Mobile crypto wallets to buy crypto with fiat are your ticket in. Think of these wallets as your easy path from cash to crypto. Maybe you’re new to this game. Maybe you’ve been here a while. Either way, you need a simple, secure way to turn your dollars, euros, or yen into Bitcoin, Ethereum, or any other digital coin. I’ve walked this path, and now I’ll guide you through it.

No fancy jargon, just the ins and outs of what works. Let’s dive into what features matter most, how to put your regular cash into it, and which wallets really stand out. No matter if you’re team Android or iOS, I’ve got your back. Ready to turn your paper bills into digital gold? Buckle up. It’s easier than you think.

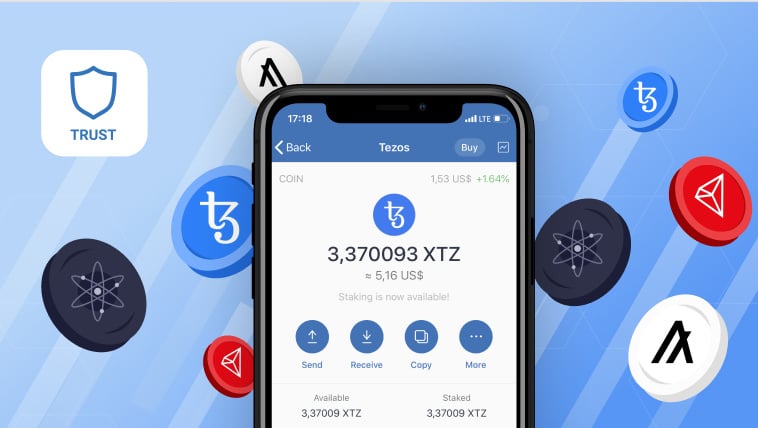

Navigating the Landscape: Choosing Your Mobile Crypto Wallet

Key Features to Look for in a Mobile Wallet

When picking a mobile wallet for cryptocurrency, I look for ease and security. It should make buying crypto simple. And keep my money safe too. I want a wallet that turns fiat money, like USD or EUR, into digital coins without a fuss. It must work on my phone smoothly. And I need to trust it with my eyes closed.

A top feature is fiat currency deposit in a mobile wallet. It means I can move my regular money into the wallet app fast. Then turn that money into crypto when I want. The best smartphone bitcoin wallets let me buy bitcoin and other coins in a snap. They are easy to use. Plus, I’m not waiting ages for the coins to show up.

I also look for low fees. Who wants to lose money on high charges, right? Good mobile app crypto buying guides stress on low fees. They tell you which wallets take less when you buy or move your coins. Another thing is the ease of buying crypto on my phone. On-the-go crypto purchasing is a must. I can buy coins while I grab coffee or ride the bus.

Some wallets let me buy crypto with my credit card on my mobile. This means instant crypto purchasing on mobile. I love this because I don’t have to waste time. I get my crypto fast. And if I use a trusted card, I know my payment is safe.

Android vs. iOS: Wallet Security and Performance

Now, the fight between Android and iOS never ends, right? And it’s the same for secure android crypto apps and iOS wallets for altcoins. Both want to be the safest and the quickest.

Android wallets offer flexibility. There are many to pick from. They have features like back-ups and recovery. So, if I lose my phone, my crypto isn’t gone for good. They use things like two-factor authentication. It’s like a double lock on my wallet. But, I have to check the app permissions. Some might want too much access to my stuff.

iOS wallets, they say, are more secure. It’s because Apple checks each app before it lets it into the store. But I’ve seen that both Android and iOS need careful picks. Both can give good security and performance. The key is to go for well-known wallets. They should have good reviews and use strong security measures.

No matter if it’s Android or iOS, I want a wallet that supports many currencies. A multi-currency digital wallet app means I can deal with many types of coins in one place. And if it’s a cross-platform cryptocurrency wallet, even better. I can use it on any device I own.

What matters most is that my crypto is safe. I only pick wallets that offer two-factor authentication, and back-up options. For peace of mind, some wallets show they follow rules with things like KYC for mobile crypto apps. It’s about knowing who uses the wallet. It makes sure everyone plays fair.

Picking the right mobile crypto wallet is like finding a good travel buddy. It should make the trip easy, keep you safe, and always be ready to go.

The Fiat Gateway: Depositing and Buying Crypto on the Go

Step-by-Step Fiat to Crypto Conversion

Buying crypto with fiat money should be easy. Let’s break it down. First, you need a mobile wallet app you trust. Look for one with low fees and a simple setup. Open the app and find the option for fiat currency deposit. This means putting money like USD or EUR in your wallet. Next, verify your identity. This is where KYC, or know your customer, comes in. It’s a safety step. Now, the fun part – pick your crypto. Bitcoin? Ethereum? Your call! Tap buy, confirm, and voilà, you own crypto!

Deciding what app to use is key. Seek wallets that back many currencies. This gives you choice and freedom. Go for apps with clear guides. You want to complete these steps fast and stress-free. Make sure your wallet is on Android or iOS. This way, you can manage your crypto anywhere. Plus, check it has good security. Two-factor authentication is a must. This protects your money and peace of mind.

Utilizing Credit Cards and Bank Transfers in Wallet Apps

So, how to add money to your wallet? Credit cards are a quick way. Just enter your card details in the app. Then, choose how much fiat to put in. Check for apps with credit card support. This saves time and lets you buy crypto instantly. But keep an eye on fees. High fees can eat into your funds.

Maybe you like bank transfers instead. These are secure and can move a lot of money. Yet, they might take more time than cards. Go for apps that offer both methods. It’s about what’s easiest for you. And remember to pick wallets that are known to be safe. This means they watch out for you and your cash.

Look for a digital wallet with fiat integration. This means it works with real money and crypto, no sweat. The best smartphone bitcoin wallets let you switch between both. They are like a Swiss Army knife for your finances. You get all you need in one place.

When you’re on the go, snappy crypto purchasing matters. So, choose wallets that make this a breeze. Look for ones with real-time updates. You want to know the current prices. Before you tap buy, this info is gold.

Mobile payments with cryptocurrency are growing fast. Now you can pay for things with just your phone. This is where a smartphone wallet fiat gateway shines. It’s the bridge between your cash and crypto worlds.

Whether you need the best Android app or a stellar iOS wallet for altcoins, it’s out there. Great apps cover all your needs, from buying bitcoin with a credit card on mobile to snagging altcoins on mobile platforms. With the right wallet, your digital money journey is secure and exciting. Ready, set, trade!

The Best Wallets for Crypto: Reviews and Comparisons

Top-Rated Wallets for Bitcoin and Ethereum on Smartphones

Did I hear you need the best smartphone bitcoin wallets? Look no further. For Bitcoin and Ethereum, the top dogs of the crypto world, you want a wallet that mixes security with ease. Whether you’re team Android or iOS, secure wallets are a must.

How does fiat to cryptocurrency conversion work? It’s simple, really. You fill your wallet with regular money, like USD or EUR. Then, with a few taps, that cash turns into crypto. Mobile apps make it easy to buy crypto on your phone. No computer needed.

What about buying bitcoin with a credit card on mobile? Yes, you can! Top wallets accept cards, making purchases fast and fuss-free. But, watch the fees! Some wallets charge more, so look for ones with low credit card fees. And remember, crypto buying on your phone should be easy.

Multi-Currency Support and Real-Time Trading Capabilities

Looking for a digital wallet with fiat integration? Seek ones with multi-currency support. This means you can hold and trade various cryptos at once. The wonders of a good mobile wallet!

And the speed of trade? Oh, it’s vital. Real-time crypto trading on mobile wallets lets you act fast on price changes. Imagine selling high or buying low, right from your phone. It’s possible with wallets built for swift trades.

Why are smartphone wallet fiat gateways important? They bridge your regular money to crypto. Without this, you’re stuck. The best wallets make this gateway as smooth as a slide in a park. Scan, tap, and you’ve stepped into crypto land.

The end goal? A wallet that lets you deposit, buy, and trade without headaches. It should be like sending a text, but instead, you’re dealing in digital gold. So go on, pick your crypto chariot and ride the virtual wave of buying and trading on the go.

Advanced Security and Compliance Measures

Implementing KYC and Two-Factor Authentication in Mobile Wallets

Keeping your money safe is a big deal. Just like you wouldn’t leave cash lying around, you shouldn’t with digital money either. One way mobile wallets do this is by knowing who you are. They use KYC, short for “Know Your Customer,” to make sure it’s really you. It’s like showing your ID card before cashing a check. And it’s not just IDs. You’ll use stuff you know, like passwords, and things you have, like phones, for two-factor authentication, or 2FA. This double-check makes things a lot harder for bad guys trying to sneak in.

Maybe you’re wondering, what does KYC do for me? First of all, it helps prevent identity theft. You wouldn’t want someone else pretending to be you and taking your crypto. KYC helps wallets cross-check info so that won’t happen. Plus, it’s not just for show; laws often require KYC for financial safety. It’s the wallet’s way of keeping everyone playing by the rules, kind of like referees in a soccer game.

And there’s 2FA. Think of it as an extra lock on your virtual money box. It usually asks for a code from your phone when you try to log in or do important stuff. Even if someone else grabs your password, they’d need your phone too, to get into your account. This makes your wallet much more secure.

Now, you might think it’s a hassle. And sure, it takes a bit more time, but it’s all about keeping your crypto safe. These steps are a small price to pay for peace of mind, knowing your money won’t just walk away without you.

Decentralized Apps and Cross-Platform Wallet Security Features

Let’s talk apps and wallets that work everywhere, called decentralized apps or DApps, and cross-platform wallets. With these, you can hop from your phone to your computer and back, all while your crypto stays secure. What’s cool about DApps is that they’re kind of like a community project. Lots of people look after the network, not just one company. It’s like having a lot of lifeguards at the pool instead of just one.

These DApps let you use crypto for games, trading, and even social media without putting all your trust in one place. As for cross-platform wallets, they’re like having a keychain that opens your house, car, and office. You can get to your crypto from different gadgets without stressing out.

So what makes these secure? They use the same tough security methods as mobile wallets, like encryption. Encryption scrambles your info into a secret code that only you can read. They also keep backups of your wallet in case something goes wrong. And just like mobile wallets, they often use 2FA too.

With these advanced security and compliance measures, you can feel cool and confident about your crypto. Stuff like KYC and 2FA might seem like homework, but they’re really about keeping your digital treasure chest locked tight. Whether you’re dealing with a mobile wallet, DApp, or cross-platform buddy, remember: security is your friend. And it’s these tough guards that keep your crypto cruise sailing smooth.

In this post, we walked through the ins and outs of picking a mobile crypto wallet. We’ve looked at must-have features, compared Android and iOS security, and tackled the process of turning cash into crypto. We also weighed wallet options, eyed top picks for Bitcoin and Ethereum, and explored wallets that let you handle many kinds of coins with ease.

Final thoughts? Choosing the right wallet is crucial. It’s your money’s home on your phone. Security is key, and being able to trade on the move is a big win. Always think about how you’ll use your wallet. For safe, smart crypto handling, pick a wallet that hits all the marks: strong on security, rich in features, and easy to use. Stay smart, stay secure, and happy trading!

Q&A :

What is a mobile crypto wallet and how does it facilitate buying crypto with fiat?

A mobile crypto wallet is an app installed on a mobile device, such as a smartphone or tablet, that securely stores the user’s cryptocurrency keys and allows them to manage their digital assets. It enables users to easily buy cryptocurrencies with fiat money—that is, government-issued currency like USD, EUR, or GBP—directly through the wallet interface. Typically, wallets partner with exchanges or offer built-in services for conversion, streamlining the process of purchasing crypto with traditional currency.

How do I choose the best mobile crypto wallet for fiat transactions?

When looking for the best mobile crypto wallet to facilitate fiat transactions, factors to consider include the wallet’s security features, user interface, supported currencies, and transaction fees. Additionally, check for wallets that offer direct fiat to crypto purchases, and make sure they operate in your country. Reading reviews and researching the wallet’s track record can also provide insights into its reliability and overall user satisfaction.

Can I use my credit card to buy crypto through a mobile wallet?

Yes, many mobile crypto wallets allow users to buy cryptocurrency using a credit card. This feature is convenient and makes it simple to convert fiat money into crypto. However, pay attention to the fees associated with credit card transactions, as they may be higher than other payment methods. Also, assure that your credit card issuer permits transactions for cryptocurrency purchases, as some have restrictions.

Are mobile crypto wallets that allow fiat purchases safe?

Mobile crypto wallets that support fiat purchases generally employ various security measures to protect users’ funds and personal information. These may include two-factor authentication (2FA), encryption, and biometric logins. While they are designed to be safe, the level of security can differ from one wallet to another. It’s essential to use wallets from reputable companies and take personal security precautions, such as keeping software up to date and not sharing private keys.

What are the fees associated with buying crypto with fiat in a mobile wallet?

Fees for buying crypto with fiat in a mobile wallet can vary widely and depend on several factors, including the wallet provider, the payment method used, the size of the transaction, and the network fees at the time of purchase. Some wallets may charge a flat fee or a percentage of the transaction amount. It’s advisable to review the fee structure before conducting any transactions to avoid surprises.

Remember, it’s essential always to do your own research and consider your own financial situation before choosing a wallet or making any crypto purchases.