In a world where digital fortunes can vanish in a click, securing your crypto is vital. Most secure crypto exchanges don’t just promise safety; they deliver it. I’ve dug into the tech that matters for your peace of mind. Two-factor authentication isn’t a fancy extra—it’s a need. And cold storage? That’s your digital gold vault. Your wealth deserves armor, and it’s my job to show you which exchanges suit up best for battle. I’ll walk you through high-tech security features, strict legal compliances, and the face-off between decentralized and centralized platforms. Ready for a security sprint that could save your stash? Let’s lock down your crypto the smart way.

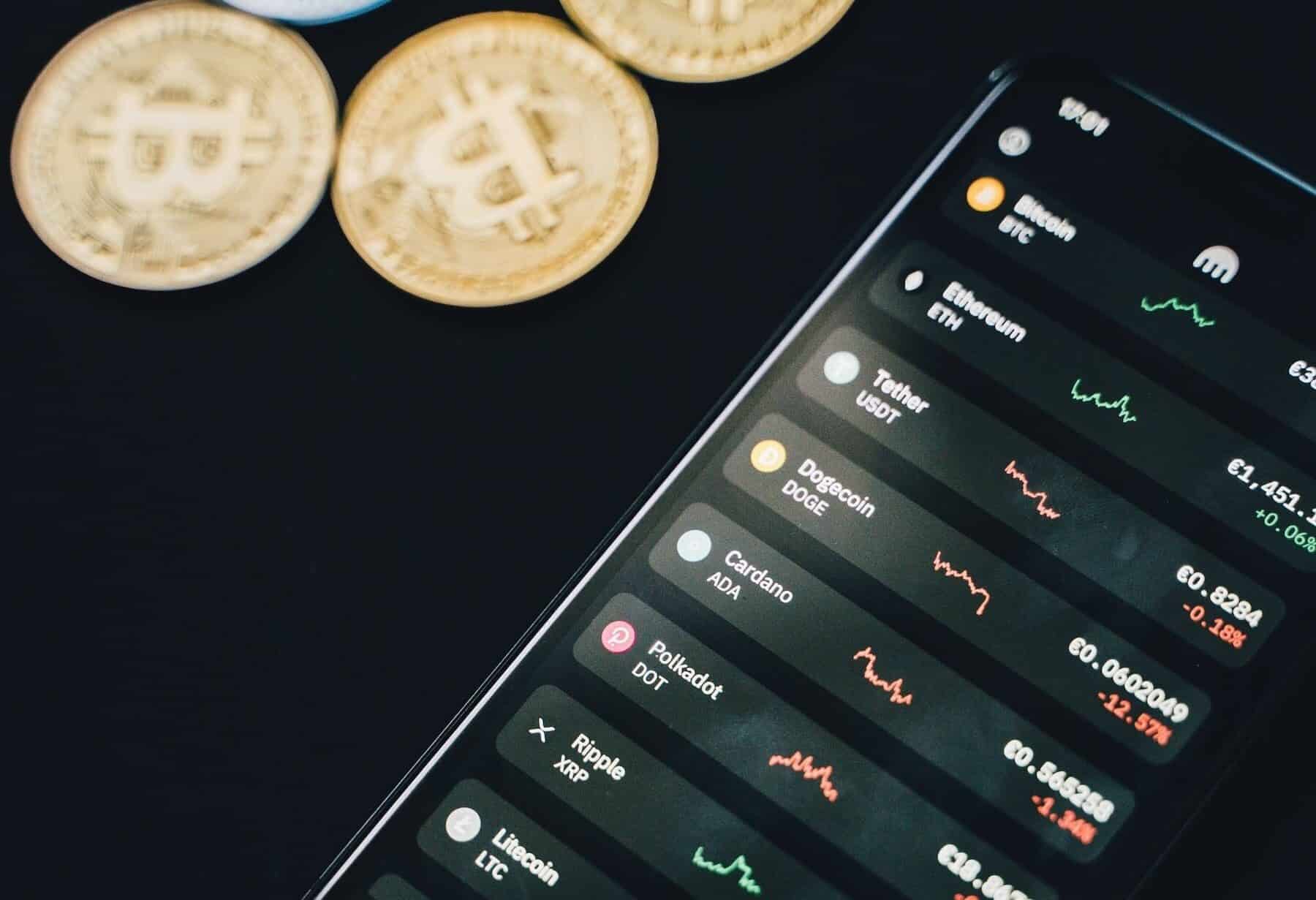

Evaluating High-Security Crypto Exchange Features

The Role of Two-Factor Authentication for Crypto Exchange Security

When you keep money online, you want to lock it tight. Think of two-factor authentication (2FA) as a sturdy lock on your digital cash box. Most top secure cryptocurrency exchange lists will tell you – 2FA is a must. It’s like having a secret handshake only you and your crypto exchange know.

What is 2FA exactly? It’s a security step. After you put in your password, the site asks for more proof it’s really you. This could be a code from your phone or a fingerprint. Even if a hacker gets your password, without your second ‘key’, they can’t get in.

We always look for 2FA on safe crypto trading sites. It’s one sign they take your money’s safety as seriously as you do. So, always turn on 2FA. It’s a simple step but a huge leap for your security.

Importance of Cold Storage Solutions in Exchange Safety

Now, let’s talk cold storage – it’s like a vault for your crypto. The best high-security crypto exchange features always include this. Cold storage keeps your crypto offline, away from hackers’ reach. Think of it as hiding your treasure where only you can find it.

Why do trusted digital currency platforms use cold storage? Because it’s good at keeping your digital wealth safe. If an exchange keeps most of their crypto in cold storage, they’re saying, “We protect your money.”

Some sites will mix hot and cold storage, like keeping some funds available for quick trades. But for big savings – cold storage is the way to go. It’s an old idea (keep your valuables hidden) that works well in our new digital world.

Remember, security is key to your peace of mind in crypto trading. Whether it’s using 2FA or choosing exchanges that love cold storage, make sure your digital wealth is well-protected.

How Most Secure Crypto Exchanges Platforms Implement AML and KYC Regulations

The Integration of Anti-Money Laundering Measures in Crypto Exchanges

Money moves fast in the world of crypto. To keep it clean, exchanges use smart tools. These tools check where money comes from and where it goes. This helps stop bad guys from using crypto for dirty money. We call these tools anti-money laundering (AML) measures. They’re like a filter for cash flow in crypto.

Exchanges must know who trades on their platform. They check IDs and track trades. No secrets allowed. It’s how they stop money laundering. They use systems that spot something fishy. Let’s say someone trades way more than normal. The system takes a closer look. This keeps everyone on the up and up.

Adhering to Know Your Customer (KYC) Compliance for Improved Security

Now, let’s talk about Know Your Customer, or KYC. This means exchanges get to know you pretty well. You give them your ID, maybe a selfie. Some feel it’s a pain. But it’s for a good reason. It stops bad folks from joining in.

KYC makes sure no one can fake who they are. If someone tries, the exchange catches them fast. This keeps our digital dollars safe. We all want that, right? Plus, if you ever forget your password, KYC helps you get back in.

Trust is key when you’re trading crypto. Trusted digital currency platforms work hard to earn it. They use AML and KYC to keep you and your investments safe. And remember, a safe exchange is a happy exchange. That’s where you want to trade your digital wealth.

Decentralized Exchanges vs. Centralized: Assessing User Privacy and Security Measures

Analyzing Decentralized Exchanges Security for User Anonymity

Decentralized exchanges (or DEXs) are where you swap coins with no middle man. Your name stays hidden. It’s like a masked ball for trading. No one knows you, you know no one. You don’t give personal info to trade. This anonymity is big for privacy. But is it safe?

For security, DEXs use tech such as blockchain. Each trade is a block in a long, unbreakable chain. It’s hard for hackers. They can’t tweak a block without breaking the chain. So, your trades stay safe. DEXs don’t hold your money either. You keep control with your own wallet. This means you’re less likely to lose your coins if there’s a hack.

Another cool thing about DEXs is they don’t shut down like stores do. They’re run by code, not people. So they’re open all the time, like a park. You can trade whenever.

But there’s a flip side. Since there’s no company behind DEXs, help can be hard to find. It’s sort of like being in a huge maze with no map. If you run into issues, you’re on your own. Also, you need to be careful about mistakes. If you send coins to the wrong place, they’re gone. No refunds.

Centralized Exchanges and the Enforcements of Cryptocurrency Insurance Policies

Now let’s talk about centralized exchanges. These are like big online banks for crypto. They hold your coins and private info. They use strong security too, like two-factor authentication. It’s like a guard checking two IDs before letting you in. They also use cold storage. Think of it like a safe buried underground. It’s really hard for thieves to get to.

Centralized exchanges often have insurance to protect your coins. If they get stolen, you might get your money back. It gives peace of mind, knowing you have a safety net.

These exchanges follow rules, like AML and KYC. It’s like a school having a dress code and attendance sheets. They make sure everyone trades clean, without shady business. They check who you are and where your money comes from. It’s all to keep everyone playing fair.

In life, nothing’s perfect. Centralized exchanges can be hacked. We’ve seen it before. But they work hard to stop it from happening again. They have teams checking for weak spots, updating security, and helping you if you get stuck.

So, what’s better? DEXs with their masks and freedom, or centralized exchanges with their guards and safety nets? It’s your call. Both can be safe if you know what you’re doing. Learn and choose what fits you best. Always remember: in crypto, being safe is being smart.

When picking where to trade, peek at their security practices. Look for things like what they’re doing to stop hackers, or if they have insurance for your coins. It’s like picking a car. You want one with good locks and airbags, right?

And, hey, keep an eye on updates. These platforms change fast. Make sure you’re playing on the field, not sitting on the bench, when it comes to safety. Happy and safe trading to you!

Proactivity and Preparedness: Learning from Past Exchange Security Breach Incidents

How Crypto Exchanges Utilize Security Audits to Prevent Breaches

Crypto exchanges do audits to find security gaps. They do this to stop hacks before they happen. Experts check everything, like looking for weak spots in the system. They act like hackers to see where a real one could break in. The goal is to fix these gaps quickly.

After finding risks, exchanges work on better security. They may add things like crypto exchange insurance or better user checks. This way, they keep your money safe.

The audits look at how well the exchange can stand up to attacks. They make sure two-factor authentication and cold storage are used right. This helps the exchange get ready for possible threats.

Enhancing Safeguarding Strategies Through Reliable Crypto Exchange Reviews and User Education

Reviews tell us which platforms are safe for trading crypto. Trusted sites review and rate exchanges based on how safe they are. This helps you pick a secure place to trade.

Education plays a big role in keeping your crypto safe. Learning about secure trading practices is key. Sites tell you how to spot scams and make safe trades.

The world of crypto can be tricky. But knowing how to protect your digital wealth makes it easier. Secure blockchain trading keeps growing. And it’s thanks to exchanges that learn from mistakes and keep your assets safe.

By staying alert and learning from reliable crypto exchange reviews, you can trade with more peace of mind. Always look for updated info on safety rankings and secure trading tips. Your wealth deserves the best protection. And this comes from using the most secure crypto exchanges out there.

In this post, we dived into the essentials of crypto exchange security. We looked at how two-factor authentication keeps your account safe and why cold storage is critical for protecting your assets. We then explored how serious platforms tackle money laundering and ensure they know their customers well, making sure the exchange is safe and trustworthy.

We compared private and user-friendly decentralized exchanges with secure, insured centralized ones. Lastly, we learned how top exchanges use audits and education to stop hacks before they happen. Staying safe in the crypto world means choosing a platform that takes your security as seriously as you do. Pick wisely, stay informed, and always be prepared. Follow Make Million Swith Coin to update more knowledge about Crypto.

Q&A :

What are the top-rated most secure cryptocurrency exchanges?

When identifying top-rated secure crypto exchanges, look for platforms with robust security measures such as two-factor authentication, cold storage for a majority of customer assets, insurance policies, and compliance with regulations. Examples include Coinbase, which is known for its extensive security and insurance policies, and Binance, which offers advanced security features and has a secure asset fund for users (SAFU) as additional protection.

How do I ensure the cryptocurrency exchange I use is secure?

To ensure the security of a cryptocurrency exchange, it’s crucial to research and verify several aspects. First, check if the exchange employs strong security protocols like SSL encryption, two-factor authentication, and multi-signature wallets. Secondly, see whether it has a track record of resisting hacks and how it manages the risks. Lastly, review the exchange’s privacy policies and customer support responsiveness for dealing with security concerns.

Can a crypto exchange guarantee the safety of my investments?

No crypto exchange can guarantee the absolute safety of your investments due to the inherent risks in cryptocurrency trading and potential security breaches. However, choosing exchanges with strong security measures, a solid reputation, and possibly ones that offer insurance on digital assets can reduce the risk. It’s also important to practice safe trading habits and use personal security measures like hardware wallets for larger holdings.

What security features should I look for in a crypto exchange?

When choosing a crypto exchange, prioritize the following security features: two-factor authentication (2FA), preferably using an app like Google Authenticator rather than SMS; cold storage for the vast majority of users’ funds; insurance policies to protect against potential losses; regular third-party security audits; and a transparent security protocol for emergency situations.

How do exchanges protect against potential cyber threats?

Crypto exchanges protect against cyber threats by implementing layers of security measures including, but not limited to, SSL encryption to protect data, cold storage options to safeguard funds from online breaches, real-time monitoring for suspicious activity, and employing cybersecurity teams to keep up with evolving threats. Advanced exchanges also conduct regular security audits and have plans in place for incident response in case of security breaches.