Track crypto exchange trading volume—it’s your window into the market’s soul. As an investor, you need to understand the tide of trades. Why? Volume tells you the story of demand, of rush, of whispering market moves before they roar. Watch the numbers dance and you’ll spot the market’s rhythm. Fluctuations aren’t just noise; they’re bread crumbs to the big players’ stomping grounds. Let me guide you into the data jungle; we’ll uncover secrets to wield volume’s power and sharpen your market edge. Ready to unlock momentum mysteries? Let’s dive in.

Understanding the Role of Trading Volume in Cryptocurrency Market Dynamics

Identifying Significance of Volume Fluctuations

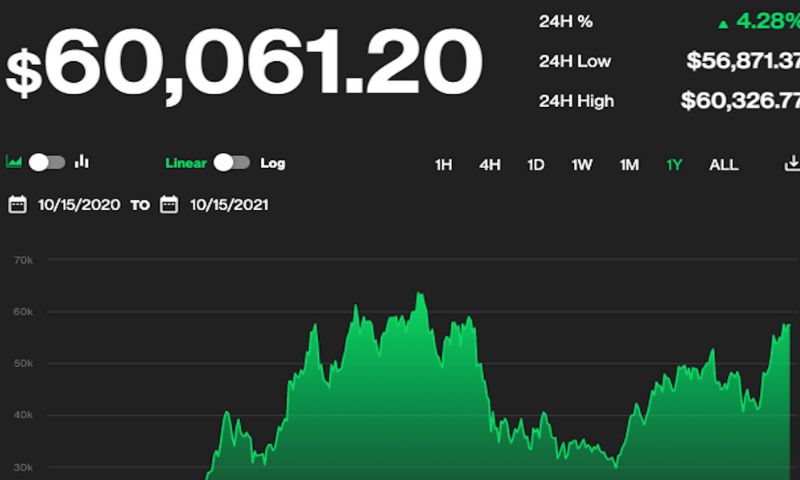

In crypto, trading volume tells us how busy a market is. It shows us if a currency gets much attention. When volume is high, more people are trading. This can mean a big price move is coming. Why is that? Well, let’s say a lot of bitcoins trade in one day. This could mean big news is stirring people up, making them buy or sell.

But low volume can be a signal too. If not many people trade, the price might not move much. It means traders are taking a break, waiting for the next big news. So, by watching how much volume there is, we can guess what might happen next.

We keep an eye on something called volume spikes. This is where volume goes up fast. It could be a clue that traders know something we don’t. Maybe they heard a rumor, or saw news we missed. When volume spikes, I often go hunting for news to see what’s up.

Volume Trends and Their Impact on Market Momentum

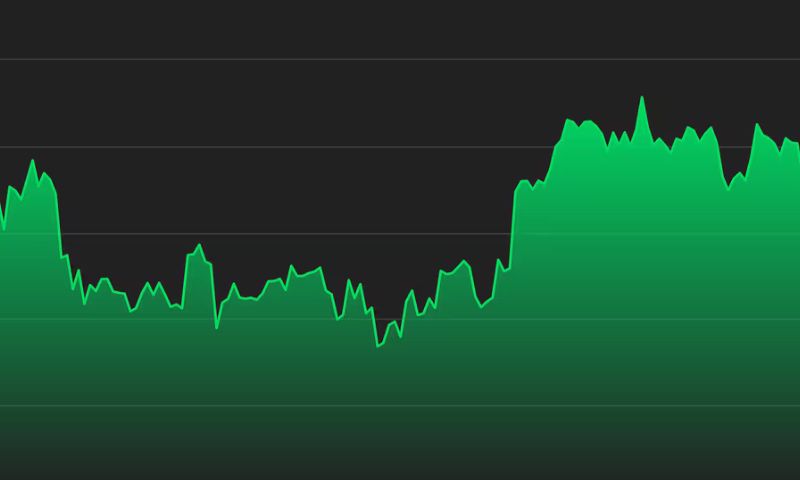

Keeping track of trends in volume is like watching the tide before surfing. If you see the volume going up over days or weeks, it’s like the tide coming in. It could lift all prices in the market. This slow rise in volume can give us a heads-up that the market is getting ready to move.

Sometimes, though, volume trends slowly drop. This is like the tide going out. It can show us the market is settling down. Prices might get stuck, not moving much. This could be a good time for traders to kick back and make plans.

I also look at how crypto volume by exchange changes. Some exchanges have more action than others. By seeing where the busy spots are, we can tell which currencies or exchanges are hot.

Still, we can’t just look at the numbers. We need to dig deeper to really know what’s happening. Let’s talk about exchange volume and price correlation. More trades usually mean more interest, which can push prices up. But if lots of trades happen without moving the price, we should ask why. It might mean big players are hiding their moves.

In the end, knowing volume helps us get the market’s beat. It shows where the energy is, if a storm is brewing, or if calm seas are ahead. As a trader, it’s all about catching the right wave at the perfect time. And understanding volume is one key way to do just that.

Tools and APIs for Real-Time Volume Tracking

Utilizing APIs to Monitor Crypto Volume by Exchange

Knowing real-time crypto trading volumes can make or break your trade. APIs, or Application Programming Interfaces, let us peek at live data. They work like secret channels that bring fresh crypto volume info from each exchange. They tell us how much Bitcoin or altcoins traders are buying and selling. This is vital. It shows us the exchange’s health and buzz.

Exchange volume shows the trust level traders have in it. High volume means high trust. Still with me? Great! With a solid API, we can see this in real time. We avoid exchanges with thin activity. Instead, we choose those brimming with trades. A bustling exchange is often a safer bet, and APIs are our doorway to this knowledge. Now, why bother with APIs? Simple. If you trade without this info, it’s like driving blind on a fast road.

Advanced Tools to Analyze Digital Currency Market Depth

Now, let’s dig deeper with advanced tools. Before diving in, what’s market depth? It’s a snapshot of a currency’s demand and supply at different price levels. Picture a scale with buying on one side and selling on the other. Market depth tools give us this image for digital cash. They show us if big waves, or volume spikes, are rolling in.

With these tools, we make smarter moves. Say Bitcoin’s volume spikes. We’d notice and know that a price jump might come next. It’s like seeing the first raindrops before the storm hits. Clever traders use these clues to buy or sell before the crowd. The tools help us compare how deep the market is for different coins, too. We see if an altcoin is just a small pond or the next big ocean.

By keeping an eye on market depth, we spot when a currency might sink or swim. Does a coin have enough support to stay afloat? Check the depth. If there’s more selling than buying, it’s a red flag. The coin might soon take a dive.

Remember, in crypto, volumes change fast. One moment it’s quiet; the next, it’s a frenzy. That’s why these real-time tools and APIs are gold for traders. They help us stay ahead of the game, catch the big waves, and avoid wipeouts.

By now, you should get why tracking volume is key. It shows the exchange’s heartbeat. With the right API and tools, you are the market’s pulse reader. Watch the flow, follow the volume, and let the current show you where to trade. And when you trade with the might of these tools, you sail with the traders’ wind at your back, navigating the crypto ocean like a seasoned captain.

Comparing Exchange Volume: A Guide to Liquidity Analysis

Exchange Volume Comparison and Liquidity Metrics

When looking into crypto trading volume analysis, it’s much like playing detective. You examine bits of data, search for clues, and unlock mysteries of the market. Crypto liquidity metrics are one piece of that puzzle. They show how quick and easy it is to trade without affecting the asset’s price. Think of liquidity as a busy market lane – the busier it is, the smoother your shopping goes.

Seeing volume trends in crypto can tell us a lot. High volume means many trades are happening. It’s like a party getting louder and more packed. Everyone wants in on the action. This shows high interest and a dynamic market. Volume trends also offer hints if the price might spike or drop. High volume with rising prices can mean strong buy interest. But, if prices fall on high volume, it may signal a sell-off.

Watching real-time exchange volume is vital. It gives you a fresh look at which way the crypto winds blow. If a crypto goes silent with low volume, be cautious. It can mean fewer people are trading, and prices may be unstable.

High volume crypto exchanges have power. They’re like big airports with more flights taking off and landing. You get many options and can pick the best routes for your trades. They help you move in and out of trades with ease.

Understanding exchange volume is knowing the heartbeat of crypto markets. It gives you inside info on the buzz around different coins. Bitcoin volume tracking and altcoin trading activity take the pulse of these markets daily.

Interpreting Trade Volume Indicators for Crypto Investments

Now, let’s dive into trade volume indicators. These are like secret codes that can help make sense of all the noise. A sudden crypto volume spike could mean big news is about to drop. If you see a spike, it’s worth seeing why traders are rushing in or out.

Knowing the importance of volume in crypto trading is like acknowledging gravity. It’s there, it’s vital, and it shapes everything. Price moves on high volume are big news. They imply more traders agree on the price change, making it more significant.

Crypto volume by exchange gets interesting too. Each exchange is its own little world. Comparing volumes can show you where the action is. Some exchanges may have more trading of a certain coin, signaling more interest or better opportunities there.

Volume-based crypto trading strategies can be smart plays. They use real-time data to make quick calls on buying or selling. These strategies are like surfing, riding the wave right as it happens, for the thrill and the profit.

Analyzing exchange volume data can be your crystal ball. It gives you a glimpse of what may come next in the markets. When done right, this analysis makes your investment choices smarter and sharper.

Remember, exchange volume and price correlation can tell tales. High volume often confirms a price move, making it more believable. It shows that a price trend has weight and could keep going.

Armed with knowledge about exchange volume comparison, you’ve got a secret map. It guides you through the crowded streets of the crypto market. Using this map, you can find golden trading spots and make smarter moves.

Volume-Based Trading Strategies: Harnessing Market Movements

Trade Volume Impact on Crypto Prices

Let’s break down how trade volume shapes crypto prices. Think of trade volume as the gas in a car. More gas, more power. In crypto, when trade volume goes up, it often means lots of trades are happening. That can shoot the price up or down, fast. It’s like a signal. When you see volume spike, pay attention. It might mean big news, or that big traders are making moves.

Trade volume tells us about excitement in the market. If lots of people want to buy Bitcoin, and they trade lots of it, the price usually climbs. If they sell a lot, it might drop. Watching Bitcoin volume tracking helps us get it. It’s a clue about where the price will head.

Developing Strategies from Volume Data Analysis

Now, let’s chat about using that volume info. As a market expert, I keep close tabs on things like crypto liquidity metrics and trade volume indicators. They help me guess what might happen next. I look at volume trends in crypto to see the rhythm of the market. Is it loud and busy, or quiet and slow? This guides my trades.

To use volume when you trade, first get the data. Real-time exchange volume is key. It tells you what’s hot right now. If you spot a crypto volume spike, ask why. Look at the news, check for crypto coin updates. There could be a big reason why everybody’s trading all of a sudden.

Let’s work through an example. Say, altcoin trading activity shoots up while Bitcoin’s quiet. Compare them. Are altcoins getting more love because of cool new tech or partnerships? If yes, maybe you should join the party. But if there’s no clear reason, be careful. It could be a false start.

Volume data can also tell you if a market move is solid or not. High volume means lots of eyes on the prize. Low volume – the move might not last. It’s telling the difference between a big wave that’s good for surfing and a small one that’s not worth your board. In trading, riding the big wave at the right moment could win you the prize.

Always look at exchange volume and price correlation. If a digital currency moves in price without much volume, be wary. It looks fishy, like maybe it’s being pushed around by just a few players.

What does this mean for your strategy? First, never trade blind. Monitor exchange liquidity. It shows you the market’s heartbeat. Then, use crypto volume by exchange to pick where to trade. Big, high volume crypto exchanges are often safer. They have more traders and more action, making prices more reliable.

By analyzing exchange volume data, you can get ahead. It’s a bit like having a crystal ball, only this one’s backed by numbers. Combine volume data with other signs to make your best move. Watch daily trading volume on crypto exchanges, too. It shows you the big picture.

And remember, trading is gutsy. Always be ready to learn and adapt. Use what you learn from volumes and ride the crypto waves with smarts. It’s how we play the game in the crypto world – alert, sharp, and always on the lookout for the next big move.

In this blog, we dug into how trading volume shapes the crypto market. We saw that volume changes are vital to get. They show if a crypto might zip up or dip down. We also learned that volume trends can push the market’s pace.

We looked at cool tools and APIs that track volume fast. These help us see volume at different exchanges and dig deep into market facts.

Next, we compared exchange volume to figure out which ones really move the market. We learned what numbers to look at when we pick where to trade.

Lastly, we talked about making smart moves based on volume data. We found that volume can hint at price jumps or drops. This know-how helps us build strong trade plans.

For me, it’s clear. Volume is key in crypto trading. Using real-time data, comparing exchanges, and understanding market vibes can make or break your moves. So, let’s use what we’ve learned and trade smart!

Q&A :

How can I track trading volume on a crypto exchange?

To track trading volume on a crypto exchange, you can utilize various tools and resources that aggregate trading data. Visit the exchange’s official website or use financial platforms like CoinMarketCap or CoinGecko, which provide real-time trading volume information. Most exchanges also offer their API data if you want to track trading volume programmatically for more in-depth analysis.

What is the significance of trading volume in crypto exchanges?

Trading volume on crypto exchanges is a critical indicator of market activity and liquidity. High volume suggests strong interest in the cryptocurrency and typically correlates with price stability or increases, whereas low volume may indicate less interest and can accompany price volatility. Investors often assess trading volume to make informed trading decisions and gauge the potential ease of buying or selling a given asset.

Which crypto exchange has the highest trading volume?

The crypto exchange with the highest trading volume can fluctuate due to market conditions and trends. However, some of the top exchanges in terms of consistently high trading volumes include Binance, Coinbase, Huobi, and Kraken. It’s advisable to check current data from financial analysis websites or the exchanges themselves for up-to-date information on trading volumes.

How does trading volume affect crypto exchange rates?

Trading volume affects crypto exchange rates by showcasing the market’s buying and selling pressure. A high trading volume typically means there is significant interest in the asset, often leading to tighter spreads between the bid and ask prices and possibly driving prices upward. Conversely, a low volume may lead to larger spreads and more erratic price movements due to decreased liquidity.

Can trading volume predict crypto price movements?

While trading volume itself cannot predict price movements with certainty, it is a valuable factor in technical analysis. Volume precedes price, so an increase in trading volume can sometimes suggest a forthcoming price movement, either upwards or downwards. Traders often look for significant changes in volume, along with other indicators, to predict potential price action in the crypto market.