto trading also helps. High volume means lots of interest, which can make these levels stronger or weaker.

Put it all together, and you get a strong start in crypto technical analysis. Remember, charts are like puzzles. Each piece adds to the big picture. Use patterns and levels to spot trends. Then, look at volumes and indicators to confirm your thoughts. This is how you start to unveil the secrets of the crypto markets.

Advanced Technical Indicators and Their Application

Utilizing RSI and MACD for Crypto Trade Decisions

When diving into crypto, you need good tools. Like finding hidden treasure, good tools make it easier. Let’s talk about two cool tools: RSI and MACD. Crypto traders love them. Why? They help you make smart moves.

What’s the RSI indicator in crypto? It shows if crypto is sold too much or not enough. Think of it like a fuel gauge for buying or selling energy. When RSI is over 70, it might mean “too pricy”. Under 30? Maybe it’s a deal.

MACD helps you see the trend. It’s two racing lines on your chart. When they cross, pay attention! A rising cross may mean it’s time to buy. A falling cross? Might be time to sell. It’s like a green or red light on the road.

These indicators, they’re not just fancy lines. They tell stories of fear and greed in the market. Learn them well, and you can make wiser choices, not just guesses.

Integrating Bollinger Bands and Fibonacci Retracement for Precision

Okay, next up are Bollinger Bands. These guys are like a rubber band for prices. If prices poke out of the bands, often they’ll snap back. Bollinger Bands use a moving average—sort of like a road. Prices tend to stay on this road. When they leave, they usually come back.

But how do you nail the exact spots for trades? Enter Fibonacci Retracement. These are magic numbers that predict where prices could turn. They’re like stepping stones in a river. If you know where they are, you can cross safely.

You draw these lines on top drops or climbs. When prices hit these lines, watch out! They often bounce or drop from here. It’s like a game of hot potato. You want to catch the potato but not get burnt.

Using Bollinger Bands and Fibonacci together? Now that’s smart trading. Bollinger Bands show you the river’s edge. Fibonacci shows the stones. Together, they can guide you through the risky waters of crypto trading.

Getting it right takes practice. But remember, patience wins. And never risk more than you can afford to lose. Cryptocurrency trading is a wild ride. With these tools, you might just enjoy it.

Remember, all traders start somewhere. At first, it’s like learning to ride a bike. Wobbly, maybe some falls. But keep at it. Soon enough, you’ll be cruising, using RSI, MACD, Bollinger Bands, and Fibonacci Retracement like a pro.

That’s it, friends. Advanced tools for your crypto journey. Use them well, and they could lead you to victory. So go on, give them a try. The market’s secrets won’t unveil themselves!

Crypto Chart Analysis Strategies for Trading

Constructing Actionable Trading Signals from Chart Patterns

Ever stared at a crypto chart and wondered what it’s saying? Crypto charts are like road maps. They show where a coin has been. They hint at where it might go next. Crypto technical analysis is the skill that lets you read these maps. Here’s how to start.

First, know the basics of reading crypto charts. Check out the price and volume first. Is the crypto getting bought a lot? Or is it quiet, with little action? This can tell you if a big move might come.

Look for patterns too. They’re like secret codes that traders seek. You might spot a “head and shoulders” or a “double top”. These names sound funny, but they’re serious clues. They can show you if prices may rise or drop.

Candlestick patterns in crypto are key. One green candle isn’t much. But many green candles, standing tall, show buyers in control. Red candles swarming could mean danger ahead. Prices might drop.

Now, onto the nifty tools. Moving averages smooth out price action. They help you see the trend. Is the coin mostly going up or down over time?

Using volume in crypto trading is smart. High volume on a big price move makes it more solid, more likely to last. Low volume might mean the price could flip.

Fancy terms like RSI indicator crypto and MACD indicator in cryptocurrency might scare you off. But they’re just helpers. RSI tells you if a coin is bought too much or not enough. MACD is like a special pair of glasses to spot trends faster.

Support and resistance levels crypto traders talk about are simply spots on the chart where prices tend to stop and think. Imagine a kid bouncing a ball. The floor is support, stopping the ball from falling more. The ceiling is resistance, keeping the ball from flying higher. Easy, right?

Blending Technical Analysis with Crypto Market Sentiment

Want to boost your chart skills? Mix tech analysis with vibes from the market.

Crypto market sentiment is the mood of all traders. Are folks scared? Hopeful? You can feel this mood on social media and in news.

The Ichimoku Cloud crypto strategy sounds complex. But it’s just another map view. It helps reveal the market mood in the chart.

Coins have a story, and price action strategies crypto traders use are the plot twists. Did price suddenly leap over a resistance line? That’s a big deal. The story might say, “Here comes an uptrend!”

Last pro tip: Keep your chart tools simple at first. Play with them like new toys. See what you like best. Soon, you’ll spot chart patterns recognition. You’ll build your own trading signals. You’ll start to see the secrets crypto charts whisper.

Remember. Be patient. Know your tools. Watch the stories unfold on the charts. With practice, you can trade like the pros!

Trading Styles and Tailored Charting Techniques

Applying Scalping and Day Trading Strategies in the Crypto Market

I love scalping in crypto markets. It’s fast and exciting! Scalping is about making lots of trades for small profits. Think of it like being a hummingbird, zipping from flower to flower, sipping little bits of nectar.

Let’s dive in. First, you need good charts. Crypto chart analysis tools help a ton. They show price moves in real-time. This way, you can jump on quick changes. For scalping, candlestick patterns in crypto are super useful. They show buying and selling action.

Imagine you see lots of green candles growing. That means prices are going up, right? Now, if you spot a small red dip following them, it’s your chance. You buy quick. When the price ticks up again, you sell. That’s your profit!

Day trading is quite similar but a tad slower. You make fewer trades and hold a bit longer. Looking at using volume in crypto trading helps here. Volume shows how much crypto is being traded. If it’s high, moves can be big and quick.

Crypto trend lines are magic for day traders. They’re like a road map for prices. Support and resistance levels crypto guide you, too. Support is where the price might not drop below. Resistance is where it might not go above.

With a strategy, tech, and some practice, scalping and day trading can lead to neat gains!

Navigating Swing and Position Trading Using Technical Charts

Now, swing and position trading are the long game. Unlike scalping, these styles are chill. Think of them as planting seeds and waiting for the plant. You’re in it for the journey, not just the quick win.

For swing trading, moving averages in crypto are perfect. They smooth out price moves to show trends. You’ll see the big picture, not just the daily zig-zags. Finding the trend means you can ride it for more profit.

So, how do we use this? Well, when the short-term average crosses above the long-term one, it’s often a buy signal. And when it dips below, it might be time to sell. Simple, yet powerful!

Position trading is even more mellow. It’s about understanding the whole market. You look at stuff like RSI indicator crypto or MACD indicator in cryptocurrency. These tell if the crypto is overbought or oversold over weeks or months.

You also dig into crypto market sentiment analysis. It’s the mood of all traders. Plus, using tools like TradingView cryptocurrency tools can give deeper insights. With patience and these tips, you can master swing and position trading.

Charting the crypto world is like exploring a new planet. There’s loads to discover! And with the right tools and know-how, you can find the treasure. Happy trading, all!

In this guide, we dove into the key parts of crypto chart analysis. First, we tackled candlestick patterns and the concept of support and resistance. They form the base of trade decisions. We then stepped up to explore advanced tools like RSI, MACD, Bollinger Bands, and Fibonacci levels for sharper insights.

Next, we looked at how to turn these chart patterns into trading signals. Understanding market mood is vital when using technical analysis. Last, we matched different trading styles, like scalping and swing trading, with the right charting tactics to help you find your best strategy.

My final thoughts? While charts can look complex, with the basics and a bit of practice, you can make smart trade choices. Keep learning, stay patient, and use these tools to navigate the crypto markets with confidence. Remember, each trade is a step to mastering the art of crypto trading. Keep going!

Q&A :

How do I start using crypto charting tools?

Crypto charting tools are essential for analyzing market trends and making informed decisions. To start, choose a reputable charting platform like TradingView, CryptoCompare, or Coinigy. Then, create an account and familiarize yourself with the interface. Look for features like price charts, volume graphs, and technical analysis indicators. Begin by observing the price movements of your chosen cryptocurrency and apply different indicators to understand market sentiment.

What are the best indicators for crypto charting?

The best indicators for crypto charting often depend on your trading strategy, but some widely used ones include Moving Averages (MA), Relative Strength Index (RSI), Bollinger Bands, Fibonacci Retracement Levels, and Moving Average Convergence Divergence (MACD). Experiment with these indicators to determine which provide the most valuable insights for your trades and help you predict price movement more effectively.

Can beginners utilize crypto charting tools effectively?

Yes, beginners can utilize crypto charting tools effectively. Start with basic features like line and candlestick charts to understand price movements. Gradually introduce simple indicators such as Moving Averages or the RSI to interpret market conditions. Many charting platforms offer tutorials and resources to help beginners learn. Practice with historical data or a demo account to build confidence before trading with real funds.

What is the difference between technical and fundamental analysis in crypto charting?

Technical analysis in crypto charting focuses on statistical trends derived from trading activity, such as price movement and volume. It utilizes various charting tools and indicators to forecast future price movements. Conversely, fundamental analysis takes into account external factors like technology, team, market news, and broader economic indicators that can affect the intrinsic value of a cryptocurrency. Combining both methods provides a more comprehensive outlook on the markets.

How often should I check the crypto charts?

The frequency of checking crypto charts depends on your trading strategy. If you’re a day trader, you may need to monitor charts continuously throughout the day to catch volatile price movements. As a swing trader or long-term investor, checking the charts several times a day or even less frequently could suffice. It’s essential to stay updated with market conditions, but avoid obsessive checking, which can lead to impulsive decisions.