As a digital asset enthusiast, you know the drill: security is king. It’s time to zero in on safest crypto exchanges with cold storage. No more sleepless nights worrying about hackers on the prowl. Dive into the ultimate security guide that cuts through the tech talk to keep your crypto in a fortress-like cold storage. Warm up to the peace of mind that comes from making the smartest choices for your digital treasure. Ready to become the Fort Knox of crypto storage? Let’s lock down that digital gold!

Understanding Cold Storage vs. Hot Wallets in Cryptocurrency Exchanges

The Fundamentals of Cold Storage for Crypto Security

When we trade cryptos, keeping our coins safe is key. Cold storage keeps them offline. It’s like a vault. It’s not on the net, stopping hackers in their tracks. Think of it as a safe. You lock your crypto in there. No one can get to it online.

Why is cold storage safe? It’s simple. Hackers can’t steal what they can’t reach. Your coins sit tight. Offline wallets are not easy to crack. They are physical devices. They can be USBs or special hardware. Top crypto platforms offer this. They know peace of mind matters when we trade.

Storing cryptos in cold storage means less worry. We get to hold our coins, not leave them out there. It’s private. We control access, not some far-off server. We trade with ease. No fear of waking up to an empty wallet.

Every top-rated crypto exchange will shout about its cold storage. It means they take your coin security seriously. They often mix it with other methods. They do this to give you a strong shield for your digital stash.

Hot Wallet Risks and Why Cold Storage Prevails

Hot wallets have their uses. They’re online. Trade happens in a flash. But they live on the edge. With hot wallets, you’re one bug away from a zero balance. They’re always linked to the net. That’s like leaving your door unlocked, and you don’t want that.

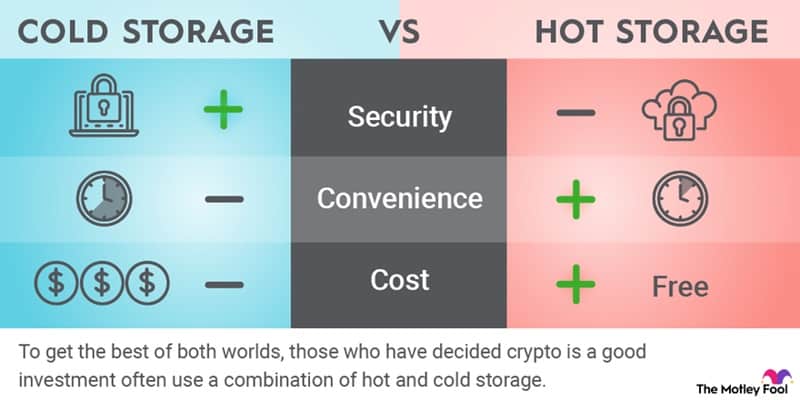

Here’s the deal. Online is handy but risky. Cold storage is safe but not as quick for a trade. The best practice? Mix them. Use hot wallets for daily trades. But store your big crypto pile in cold storage. Leading exchanges with offline wallets do this dance well. They give you a bit of both.

Let’s wrap up. For long-term safekeeping, cold storage wins. For quick and easy, hot wallets have a place. Know the ups and downs. Hold onto your coins for good.

Remember, choosing a secure crypto exchange is critical. Look for those who offer robust security. They should do security checks all the time, and have backup ways to keep your coins safe. The best ones will let you sleep at night, not fret over your crypto cash.

So, cold storage is like your crypto security blanket. It shields your dough from the dark web. Hackers frown when they see you use it. It means they can’t grab your hard-earned coins.

Now you know the score—cold storage for the win. Keep your investments tucked away and trade knowing you’re covered.

Evaluating Security Protocols of Top Crypto Platforms Offering Cold Storage

Exchange Security Infrastructure and Its Importance

When we trade cryptocurrencies, we want to feel safe. Think of the security in crypto like a strong safe. It should be tough for bad guys to get inside. Top crypto platforms offering cold storage know this well. They keep your digital coins offline, away from hackers. This way is like keeping your gold in a vault. No internet link means better safety for your coins.

Look for cryptocurrency exchanges with robust security. They should have layers of defense, like a bank. This keeps your digital cash locked down tight. Even if one lock breaks, others still guard your funds. These layers might include codes that only you know, or plans to track any strange activity that could harm your hard-earned money.

Scrutinizing the Integration of Hardware Wallets with Exchanges

Hardware wallets are like personal safes for your crypto. When an exchange uses them, it’s a big win for securing your digital money. These wallets hold your coins in a physical gadget. It can be as small as a USB stick, but it’s way smarter.

When you use an exchange, check if they support these smart little devices. Good integration means you can move your coins smoothly between the exchange and your gadget. This helps keep your coins safe when trading.

The real gem is when an exchange lets you trade right from your hardware wallet. Then you don’t have to move your coins to the exchange too much. This lowers the risk a lot.

Hardware wallet integration with exchanges means you can trade cryptocurrencies with peace of mind. Your coins travel less on the web, where they could get grabbed by a sneaky thief. It’s like taking a secret tunnel instead of a busy highway.

It’s also great if the platforms use multi-signature wallets. These need more than one key to open. This is like a safety deposit box that needs two keys at once—one from you, one from the bank manager. No one can open it alone. With this, even if someone finds out your secret code, they can’t get to your coins without the other key(s).

For safer trading of digital currencies like Bitcoin or Ethereum, you want to know the exchange is looking after your stuff. Just like a bank that checks every corner for robbers, these exchanges should always be on the lookout. They should test their safety measures, try to break them (safely, of course), and fix any weak spots.

When you trade on crypto platforms with enhanced security measures, it’s like having a big, burly guard watching over your shoulder. You can focus on making smart trades, knowing your digital treasure is under lock and key. And that feeling, my friends, is priceless in the world of crypto.

Key Practices for Secure Digital Asset Trading on Exchanges

The Role of Multi-Signature Wallets in Enhancing Security

Multi-signature wallets are like a bank vault with two keys. You need both to open it. This makes money safer. Imagine your account needing two or more passwords. It is the same idea. Thieves must steal several keys, not just one. This is why these wallets help a lot.

Say you keep Bitcoin. You want it safe, right? Imagine two out of three or even five out of seven keys must agree. Now, that’s safe! It’s like having lots of locks on your door. Even if a hacker gets one key, they can’t get in. It’s not just you with the keys. Friends or co-workers can have them too. If someone tries to steal, they can’t use just one key. That’s why it’s smart and safe. Even if your computer gets hacked, the hacker can’t take your coins. You’re safer when many keys protect your money.

Best Practices for Storing Cryptocurrency Securely

Let’s talk about keeping your crypto safe. You’ve bought Bitcoin or Ethereum. Now, you need to store it. You want to trade with no fear. So, here are some smart moves.

First, know about cold storage vs. hot wallets. Cold storage is keeping crypto offline. Hot wallets are online and easy to hack. Cold storage is like hiding money in a safe place, not in your pocket.

Now, think about the top-rated cold storage exchanges. These are places that understand safety is key. They keep most money offline. This means even if bad guys strike, most funds are out of reach.

Using secure crypto storage solutions is smart. This includes hardware wallets that are like USB drives. They hold your currency offline. When you’re not trading, your money sits tight in hardware wallets.

Know that reliable crypto exchanges for security matter. They watch over your money day and night. They check their defenses and seal any holes. If hackers come knocking, these places are ready.

Here’s something important: always back up your wallet. And check if your pick of exchange does it too. This means if something goes wrong, like if you lose the hardware wallet, you can get your coins back.

Also, look for crypto platforms with enhanced security measures. These are things that make it even safer for your digital cash. They might have cool stuff like face ID or finger scanning. This helps keep your account locked tight.

Stay updated on security tricks. It’s not fun to talk about, but it’s key to keeping your money safe. You’ve worked hard for your coins. They need a safe home.

Remember this: secure digital asset trading needs both good habits and safe places to trade. Use smarts and choose the right platforms. Then you can trade cryptocurrencies with peace of mind. Always go for the safest options. The world of crypto waits for no one, and neither should you when it comes to security.

Choosing the Safest Crypto Exchange with Robust Cold Storage Options

Criteria for Evaluating Exchange Platform Security

When picking a secure crypto exchange, we must check its defense against theft. Strong exchanges use cold storage. This means they keep most funds offline. This guards them from online hacks. We should seek out exchanges with a mix of cold storage and other security measures.

We also need multi-signature wallets. These need more than one key to open. This spreads risk and avoids single points of failure. It’s smart to look at past security. A platform that has been safe in the past is likely safe now. We check if they have insurance too. This helps if something goes wrong.

Another sign of a safe platform is open communication about security. Exchanges that share their safety steps show they take protection seriously. User trust grows when there is clear info on keeping funds safe. Lastly, we watch for exchanges that keep up with security trends. This shows they care about defending against new threats.

Top-Rated Exchanges and Their Cold Storage Solutions

Now let’s talk about the best in the game. Top exchanges protect your money well. They do this by storing most of it in cold storage. We want them to use the latest in security tech. This includes strong offline wallets and tight access controls. Some even keep their hardware wallets in safe places like vaults.

These leading platforms often do routine checks on their systems. They look for weak spots and fix them before they’re a problem. The best ones often get experts to run security audits. This helps catch any sneaky risks.

Taking care of our cryptos is like keeping cash safe. Would you walk around with all your money in your pocket? Probably not. Just like that, storing crypto in hot wallets—online and easy to reach—is risky. They are good for fast trading but not for keeping your assets long-term.

That’s why we lean towards exchanges that use cold storage as their main way to keep our coins safe. Plus, these exchanges often have plans in place in case things go sour, so your assets are secure even if something unexpected happens.

In conclusion, always choose a crypto exchange that prioritizes your asset’s safety. Aim for those that constantly work on their defenses. They’re the ones that invest in strong cold storage methods and have a history of trust. Remember, the right exchange will help you trade cryptocurrencies with peace of mind, knowing your digital treasures are well-guarded.

In this blog, we talked about keeping your crypto safe. We learned that cold storage is safer than hot wallets. Cold storage keeps your crypto offline and away from hackers. Hot wallets are good for quick trades but riskier.

We looked at how top exchanges protect your crypto. Good security is key. Some use hardware wallets for extra safety. I showed you what to look for in a secure exchange. Look for exchanges that use things like multi-signature wallets for better protection.

Always follow best practices when you trade. Use strong passwords and think about how you store your crypto. Pick exchanges that take security seriously and offer solid cold storage.

Stay safe and trade smart! This is critical to keep your digital money secure.

Q&A :

What Are the Top Safest Crypto Exchanges That Offer Cold Storage?

When looking for the safest crypto exchanges, it’s essential to consider those that offer cold storage options to secure your digital assets. Cold storage refers to keeping a reserve of cryptocurrencies offline to protect them from unauthorized access, cyber hacks, and other vulnerabilities that online systems face. Leading exchanges known for employing robust cold storage methods include Coinbase, with its Vault service, Kraken, which touts comprehensive offline storage, and Gemini, which prides itself on its security-first approach.

How Does Cold Storage Enhance Security on Crypto Exchanges?

Cold storage significantly enhances security on crypto exchanges by moving the storage of assets offline, which isolates them from online threats such as hackers and malware. This form of storage is akin to a digital safe deposit box, shielding funds from the vulnerabilities present in internet-connected systems. It serves as a crucial layer of protection, particularly for substantial sums of cryptocurrency that aren’t needed for daily trading.

Can Users Access Their Cryptocurrency Easily If It’s In Cold Storage?

Accessibility can be slightly less convenient when your cryptocurrency is in cold storage, due to the added security measures. However, the safest crypto exchanges streamline the process, ensuring that users can still access their funds when necessary. It’s important to understand each exchange’s process for retrieving assets from cold storage, as this can vary and may involve a time delay for security reasons.

Are There Any Additional Costs for Using Cold Storage on Crypto Exchanges?

While some exchanges offer cold storage as a part of their standard service, others may charge additional fees. The cost can depend on the exchange’s pricing structure, the value of assets being stored, or the type of account a user holds. It’s recommended that users review the fee schedule of their chosen exchange to understand any costs associated with the enhanced security of cold storage.

Is It Necessary for Casual Crypto Traders to Use Exchanges With Cold Storage?

For casual crypto traders, using an exchange with cold storage may seem unnecessary. However, even smaller amounts of digital assets are valuable and can be targeted by cybercriminals. As such, exchanges with cold storage options provide an extra level of defense that can bring peace of mind even to casual users. It’s crucial to weigh the value of assets against the need for such security measures and opt for an exchange that aligns with your security requirements and trading habits.