As a digital savvy, you might be eyeing crypto but can’t stomach the wild swings. Enter stablecoins. They’re the anchors in the choppy seas of Bitcoin and friends. In “Stablecoins Explained: Your Safe Harbor in Crypto Storms,” I’ll unpack what are stablecoins and how they offer a steadier ship for your crypto voyage. We’ll cut through the jargon, diving deep into their types, uses, and why they’re pivotal in maintaining balance in the digital currency world. Stick with me, and let’s steady your crypto course.

Understanding the Fundamentals of Stablecoins

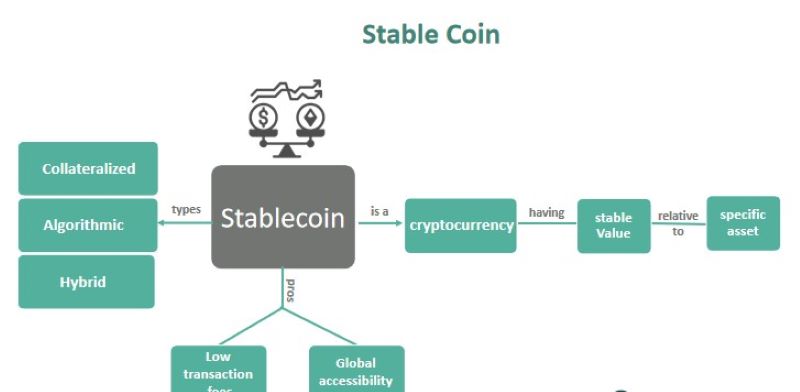

The Various Types of Stablecoins

Imagine you have a magic dollar that never changes value. It seems crazy, right? But this is what stablecoins do in the world of crypto. They are like safe boats in the wild sea of digital currency, where prices can rise and fall super fast. So what makes these coins so steady? They’re tied to things that don’t swing much in worth, like the dollar or even gold. This tie gives them their power to stay calm in the storm.

There are a few key types of stablecoins out there. First off, we have fiat-collateralized stablecoins. Think of these like a money promise. For each of these coins, there’s a real dollar or another currency kept safe somewhere. It’s easy to get why they are stable, right? When you know there’s a real dollar behind a coin, you feel good about its value.

Then we have crypto-collateralized stablecoins. This type might sound tricky. How can something as wild as crypto back up a stablecoin? Well, instead of one dollar backing up the coin, there might be two dollars of crypto put aside. This extra crypto acts as a cushion if prices drop. Pretty smart, eh?

Lastly, let’s talk about non-collateralized stablecoins. These coins are like a game of trust. They aren’t backed by cash or crypto. Instead, they use special rules or programs that help keep their price right at one dollar. It’s kind of like a robot that makes sure the coin always stays close to a dollar, no matter what.

The Role of Stablecoins in Cryptocurrency Stability

Now let’s dive into why we even need stablecoins. The big deal about them is that they don’t jump all over the place in price like other cryptos. This is great for folks who use them to buy things. It means that you won’t pay twice as much for something tomorrow just because the price of your crypto shot up!

Apart from shopping with them, stablecoins help people move money around the world. Fast and cheap. With stablecoins, you can send cash to a friend across the globe in a snap. And because the value stays the same, they get exactly what you sent. No nasty surprises.

People who work with crypto also love stablecoins. When traders or investors think the market’s about to get rough, they can switch their money into stablecoins. This move keeps their cash safe, like parking it in a garage till the storm passes.

To sum it up, stablecoins have some neat tricks up their sleeves. They give us a stable way to deal with money on the net. They’re a mix of the old school (like real dollars) and the new school (like crypto). And as they grow, they could turn into a massive deal, not just for techy types but for everyone. So keep an eye on these steady movers because they might just change the game in money and banking for good!

The Advantages and Challenges of Stablecoins

Exploring the Benefits of Stablecoin Usage

Stablecoins shine as stars in the crypto world. They link digital speed with stable value. People like them because they don’t jump in price like other cryptos. They’re great for buying things and sending money fast. Imagine buying your morning coffee with crypto, without the fear of the price changing before your sip!

Different stablecoins are backed by different things. Some have cash backing them up. Others use crypto, or even just a smart computer program keeping the price steady. No matter the type, their aim is same: to keep their value fixed to something stable like the dollar.

Using stablecoins feels safe. They give you the power of quick digital money moves. Plus, you can earn more interest than in a regular bank. And as they get more popular, you’ll find more places to use them.

Assessing the Risks and Regulatory Landscape

But hang on – stablecoins have risks, too. Sometimes, the things backing them can fail. If the backup fails, so does the stablecoin. This risk is why we need rules in place.

Regulations are like traffic lights for stablecoins. They help everything run smooth. Some places have strong rules, while others still need to catch up. Safe stablecoins often have clear records of their backups. These records are audits. An audit is like a health check for stablecoins to show they’re solid.

So, investors should watch the news. New rules can change how stablecoins work. And always remember – even stablecoins need a safety belt sometimes. It’s smart to not put all your money in just one place.

The world of stablecoins is growing fast. They’re neat tools for saving, buying, and earning more. Yet, like all tools, we must use them right. Stay sharp, be aware of the risks, and you’ll sail smoothly on the crypto seas.

Stablecoin Platforms and Investment Strategies

Navigating Stablecoin Market Capitalization and Value Storage

Many folks ask, “What’s a safe place for my cash in the crypto world?” The answer is often stablecoins. Now, you might wonder what these are. Picture a busy harbor where ships safely dock away from storms. Stablecoins are like that but for your money in the digital sea. There are different types of stablecoins, and here’s the catch: they aim to keep their value no matter how wild the crypto waves get.

Types like fiat-collateralized stablecoins are backed by real-world money. You put in a dollar, you get a stablecoin worth a dollar. It’s simple and pretty safe. Then there are crypto-collateralized stablecoins, which are backed by other crypto money. This method is a bit more complex but can handle a crypto storm better. On the wild side, we have non-collateralized stablecoins that use smart software to keep their price stable.

So why bother with stablecoins? They come with less ups and downs or, in fancy talk, less volatility. They make doing business or trading easier because their value doesn’t jump around. This is why we talk about stablecoin benefits a lot.

But wait, there’s more! What’s their market cap? That’s just how much all the stablecoins are worth put together. Why care? Because a big market cap means many people trust and use that stablecoin. It’s like having a big, strong harbor that many ships trust to anchor in.

Considerations for Investing in Stablecoins

So should you invest in stablecoins? Hold your horses. There are things to ponder about before diving in. Stablecoin risks exist, yes they do. The rules around them, what we call stablecoin regulation, are still being drawn up. It’s a bit like building the harbor while ships are already docking. The ground can shift.

And then there’s trust. You want to pick stablecoin platforms that are trustworthy, right? Look for ones with a solid rep, where you can see where your money’s going and what’s backing it, basically stablecoin transparency.

When you’re eyeing stablecoins like tether (USDT) and USD Coin (USDC), bigger names in the game, notice their stability track record and how easy it is to turn them back to regular dollars, what we call redeemability. Look also at stablecoin liquidity; that’s just a fancy word for how easy it is to trade them without affecting their price.

In the end, if you’ve got a head for numbers and a steady nerve, stablecoins could be your best mate in the crypto world. Just remember, it’s not all calm seas and sunshine; do your homework and navigate carefully.

Advanced Stablecoin Mechanisms and Market Adoption

The Evolution of Stablecoin Governance and Ecosystems

Stablecoins are like safe boats in rough crypto waters. They link to real stuff like dollars or gold. This tie helps them stay steady when other coins go up and down. There are different types, like those backed by money (fiat-collateralized), by other cryptos (crypto-collateralized), or by smart rules instead of real assets (non-collateralized). Each one works in its own way, but the goal is the same: to be a steady coin in a world of wild crypto swings.

The key to this steadiness is good control or governance. As stablecoins grow, the rules that guide them must be strong and clear. The folks who make these rules work to keep our trust in the coins. They use audits and smart contracts to show that each coin is really backed by something.

Many people use these coins because they are steady and easy to turn into cash (liquidity). They are used to buy goods, send money across borders, or save for the future. Big names in this space include tether (USDT) and USD Coin (USDC). They’re popular because they hold their value well.

The Intersection of CBDCs and Stablecoin Scalability

Has the word CBDC reached your ears? It stands for central bank digital currency. It’s a digital form of money that comes from a country’s bank. CBDCs are like cousins to stablecoins. They’re both kind of the same idea, but CBDCs come from the top (central banks), while stablecoins can come from anywhere (like companies).

As more people use stablecoins, we need to make sure they can handle the load. This means they should be able to manage lots of transactions without problems. It’s about scaling up and still being safe and fast. The tech behind the scenes, which is blockchain technology, makes sure of this.

Blockchain is like a digital ledger that records every coin move. It’s public, so it adds trust. But there are rules to follow, known as compliance. These are like road signs for stablecoins, guiding how they should act in the crypto world.

When we talk about CBDCs, we see that they might use the same tech. This could change how money works and talks to stablecoins. Think of it as a new bridge being built between traditional money and crypto money. This bridge can carry stablecoins to places we never thought they’d go. It’s not just about using them online but maybe even at your local store someday.

As you dive into the deep sea of stablecoins and their growing world, remember, they aim to give us calm in the dizzy dance of digital currency. They are not just another crypto coin; they are tools that aim to make money safe and easy to use in our digital future. They come with their own risks, like rules that can change or markets that might not welcome them. Yet, they offer ways to keep your money’s worth steady in times of change. And that’s what makes them both exciting and valuable in the wild ride of crypto.

In this post, we dived into the world of stablecoins. We looked at their types and how they help keep crypto steady. We uncovered their pros and the tough parts too, like risks and rules. We checked out how to store value with them and things to think about before putting money in. Finally, we explored how stablecoins are changing and growing, and even touched on central bank digital currencies.

Here’s my final take: Stablecoins are key in the crypto universe. They bridge traditional money systems and digital coins. But, tread carefully. Keep an eye on rules and always have a solid plan when you invest. Remember, knowledge is your best tool in this game. Stay informed, stay ahead, and use stablecoins to your advantage.

Q&A :

What Exactly Are Stablecoins?

Stablecoins are a type of cryptocurrency designed to offer stability in value by being pegged to another stable asset like the US dollar, gold, or other fiat currencies. Their primary aim is to combine the instant processing and security of cryptocurrencies with the stable valuations of fiat currencies.

How Do Stablecoins Maintain Their Stability?

Stablecoins maintain their stability through various mechanisms, depending on their type. Fiat-collateralized stablecoins are backed one-to-one by reserve assets like USD. Crypto-collateralized stablecoins are backed by other cryptocurrencies but require overcollateralization to absorb price fluctuations. Algorithmic stablecoins don’t use collateral but instead rely on a working mechanism similar to that of a central bank to expand or contract the supply of the coin, aiming to maintain its value.

Are Stablecoins a Safe Investment?

Stablecoins are considered to be less volatile than other cryptocurrencies due to their peg to stable assets. However, stability doesn’t equate to a risk-free investment. The safety of a stablecoin depends on the credibility of its reserve audits, the management team’s policies, and the underlying mechanism for maintaining its peg. Always do your due diligence before investing.

Can Stablecoins Be Used for Everyday Transactions?

Yes, stablecoins can be used for everyday transactions. They offer the advantage of the speed and security of cryptocurrency transactions while aiming to avoid the price volatility that makes using other cryptocurrencies for everyday purchases impractical. The growing acceptance of stablecoins continues to enhance their viability as a medium of exchange.

What Determines the Value of a Stablecoin?

The value of a stablecoin is determined by its peg to another asset. For instance, a stablecoin pegged to the US dollar should ideally always be valued at 1:1 with the dollar. The market confidence in the stablecoin issuer’s ability to maintain this peg and the reliability of their reserve holdings also influences the perceived value of the stablecoin.