Embarking on the crypto journey? Let’s make sure your launchpad is solid. Diving into the digital currency pool can feel like stepping into the unknown – exciting, yet kind of scary. This is why knowing tips for making your first cryptocurrency purchase is like having a trusted map in this new territory. I’ll guide you through the maze, from understanding the crypto basics to securing your sparkling new digital coins. Ready to become a confident crypto buyer? Let’s get started!

Understanding the Basics of Cryptocurrency and Blockchain

Beginner’s Guide to Crypto

Let’s dive into buying crypto. Imagine it like a new kind of money. This money lives online, not in a bank. When you buy it, you can use it to trade, just like when you trade cards. But first, let me tell you how it works. It’s simple, really. You choose what kind you want, like Bitcoin or others. Some are well-known, others not so much. You must pick one to start with.

You need to know where to buy it too. Places where you buy crypto are called exchanges. Think of it like a store for digital money. You need to find the best one for you. Before you start, always remember this – research is key. Learn as much as you can. Ask yourself, “Which is the best crypto for me?”

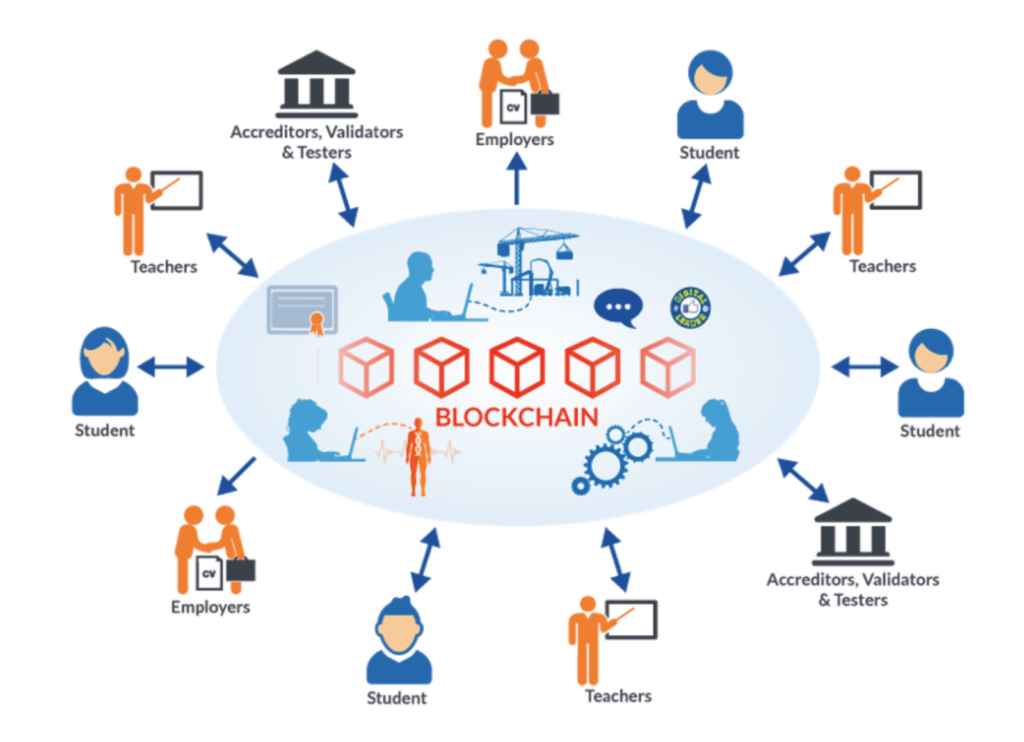

Understanding Blockchain

Now, let’s talk about blockchain. Blockchain is like a magic ledger. But it’s not magic; it’s technology. It keeps track of all trades. Every time someone trades crypto, it’s like adding a new line to this ledger. It’s special because no one can erase it. Once it’s there, it stays there.

Blockchain is important for crypto. Without it, we wouldn’t have a safe way to trade. It makes sure you can trust the trade. It’s like a trusty old diary that never lies. Plus, it’s not controlled by any one person or place. So, nobody can cheat.

When you buy crypto, you’re saying, “Hey, put me in the blockchain ledger!” This is important because it means you are now part of the trade book. Everyone else can see this. But don’t worry, they can’t see your name, just your trade.

Always check things before you buy. For example, learn what KYC means – it’s like a safety quiz for buying crypto. It helps keep everyone safe. The place where you buy crypto will ask you some questions. It’s to make sure you’re really you. This keeps the trades clear and keeps cheats out.

In all, buying crypto is exciting! But remember, taking your time to learn will help you make smarter choices. Listen, ask questions, and trade safe. Welcome to the world of crypto! Your adventure is just beginning.

Preparing for Your First Cryptocurrency Purchase

Setting Up a Crypto Wallet

Before you buy your first crypto, you need a safe place to keep it. Think of a crypto wallet as a bank account for your digital coins. It lets you send, receive, and store your crypto. There are two main types: ‘hot wallets’ and ‘cold wallets.’

Hot wallets connect to the internet. This makes them handy for quick access to your crypto. But since they are online, you must be extra careful about hacks. Examples include apps on your phone or accounts on exchange sites. Cold wallets, on the other hand, are like safes. They stay offline, so they’re very secure. They can be small devices or even paper printouts with your secret codes. When choosing a wallet, think about how you plan to use your crypto. Will you buy and hold, or trade often? Your answer will guide your choice.

Now, picking a wallet may seem tough, but don’t worry; you’re not stuck with one forever. Try it out. If it doesn’t fit your needs, you can always switch. Just make sure to transfer your crypto safely if you do!

KYC Procedures for Crypto

When you sign up at a crypto exchange, they’ll ask for your personal info. This is part of the ‘Know Your Customer’ (KYC) steps. Yes, it’s a bit of work, but it’s also super important. It keeps your investments safe and fights against illegal activities. You’ll need to provide things like your ID and maybe a photo of yourself. Sometimes, you’ll have to show proof of where you live, like a utility bill.

You might think, “Is all this personal stuff really safe?” Exchanges put a lot of work into security to protect your data. But you should still do your homework. Look for reviews and ratings before you pick an exchange. We call this ‘due diligence’ – fancy talk for doing your research. And always use unique, hard-to-guess passwords. Plus, turn on two-factor authentication (2FA) whenever you can for extra safety.

Check out the exchange’s support section, too. They often have guides to help you through the KYC process. Take your time and follow each step carefully. Good exchanges will always be there to help if you get stuck.

Remember, both choosing your wallet and going through KYC are key first steps in buying crypto. They’re like the foundation of a house. Get them right, and you’re ready for a secure crypto journey. Want to know more after this read? Keep diving in! Crypto’s full of adventure, and the more you learn, the better your ride will be.

Choosing Your First Cryptocurrency Investment

Research on Cryptocurrencies

When you start to buy into crypto, research is your best tool. You’ll see a lot of coins out there to pick from. It’s like a big market, with many different items for sale. You want to learn which ones are loved by many and will stick around. Think of yourself as a detective. Dig into what makes each coin unique. How do they work? Who made them? What do folks say about them online? Ask all these questions before putting money down.

Find good articles and videos aimed at beginners. Use simple terms so you can grasp the ideas fast. Don’t rush this part. Taking time to learn sets you up for smarter choices. Always remember to check facts twice. Go to websites known for crypto information and read what experts say. Understand blockchain too, because it’s the backbone of all cryptocurrencies.

Do you want the coin to buy stuff? Or to save it and watch it grow in value? These goals will guide your choice. There are coins built for quick payments, others for using apps, and some for privacy. You weigh these uses against your own needs. Do you value fast transactions or is privacy more important to you? Write down your answers. They help you pick your first investment.

Bitcoin versus Altcoins

Now, let’s talk about the two big types: Bitcoin and altcoins. Bitcoin is like the first player in the game of crypto. It’s well-known and has been around the longest. Many say it’s a safer bet due to its history and fame. But, it’s not your only option. Altcoins, which just means ‘alternative coins’, have unique traits that might match your needs better. There’s Ethereum that’s big on smart contracts. Litecoin offers fast and cheap transactions. And Ripple works well with banks.

If you wonder, Which should I choose? Think about your goals. If you just want to start and go with a name most people trust, Bitcoin is a safe bet. But if you’re into tech and want newer features, altcoins might be your jam. Always look up how much you can buy. Some coins are pricier than others. And some, like Bitcoin, can be bought in small pieces instead of a whole coin.

Taking your first steps into crypto is exciting. But never jump in without looking. Don’t let the buzz push you to buy without thinking. Remember, the aim is not just to own crypto but to make smart decisions that meet your goals. Start small, learn a lot, and always be cautious. Crypto can be a thrilling part of your investment journey, just step carefully and always keep learning!

Conducting Transactions: Buying and Storing Your Crypto Safely

Selecting the Best Cryptocurrency Exchanges

When you start buying crypto, picking a good exchange is key. Think of it as your digital storefront where you’ll buy your first crypto coins or tokens. A top-notch exchange offers easy use, strong security, and great support.

Now, what makes an exchange one of the best? First, check how many folks use it and what they say about it. A big, well-liked exchange is usually a safe bet. Look for an exchange with top-notch security features like two-factor authentication (2FA). This keeps your account safer from bad guys.

Remember, fees matter too. Each trade on an exchange can come with its own costs. Some exchanges charge more, some less. Take your time to find one with fees that won’t eat too much into your investment.

Lastly, think about the crypto coins you want to buy. Not all exchanges offer every coin. Make sure your chosen exchange has the ones you’re eyeing, especially if you’re after less common altcoins.

Secure Cryptocurrency Storage

Buying your first bits of crypto is a big step. But storing them safely matters just as much. A crypto wallet holds the keys to your coins and keeps them safe. It’s like your own personal vault.

When setting up a crypto wallet, you can choose a digital or a physical one. Digital wallets, also known as “hot” wallets, live online. They’re convenient for quick access and trading. But since they’re connected to the internet, they can be at risk of hacks.

Physical wallets, or “cold” wallets, are like USB drives for your crypto. They’re not connected to the web, so they’re much safer from online threats. But they can be a little less handy when you want to make quick trades.

Always keep your private key—a secret code that lets you access your coins—private. If someone else gets it, they can take your crypto. And unlike a bank, there’s often no way to get it back once it’s gone.

Store your wallet backup somewhere safe too. This backup can help you get back into your wallet if your computer dies or you lose the device.

Understanding blockchain and how crypto works can help you keep your investment safe. The blockchain is like a super-secure ledger that records all transactions. It’s what makes crypto unique and safe from tampering.

Good exchanges and wallets will look out for you with KYC procedures. KYC means “Know Your Customer”. It’s a way for the exchange to make sure you’re you. This keeps everyone safer from scams and shifty dealings.

Doing your homework is big when you’re new to crypto. Research, read up on exchanges, and always learn from credible sources. By being smart about where and how you buy and store your crypto, you’re setting yourself up for a smoother and safer journey into the digital currency world.

In this post, we tackled the crypto world, from its basics to making your first buy. We started by breaking down how cryptocurrency and blockchain work. Then, we talked about setting up a crypto wallet and getting through KYC – know your customer – checks. Next, we dived into choosing your first investment, considering Bitcoin and other coins. Lastly, we looked at how to buy and store your crypto with care.

My final thought? Diving into crypto is big – and it’s smart to learn before you leap. So, take this knowledge, use it to make wise choices, and always stay safe in your crypto journey. Remember, it’s your hard-earned money, so invest it with care and understanding. Good luck!

Q&A :

What should I know before buying my first cryptocurrency?

Before you dive into the world of digital currencies, understanding the basics is crucial. Research the different types of cryptocurrencies available, their market performance, and potential use cases. Familiarize yourself with the concept of blockchain and how transactions work. It’s also essential to grasp the risks involved, including volatility, regulatory changes, and security threats. Always start with an amount you are willing to lose and consider your long-term financial goals.

How do I choose the right platform for my first cryptocurrency purchase?

Selecting the right platform for your cryptocurrency purchases involves taking into account factors such as security, fees, ease of use, and the types of cryptocurrencies offered. Look for platforms with strong security measures like two-factor authentication and cold storage. Compare transaction and withdrawal fees across services. Additionally, read reviews and check if the platform is compliant with financial regulations in your country.

What are the key steps to making my first cryptocurrency purchase?

- Choose a cryptocurrency exchange or broker that aligns with your needs.

- Sign up for an account, providing any necessary verification to meet regulatory requirements.

- Set up a secure digital wallet to store your cryptocurrency.

- Deposit funds into your exchange account, which could be fiat money like USD, EUR, etc.

- Start small, and make your first purchase of a cryptocurrency by placing a buy order.

- Monitor your investment and consider using security features such as whitelisting withdrawal addresses and setting up withdrawal limits.

Can I buy a small amount of cryptocurrency to start?

Absolutely. Many cryptocurrency exchanges allow you to buy fractions of coins. This means you don’t need to purchase an entire Bitcoin or other cryptocurrencies, but rather can invest with small amounts. This is a great way to get started and familiarize yourself with the process of buying and managing digital assets without committing a significant sum of money.

What are the common mistakes to avoid for newcomers to cryptocurrency?

Newcomers to cryptocurrency often make several common mistakes, such as investing based on hype without doing proper research, neglecting the importance of security measures, and not having a clear investment strategy. It’s also important to avoid panic selling during market dips and not to invest money that one cannot afford to lose. Additionally, be wary of scams and too-good-to-be-true investment schemes that prey on less experienced individuals in the crypto space.