Ready to dive into the world of **types of crypto wallets**? You've come to the right place. On this journey, we'll open the vault to the basics, wade through the waters of hot and cold storage, and inspect the layers of custody in wallet security. We know that with crypto, your digital treasure needs formidable protection. But how do you pick a guardian for your virtual gold? Convenience often tugs one way, security the other. Today, I'll guide you through the maze, from the fort-like hardware wallets to the ever-accessible software options. Whether you're looking for a vault in your pocket or a digital safe that's a bit more hands-off, understanding the nuances of each type is key. Grab your digital map, because we're about to unlock the treasure troves of crypto wallets together.

Unlocking the Basics of Crypto Wallets

Understanding Hot vs. Cold Storage

The Security Spectrum: Benefits and Risks

Hot wallets are like pockets. They keep money you need to use soon. They’re online and let you trade or shop fast. But, they’re less safe. Hackers might steal from these.

Cold storage is like a safe. It hides your money offline. Tough for thieves to crack. But, trading takes longer. We keep big amounts here for high safety.

So, what’s better? Hot wallets offer speed, but cold storage gives strong safety.

Demystifying Wallet Types: Custodial and Non-Custodial Solutions

Choosing Between Control and Convenience

Custodial wallets are simple. The service keeps your keys. No stress over losing them. But you have to trust them. They hold your crypto keys, not you.

Non-custodial wallets are the opposite. They give you the keys. No middlemen. You’re the boss. But, if you lose the keys, tough luck. All control, but big responsibility.

Compare these with care. It’s about trust and managing your own risk.

The World of Hardware Wallets and Their Fortified Security

Embracing the Cold Storage Crypto Approach

Cold storage crypto keeps your coins safe. Think of it as a vault. No one gets in unless you say so. It’s not online, so hackers can’t touch it. By keeping your coins offline, you sleep well at night, knowing your digital treasure is safe.

Encrypted Transactions and Immunity to Online Threats

Hardware wallets work like a charm. They encrypt your coins. This means they turn your public and private keys into a code. Only you can crack this code. Even if someone steals your hardware wallet, they can’t get your coins. It’s like having an unbreakable lock.

Advanced Security Techniques in Cryptocurrency Hardware Wallets

Security in these wallets is top-notch. With multi-factor authentication, it’s not just a password between your coins and the world. You use something you know, something you have, or something you are to get access. It’s a triple lock.

Multi-factor Authentication and Seed Phrase Protection

There’s another hero in the wallet world: the seed phrase. This is a list of words you keep safe. It’s your backup plan. If things go wrong, like losing your wallet, this phrase gets your coins back. Like a secret knock that opens a hidden door, only you know it.

Using hardware wallets means you’re serious about security. It’s good for people who don’t trust the web with their coins. Remember, it’s called “cold” storage for a reason. It’s as cold to hackers as a snowman yet as secure as a warm hug for your coins.

Diverse Software Wallets: From Desktops to Smartphones

How Desktop and Mobile Crypto Wallets Shape Your Digital Currency Experience

Let’s dive into desktop cryptocurrency wallets first. They live on your computer. Like a trusted friend, they keep your digital coins safe at home. Setting one up is simple. Download it, install it, and you’re ready to go. You control your coins here, not a third party. It’s all on your PC, away from web threats. But remember, with great power comes great responsibility. Your digital coins’ security rests on your shoulders. Make sure your computer is free of viruses and malware.

Now, about mobile crypto wallets. These go where you go, right in your pocket. They turn your phone into a mini bank. Imagine paying for coffee with your phone through a simple app. Easy right? And it’s secure. Many mobile wallets also use features to protect your coins, like PIN codes or fingerprint checks. Some even let you control your private keys. That’s a big deal. It’s like holding the key to your safe. No one can get to your coins without it.

But both types, desktop and mobile, share a common risk. They’re part of the internet world, which we call ‘hot wallets’. If your device gets hacked, your coins might be at risk. So while these wallets offer you quick access and ease, always think about safety.

Online Wallets: Managing Digital Coins in the Cloud

Talking about ease, let’s talk about online wallets for digital coins. Online wallets mean your digital money is in the cloud. You can reach your coins from any place, any device. It’s super convenient. But, this ease can come with risks. When you use online wallets, a company usually holds your private keys. This means you must trust them to keep your coins safe. They might have strong security, but it’s not in your hands. Think of it like borrowing a friend’s safe for your precious items.

Some online wallets are part of exchanges. This is where you trade coins. It’s handy to have coins here for quick trades. But don’t keep more coins in exchange wallets than you need for trading. It’s safer that way.

Then there are trustless wallet platforms. These are like DIY safety vaults. They let you interact with digital coins without giving your private keys to someone else. You’re the boss. It’s still online, but it’s more in your control. That feels good, doesn’t it?

Given the range of options, comparing wallet types is smart. Think about what matters to you. Is it ease, security, or both? Everyone’s needs differ. Find a balance that works for you when picking a wallet. Do you want control over your keys, or would you rather let a third-party manage them? Your choice will guide your steps in the fascinating world of digital currencies. And remember, with every type, keeping backup, like encrypted wallet backups or seed phrases, is crucial for recovery if things go south.

Specialized Wallets: Pushing the Boundaries of Digital Currency Security

Innovations in Biometric and Multisig Wallets

Let’s dive into the tech that guards your digital gold, friends. Have you heard of biometric security wallets? They use stuff like your fingerprint to unlock your cash. It’s like your body becomes the key! Pretty cool, right?

Biometric wallets make it hard for thieves to sneak into your stash. Only you – with your unique prints – can open it up. They’re one of the newest types on the block, giving you peace of mind and a hi-tech feel.

Now, let’s chat about multisig wallets. They need more than one key to open. Think of it like a treasure chest that needs several keys at once. This means better security. If someone gets one key, they still can’t get in. It’s teamwork for your wallet!

These wallets are top-notch for groups or companies sharing funds. Everyone keeps an eye on the money. It’s like having a bunch of guards instead of just one.

Coupling User-Friendly Interfaces with Advanced Security

Boss-level security doesn’t mean it’s tough to use, though. Now, these wallets come looking sharp and are easy to handle. You get safety without the headache. It’s a win-win for everyone, from new folks to old hands in the crypto game.

The Integration of Crypto Wallets with Web3 and DeFi

Moving onto where wallets meet the wild web. Web3 is the new internet, all about sharing power. And DeFi? That’s finance without the big banks calling the shots.

For wallets, this means they need to play nice with these new systems. You want yours to work with all the different coins and DeFi stuff you’re into. This makes sure you’re ready for whatever the tech world throws at you.

Web3 wallets are all about staying connected without giving away your secrets. They let you join the network while keeping your private keys safe. You control your money, not someone else. That’s the dream, right?

Wallets in the DeFi zone mean you can lend, borrow, and trade without worry. They’re like Swiss Army knives for your digital dough. Ready to tackle anything, they’re the trusty sidekick for your online adventures.

In this crypto safari, whether you’re into keeping your coins under lock and fingerprint or joining the DeFi revolution, there’s a wallet out there for you. And with all these advances in tech, your digital treasure’s safer than ever. Now go explore and find the perfect wallet to match your fearless finance journey!

We’ve explored the crypto wallet world, covering hot and cold storage and the pros and cons of each. We delved into custodial and non-custodial wallets, and weighed control against ease of use. We also dived deep into hardware wallets, their advanced security, and how they shield you from online dangers. Software wallets for desktops and phones, including web-based options, were not left out, and we discussed their access versus security trade-offs. Finally, we looked at cutting-edge biometric and multisig wallets and their role in the evolving Web3 and DeFi spaces.

In this journey, one thing is clear: your choice matters. Being smart about your wallet can shield your digital cash. So think, learn and choose wisely. Whether it’s a robust hardware wallet, a handy software one, or a fancy biometric keeper, let your needs guide you. Stay safe and ahead in the crypto game!

Q&A :

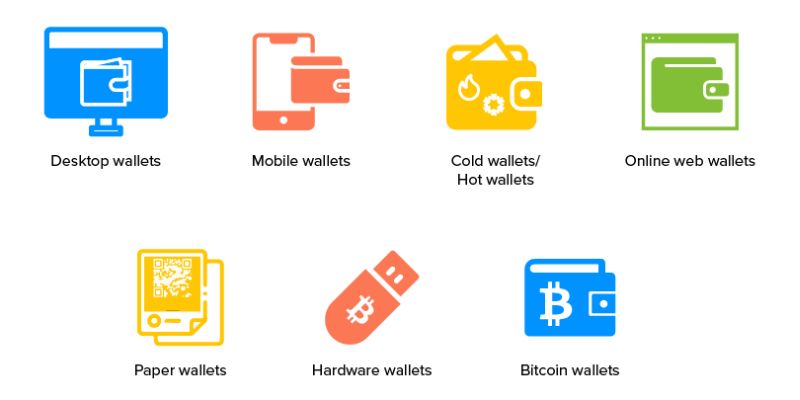

What are the main types of cryptocurrency wallets available?

Cryptocurrency wallets come in several forms, each offering different levels of security and convenience. The main types are:

- Hardware Wallets: These are physical devices that securely store the user’s private keys offline.

- Software Wallets: These are applications that can be installed on a computer or smartphone, providing easy access to funds.

- Paper Wallets: Simply a physical printout of your public and private keys. They are considered cold storage but require careful handling to protect from damage or loss.

- Web Wallets: Wallets that are accessed through a web browser and are typically hosted by a third party which maintain control of your private keys, offering convenience at the expense of lower security.

- Mobile Wallets: App-based wallets designed for mobile use, allowing users to access funds easily from anywhere.

Each type has its own set of features, and the choice depends on individual needs for security, convenience, and accessibility.

How do I choose the best crypto wallet for my needs?

Choosing the best crypto wallet depends on several factors:

- Security: Hardware wallets are the most secure as they store private keys offline. If security is your main concern, this might be the right choice.

- Frequency of Transactions: If you transact frequently, mobile or web wallets offer more convenience.

- Control: If you want complete control over your keys, avoid wallets that hold your keys for you (like many web wallets).

- Asset Diversity: If you own multiple types of cryptocurrencies, look for wallets that support multiple assets.

- User Experience: Beginners might prefer wallets with a user-friendly interface, while experienced users might want more features.

Consider your individual needs in terms of security, convenience, and the type of transactions you’ll be performing before making a decision.

Are all crypto wallets compatible with every cryptocurrency?

No, not all crypto wallets are compatible with every cryptocurrency. Wallets vary in the number of cryptocurrencies they support. Some are designed for a specific cryptocurrency, while others can store multiple types. Before choosing a wallet, ensure that it supports the cryptocurrencies you want to manage. Multi-currency wallets have become more popular as they provide the convenience of managing different assets in one place.

Can I use multiple types of crypto wallets at the same time?

Yes, it’s common for people to use multiple types of crypto wallets simultaneously. For example, one might use a hardware wallet for secure long-term storage of assets and a mobile wallet for everyday transactions. Using multiple wallets can be part of a strategy to balance security with convenience.

What are the risks of using a crypto wallet?

Using a crypto wallet comes with several risks:

- Security: Wallets can be vulnerable to online attacks, especially if they are constantly connected to the internet (hot wallets).

- User Error: Losing access to your wallet due to forgotten passwords or lost hardware devices can result in the permanent loss of your cryptocurrencies.

- Third-Party Risk: If you use a wallet service that holds your private keys, you rely on their security measures and trustworthiness. Any failure on their part could lead to loss of funds.

- Software Bugs: Software wallets can have vulnerabilities or bugs that malicious parties might exploit. It’s crucial to keep your wallet software updated.

To mitigate these risks, always follow security best practices such as using strong passwords, enabling two-factor authentication, and making backups of your keys.